February freight market mixes slow demand with unusual variables

The truckload market is slow even for February, according to DAT Freight & Analytics data and analysts who cited slipping demand as fleets continue to reduce capacity. The market is full of mixed signals as post-pandemic variables impact freight in unusual ways.

“The first quarter is always a quiet season,” Dean Croke, principal analyst for DAT, told FleetOwner. “We’ve been saying for six months: ‘Is this season quieter than most first quarters?’ And it’s certainly panning out that way.”

DAT’s spot truckload data for the week of Feb. 11-17, based on load and truck posts in DAT One, found another cold week for the spot market. Softening demand for trucks in the spot market is typical for February—but the number of load posts in DAT One was the lowest for Week 7 in eight years.

Declines across the board

Declines in load and truck posts hit across all three equipment types (van, reefer, and flatbed) both week-over-week and year-over-year. Load-to-truck ratios hit historic lows for Week 7. Benchmark rates were also down.

The number of loads posted on DAT One fell to 647,166, down 17.6% compared to Week 6 of 2024 and down 60% year-over-year. It is the fourth straight week of load post declines, falling almost 47% since Week 3.

Truck posts fell to 328,828, down 7.5% against Week 7 and 21% year-over-year.

Average load-to-truck ratios for van, reefer, and flatbed were DAT’s lowest Week 7 ratios on record. DAT measured fewer loads per truck than in any previous Week 7 since it began tracking the data in 2015.

Why is the freight market so cold?

There are countless market disruptions in 2024. The slowing freight market, generally, and the spot market specifically, is due to issues ranging from regular seasonal dips and retention practices to inflation, interest rates, and aftereffects of the COVID-19 pandemic.

“I have no idea what’s driving this market because our economic textbook is out the window,” Croke said. “Things that you would normally think would drive the market aren’t. Other things that are still in the market are impacting the market in other ways that you wouldn’t normally expect. There’s just so many mixed signals in the market.”

A simple question like “Why are Week 7’s load posts dropping?” is best answered by a complicated pool of different variables. Here are just some simple points from those answers:

Why load posts are dropping

Demand for freight movement has been relatively flat compared to pre-pandemic levels.

“Overall, truckload demand is down,” Croke said. “I’d say think about the total freight pie: it has shrunk post-pandemic. The total number of tons being moved, speaking very broadly, is a little bit higher than where we were in January of 2018 and a little bit higher again in 2019. So, the market has reverted back to 2018-2019 levels in terms of tonnage moved.”

The economy is still strong—however, interest rates are high, and there are no clear signs that demand will improve soon.

Why truck posts are dropping

The first months after the start of the pandemic fostered a surge in excess capacity that is now falling back into balance with dropping demand.

“There was a shortage of drivers, shortage of equipment, couldn’t get trucks out of factories, used truck prices went through the roof. [Carriers] ramped up their capacity because money was falling from the sky,” Croke explained. “You get to the start of 2023, and things started to turn, and they had four quarters of decreasing truckload capacity at a really rapid rate.”

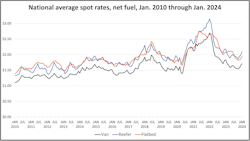

With rates continuing to drop, caused partly by low demand and a low load-to-truck ratio, profitability is becoming more complex. National average rates are near their levels from 2015.

“Our national average also is identical today to where it was in 2015... If line haul rates are as low as they were back in 2015, and operating costs to run a truck because of inflation in the pandemic are about $0.25 a mile higher than those years, suddenly you’ve got margin compression for carriers,” Croke told FleetOwner. “That’s why it’s such a tight market for carriers where a lot of them are a breakdown away from going out of business.”

Carriers are continuing to decrease their capacity, either through layoffs or by leaving the market entirely. This decrease tends to calm down once it falls in balance with demand.

See also: FleetOwner 500: For-Hire ups and downs

Where does this data come from?

DAT offers more than load-board services through DAT One; it also provides extensive business intelligence and freight-data analytics. The company publishes regular data on both the contract and spot markets.

DAT bases its load-to-truck ratio on the posts of available loads and trucks in DAT One. The company bases rates on data in RateView, its pricing and demand analysis tool for truckload freight.

Information from the company reflects a significant share of U.S. truckload freight. DAT One manages over 230,000 van, refrigerated, and flatbed loads each business day. More than 1,300 freight shippers and brokers submit transaction data to DAT. The company’s database covers more than $150 billion in annual market transactions.

“We’re in this phase of the market cycle where capacity is exiting the industry or being reduced, but it’s chasing a moving target,” Croke explained. “And the moving target is demand because it keeps slipping... If you could picture these two lines on a line graph chasing each other down, they’re not getting any closer.”

How will the freight market adjust?

If rates continue to drop at their current rate, Croke said that it may lead to a quick drop in capacity and a sharp correction in rates.

“This is sort of a best-case scenario for those that can stay in the business, worst-case scenario for those that have to fold up and leave,” Croke said. “I think the one thing that is clear is that, when this market turns, there will be fewer trucks. There’s no question about that. That’s a dangerous game for shippers because it could be a sharp correction.”

“Those who are left standing, they are the ones that have been through a few freight market cycles, who know that there’s light at the end of the tunnel, who have a really good handle on their operating costs—more so than the recent entrants who have exited the market,” Croke continued. “They’re the ones left standing that can hold on a little bit longer.”

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.