DAT: Uncertainty looms despite steady January

Spot truckload freight volumes increased in January as shippers replenished inventories after the holidays, pulled forward imports ahead of potential tariffs, and sought more flexible, short-term capacity on the spot market to cope with disruptive winter weather, according to new data from DAT Freight & Analytics.

A measure of van, refrigerated, and flatbed loads moved in a month, the DAT Truckload Volume Index (TVI) increased for all three equipment types:

- Van TVI: 277, up 6%

- Reefer TVI: 237, up 7%

- Flatbed TVI: 256, up 8%

The TVI was higher for all three equipment types year-over-year. The van TVI was up 8%, the reefer TVI jumped 13%, and the flatbed TVI increased 6%, DAT reported. The van TVI was year-over-year positive for the 10th consecutive month.

Spot rates rise modestly

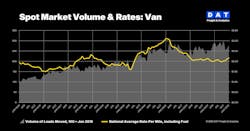

National average spot rates rose but did not keep pace with demand.

January’s average van rate increased 4 cents to $2.16 a mile, the reefer rate increased 8 cents to $2.55, and the flatbed rate gained 5 cents to $2.44. Spot rates were also buoyed by carriers negotiating to recover higher fuel costs compared to December.

Linehaul rates, which subtract an amount equal to an average fuel surcharge, increased modestly. The van linehaul rate averaged $1.76 a mile, up 2 cents month-over-month. The reefer rate was $2.12, 6 cents higher, and the flatbed rate was $1.96, a 2-cent increase.

On-highway diesel fuel averaged $3.63 a gallon in January, a 14-cent increase from December.

“January was a month of mixed indicators, with shippers rebalancing inventories as they typically do while responding to the uncertainty of tariffs, higher fuel costs, and unusually bad weather,” Ken Adamo, DAT chief of analytics, said in a news release.

Contract rates reflect market equilibrium

Rates for freight moving under long-term contracts held firm last month:

- Contract van rate: $2.41 per mile, up 2 cents and down 3 cents year-over-year

- Contract reefer rate: $2.76 a mile, up 2 cents and 10 lower year-over-year

- Contract flatbed rate: $3.07 a mile, up 1 cent and down 1 cent year-over-year

Contract and spot van and reefer rates tightened for the fifth consecutive month, and the margin was the lowest since March 2022.

The DAT iQ New Rate Differential (NRD), which measures changes in the contract market by comparing rates entering the market to those exiting, was 1.4% in December. A positive NRD signals a tightening market, while a negative NRD suggests the market is softening.

“The van NRD has been positive for four straight months and trending higher for almost two years,” Adamo concluded. “It may not feel like it, given last month’s business and trade volatility, but spot and contract freight data reflected a market in equilibrium in January.”