Data-driven decisions are essential for fleet management. With the rise of artificial intelligence solutions, fleets—big and small—have unique opportunities to enhance their productivity.

New AI applications for fleet managers illustrate how data analysis and network planning forecasts are more accessible than ever.

“Things that might have taken hours or days or sometimes even weeks can be done in a matter of seconds,” Mike Branch, VP of data and analytics at Geotab, told FleetOwner.

See also: AI: On the road to limitless potential

Want more trucking industry news? Subscribe to FleetOwner's newsletters here!

Empowering businesses

According to Branch and Jay Delaney, director of product management for Magnus Technologies, AI-powered solutions can help to empower smaller businesses.

“Most of our customers—unless you’re a very large trucking company that has very large IT staff in place that can do this themselves—most of them can’t do this, and therefore they don’t have that visibility,” Delaney said.

Generative AI, according to Branch, is uniquely capable of “reducing time to insight and putting the power in the hands of the change makers.”

Gathering operational data and pulling insights from that data can be costly and time-consuming, especially for resource-constrained businesses.

“What this does is it kind of levels the playing field a bit," Branch said. "If I’m a fleet manager and have no data analytics experience, all of a sudden I can now answer questions that my organization is looking for much more quickly."

Fleet data insights from GPT-4

Geotab worked with traditional AI-powered solutions for years, from predictive maintenance to predictive collision risk. The company recently launched Geotab Ace, a chat platform powered by generative AI to help customers retrieve and process data.

Geotab’s 50,000 customers range from small businesses to large enterprises, operating under many different verticals. With such a varied customer base, there was no one-size-fits-all dashboard for data insights. Geotab instead enabled fleet managers to simply ask data questions without drilling deep into reports or custom dashboard configurations.

“Picture Ace as kind of like ChatGPT for your fleet, enabled to answer questions about the data from your fleet,” Branch told FleetOwner. “What it then does is interprets that question, sifts through all of this data, and provides you with an answer.”

Geotab is offering customers Ace at no charge for a year.

Fleet managers can ask for various data points or analyses, such as: "How much did my vehicles idle last week?" or "I want to know the carbon emissions of my fleet from the entire year."

How it works

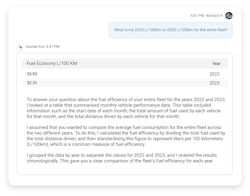

Ace uses the advanced large language model GPT-4 to interpret and generate natural language. The model receives users’ questions, translates them into a series of queries for Geotab’s database, and then formats a response for the user.

To calculate a fleet’s total carbon emissions, for example, “it has to understand the types of vehicles in the fleet—whether they’re diesel or whether they’re gasoline—apply a conversion factor throughout the course of the entire year, understand the fuel that was consumed for each vehicle, and produce that report,” Branch said. “And it does that within seconds, which is pretty cool.”

Protective measures

Geotab implemented a number of safeguards to prevent it from answering questions that it shouldn’t, like "Who should I fire in my fleet?" or "How do you hotwire a car?"

The company also designed the platform to protect users’ sensitive business information. Geotab uses a technique based on retrieval augmented generation to limit what information the AI retains and to reduce hallucinations.

Network planning with machine learning

TMS provider Magnus Technologies in March unveiled new AI-powered truckload planning services for its customers at no additional cost.

“We’ve added AI to help our planning function manage what we’re calling network management,” Delaney told FleetOwner. “The problem we’ve seen is, the time that typically a carrier sees that they’ve undersold or oversold a market, it’s too late to do anything about it. They either know that the day of the event or, if they’re lucky, 24 hours in advance—but that’s not enough time to actually solve the problem.”

See also: AI is a tool worth exploring

“What happens when you’re oversold or undersold? What do you do? You either have a driver sit, which affects your utilization—or you shift them 50, 100, 200 miles, which affects your bottom line expense,” Delaney said. “But if you have five days in advance to actually detect that and correct it, now you could find some freight. Maybe it’s not making you money even at cost, but that revenue is still going against what would otherwise be directly to an expense line.”

Delaney calls it operational leakage, where fleets incur expenses that they don’t know could be mitigated.

The company uses a machine learning-powered solution to look at historical data, economic reports, traffic, real-time weather, TMS information, and more to provide a five-day forecast to the planner of potential undersold or oversold markets.

“We think five days is sort of that magic sweet spot between where AI can actually provide you with relevant predictive data,” Delaney said.

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.