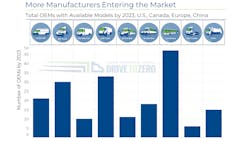

Fleets’ choice of heavy-duty zero-emission trucks (ZETs) in the U.S., Canada, China and Europe was at 40 units last year, though the number of available and announced models is expected to swell to 71 (an 80% increase) by the end of 2023, according to Calstart. In the U.S., the number was eight in 2020 and will be 28 in 2023, a 250% increase.

Notable heavy-duty trucks include the thoroughly tested Freightliner eCascadia and Volvo VNR Electric.

The data was collected through Calstart’s Global Commercial Vehicle Drive to Zero program’s interactive tool called Zero-Emission Technology Inventory (ZETI). The models counted include both battery-electric and fuel cell electric trucks, the latter of which convert hydrogen into electricity. Both types of zero-emission vehicles (ZEV) are new and mostly unproven, but they do represent what the future of trucking may look like.

“We're on the cusp of a major technology transformation in the truck market — the technology is still in its very early stages, but there are a healthy number of models available,” said Dr. Cristiano Façanha, Drive to Zero’s global director.

Façanha did point out that even with the selection of zero-emission heavy-duty models growing, the volume sold and operating in fleets remains meager for the time being.

“Fleets need to be aware that there's a major change coming,” he warned, citing California’s Advanced Clean Trucks rule that goes into effect for 2024. This state policy mandates a certain percentage of trucks must be zero emissions, incrementally rising each year. In 2024, it’s 5% for Class 7-8 trucks. In 2027, that triples to 15% and levels out at 40% in 2032. Fourteen other states, and Washington D.C., have joined California in calling for 30% of new trucks and buses sold in their areas to be ZEVs by 2030.

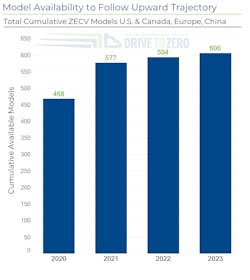

ZETI found the total number of available zero-emission commercial vehicle models should rise from 557 in 2021 to 606 in 2023.

Assuming the ZEV push continues on—and due to the public fear of climate change and lower total cost of ownership for fleets that seems likely, that means fleet owners need to begin figuring out which of these upcoming 71 models might be right for their business.

Façanha advised fleets start researching and talking to the various OEMs and “really evaluate how the technology can best fit for their duty cycles and decide those routes that are most applicable” now to be better equipped for when the business case (and/or government) compels them to eschew internal combustion for an electric motor.

“There is a huge opportunity for fleets, especially for leading fleets to move even earlier, because there are really substantial financial incentives to bring the electric trucks more in cost parity with their diesel equivalents,” Façanha said.

One source is the federal $7,500 tax credit for EVs, though that is far more enticing for a fleet buying $40,000 pickups than $250,000 electric trucks. There is no telling what kind of government handouts will be available to fleets if and when the American Jobs Plan, which sets aside $174 billion to normalize EVs, is passed by Congress.

“The worlds of climate policy, supply chain and the trucking world could not be further apart,” acknowledged Façanha, who has experience working in the supply chain. “I am definitely not naïve here. [Climate change] is definitely very, very far from their list of priorities. But the best way to get them on board is really by focusing the cost benefits of these new technologies.”

Range will be another huge factor affecting adoption, and there is positive momentum there in improving battery storage and cost.

“The pace of battery technology advancement is happening faster than we thought and battery costs are also dropping faster than anticipated,” Façanha said.

While most the currently available ZETs have a range of under 200 miles, Calstart noted in 2022 some models will reach ranges of 375 miles and in 2023, more than 600 miles. This is due to the expected wave of more advanced electric tractors and FCETs making their way into fleets.

Theoretically, with more choices out there, more fleets will test if ZEVs really do have a TCO advantage. Calstart also recognizes how vital residual value is to the truck market, as those early adopter fleets will eventually sell these ZEVs to the secondary market. But how much return they get for them is an unknown.

In a paper called Taking Commercial Fleet Electrification to Scale: Financing Barriers and Solutions, Calstart advocated for government intervention in this area to help fleet confidence in this new investment:

“… Government agencies, working in concert with financial market stakeholders, should serve as 'First-Loss Protection Providers' (FLPPs) to target the most oft-cited financing barrier for ZECV projects—residual value risk, or the concern over how well ZECVs will retain value at the end of their fleet service time. Such a function would mitigate project risk by absorbing the first amount of residual value downside risk and would in turn ease financing of ZECV projects by traditional financial intermediaries.”

Where do small fleets stand?

Now what about all those small fleets that make up a vast majority of the trucking industry? They typically don’t have the capex to afford the latest safety technology, let alone brand new powertrains and charging infrastructure. Is this push to eliminate emissions shoving them out of the industry?

“It's a totally valid argument,” Façanha said of the capital plight small fleets are facing. “And this is not specific to zero-emission technologies. Most carriers are really small, they work at razor-thin margins, and they haven't had access to new technologies. They're essentially priced out.”

He did offer a ray of hope for small fleets, though, in the form of EV-as-a-service.

“Specific companies are combining both the vehicle and the infrastructure, such as charging, through a the fee per mile, or fee per day,” he offered.

This is the model Nikola has presented in the last few years, where the hydrogen-fueled truck would be leased and users pay $1/mile for the truck, warranty, service and hydrogen. Regardless of Nikola’s past and current complicated standing in the ZEV community, leasing ZEVs seems like a logical solution for fleets that work with shippers with net carbon neutral goals.

Charging up

If the trucking industry has learned anything from the recent shortage of semiconductor chips, rubber and other crucial materials, it’s that supply is volatile, so act while you can. And acting early may be the best strategy for fleets who will need to buy ZEVs, if only to have a dedicated place to charge vehicles when not in service.

At some point, there will be a rush to install infrastructure, and there is a finite number of installers and even large utilities do not have unlimited resources.

“This problem is already happening and it is certain to get worse as we approach the 2024 requirement by California and 14 other states to sell electric trucks,” said Cameron Funk, CEO of In-Charge Energy. “Today, we are experiencing 24-month timelines for utility service upgrades. Therefore, to take delivery of vehicles in 2023, you need to start your infrastructure planning today.”

Funk, whose company has worked with dozens of fleets since 1996, including Ryder, Anheuser Busch, UPS and FedEx, recommends taking action as early as possible.

“One thing to keep in mind is that you will be coordinating with your real estate or facilities people in a way you may not have before,” he said. “It helps to understand the daily mileage and down times of your vehicles, the utility and locations of utility services on your properties and the ownership/lease information of your properties. I'd also suggest reviewing the electricity bills.”

The more a fleet can share about their facilities, power usage and fleet activity, the better they can convince the federal and state purse holders to dole out some financial assistance.

“Grant makers are looking for ‘shovel-ready’ projects, so you should start the work now to understand how you want to use the vehicles and what infrastructure you should install,” Funk concluded.