A post-Thanksgiving surge in truckload freight volumes made for a solid November overall compared to previous years, according to a new report from DAT Freight & Analytics.

The DAT Truckload Volume Index (TVI), an indicator of loads moved in a month, fell for all three equipment types:

- Refrigerated TVI: 191, down 3.5%

- Flatbed TVI: 232, down 11.1%

- Van TVI: 232, down 9.0% compared to October

“Thanksgiving and Black Friday were early in the month, which meant there was almost a full week of shipment activity after the holiday,” Ken Adamo, DAT chief of analytics, said in a news release. “Businesses running leaner inventories compared to the last couple of years are taking advantage of lower transportation rates as they position goods ahead of peak retail shopping.”

Market remains flush with capacity

Shippers continued to benefit from ample truckload capacity, DAT added. “For every 10 carriers that left the market in November, eight new ones came in,” Adamo said. “There’s been an acceleration of capacity out of the long-haul freight sector, where carriers are subject to spot-rate volatility and high diesel costs, and a shift back to other parts of the economy, like regional dedicated operations.”

Load-to-truck ratios, which measure the number of loads posted to the DAT One marketplace relative to the number of trucks, were at their lowest point for November since 2015:

- Reefer ratio: 3.2, up from 2.9

- Flatbed ratio: 5.5, down from 6.3

- Van ratio: 2.1, unchanged from October

Low ratios signal weak negotiating power for truckload carriers. Changes in the ratio usually anticipate changes in the pricing environment, DAT said.

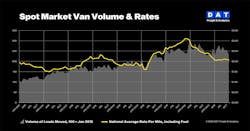

Reefer, van line-haul rates trend higher

National average broker-to-carrier spot rates showed little movement in November. The van rate was $2.07 per mile, 2 cents less than in October, while the reefer rate increased 3 cents to $2.49 per mile. The flatbed rate rose 5 cents to $2.43 a mile. Year over year, average spot rates were down 16 cents for vans, 30 cents for reefers, and 19 cents for flatbeds, accounting for lower fuel costs compared to November 2022.

Line-haul rates, which subtract an amount equal to an average fuel surcharge, strengthened after five months of declines:

- Line-haul reefer rate: $1.94 a mile, up 7 cents.

- Line-haul flatbed rate: $1.83, unchanged.

- Line-haul van rate: $1.57 per mile, up 2 cents compared to October.

Last month’s rates were higher than in November 2019, before the supply chain disruptions of the pandemic. At that time, the benchmark van line-haul rate was $1.52 per mile, the reefer rate was $1.85, and the flatbed rate was $1.74.

Rates for contracted van and reefer freight declined for the third straight month as pricing power continued to swing toward shippers, DAT reported. DAT’s benchmark contract van rate fell 3 cents to $2.53 per mile in November, while the reefer rate fell 3 cents to $2.94. The flatbed rate rose 4 cents to $3.17.

At 46 cents, the gap between spot and contract van rates was the lowest since March 2022—when the average broker-to-carrier spot rate was $3.05 and the contract rate was $3.26.