DAT Solutions: Spot truckload volumes rebound from Imelda

Load postings jumped 29% and load-to-truck ratios rose for all three equipment types during the week ending Sept 29, said DAT Solutions, which operates the industry’s largest electronic marketplace for spot truckload freight.

The spot market recovered the 25% loss in volume during the previous week, when Tropical Storm Imelda disrupted supply chains in the Houston area and other regions across the Southeast and Midwest. The number of truck posts increased 19%, reversing a 17% decline the previous week.

National average spot van, refrigerated and flatbed rates, on the other hand, were largely unmoved week over week and affected mainly by a higher fuel surcharge.

National average spot rates, September 2019 (through Sept 29)

- Van: $1.84 per mile, 3 cents higher than the August average

- Flatbed: $2.19 per mile, 1 cent lower than August

- Reefer: $2.17 per mile, 3 cents higher than August

Van Trends

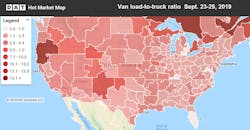

The national average van load-to-truck ratio averaged 2.2, up from 2.1 the previous week. Spot van rates were higher on only 32 of DAT’s Top 100 largest van lanes by volume. Rates typically rise with freight volumes, especially during the final week of a business quarter.

Where rates were up: Volume from Houston increased 20% and Charlotte was up 19%, but in keeping with the national trend, outbound rates ($1.68 and $1.98 per mile, respectively) failed to budge.

Seattle rose 6 cents to $1.63 per mile, mostly on southbound lanes. Seattle to Los Angeles gained 8 cents to an average of $1.31 per mile. Freight availability in Los Angeles remains strong, with the load-to-truck ratio hitting 5.8 last Friday and averaging 4.2 last week.

Reefer Trends

The national average reefer load-to-truck ratio increased from 3.9 to 4.2 as volumes picked up 2.4% on the 72 largest lanes. Like the van market, reefer rates did not respond: only 18 lanes rose while 51 moved lower.

Where rates were up: Volumes from McAllen TX increased 23% compared to the previous week and the average outbound rate rose 11 cents to $2.00 per mile. Importers had a backlog of produce to move to major US markets: the average rate from McAllen to Chicago gained 14 cents to $1.86 per mile, and McAllen to Atlanta was up 12 cents to $2.03 per mile.

This weekly spot-rate snapshot is derived from DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $65 billion in annualized freight payments. DAT load boards average 1.2 million load searches per business day.

Visit Dat.com/Trendlines for more information.