Uncertainty rules as COVID-19’s effect on freight has no end in sight

The COVID-19 pandemic is like a natural disaster — but unlike any natural disaster in history because no one knows when it is going to end. With no end in sight, freight forecasters are working in a world of uncertainty.

"It's like 10 hurricanes all at once," Clay Slaughter, chief strategy officer and general counsel for FTR Transportation Intelligence, said during a media briefing on March 26. "And part of that is that it leaves destruction and all that destruction may not be buildings that are torn apart and have to be rebuilt; it is going to leave destruction in terms of the disruption to supply chains, the disruption to businesses that are no longer in business."

Small businesses working within low profit margins don't have a lot of reserves, Slaughter pointed out. "They're gonna find themselves out of business pretty quickly," he said, adding that any thought of the novel coronavirus pandemic as a short-lived disaster "is short-sighted in my view."

While freight continues at a busy rate around the U.S., imports are plummeting, according to Bob Costello, the American Trucking Associations' chief economist. "So far this quarter, 58 ship sailings from China have been canceled," he said last week. "Compare that to a year earlier when the trade war was raging when 33 were canceled."

Limited travel in China, where COVID-19 originated, has created labor shortages. While the virus appears to be under more control in Asia than at its outbreak, many truck drivers are not back to work yet in China, Costello noted. With China's supply chain not backed up and seaports on both sides of the Pacific operating at reduced capacity, there are more questions than answers. As Costello points out, "many Chinese goods are inputs to U.S. manufactured goods… Depending on the product, China's production was delayed anywhere from three to 12 weeks. Chinese manufacturing is running at 50% to 90% depending on the industry."

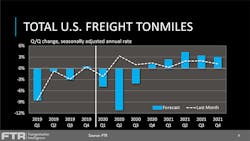

If there is a peak season for freight in the U.S. this year, it would be "fairly subdued," Todd Tranausky, FTR's vice president of rail and intermodel, said. "Folks have a lot of inventory at the moment and they're going to have more as China gets back to production."

But there is a lot of uncertainty about when the U.S. will come out of the COVID-19 economic slowdown, he said, noting a lot depends on "how quickly we come out of this. If we see a significant amount of economic activity from the middle of the third quarter on and people start to feel comfortable about their job situation, then maybe there is a little bit of a peak season. But from where we are right now, it's hard to see how we get there."

The push by health officials to "flatten the curve" also doesn't square with a shorter period for social distancing, Slaughter said. "They're not talking about fewer people getting (the virus), they're talking about spreading out the timeline in which people do get it. This means that you're just going to spread that out."

The movement, through physically distancing, to flatten the curve of people contracting the virus is to slow the rate of infection so the health care system can handle the increase in patients. "So when you think about what we're doing as protectionist measures to try and flatten that curve, that doesn't square with a shorter period of time. It's not like there's going to be this drop-off — or this cliff — that's going to happen and we're all going to get to go back to work," Slaughter said, noting that if the distancing ends too soon, it could lead to another spike in virus infection rate. "And I think that could be even more detrimental than the original one."

This is a natural disaster with no "concrete end," he continued. "It's not like a hurricane where you can track the eye of the hurricane and know when it's over, and everyone can begin rebuilding at the same time."

If most of the U.S. continues focusing on social distancing and keeping people home until the summer, there likely wouldn't be a peak freight season this year, Tranaisly said. "And I think that's where we're trending. To Clay's point about flattening the curve, if you flatten the curve, you extend the time it takes to run its course. If we are up and running by Easter, then maybe we do have a chance at it. I would say that's unlikely at this point."

COVID-19 is affecting different states and different regions in different ways. "That regionality, I believe, is going to be pretty intense in its differences between the regions and it's also going to yield different response rates," Slaughter said. "We've got states that just now declared a state of emergency in the last 24 hours, and you've got other states who've been in a state of emergency and working in containment for well over two weeks. And that's pretty widespread and we start thinking about what that response is going to look like. And that rate of response is going to dictate the outcome and how rapidly that outcome is going to be achieved."

With the second quarter of the year just days away, FTR Chairman and CEO Eric Starks said: "The million-dollar question is about inventory levels. How far do we run the inventory levels down during the second quarter?"

He said that FTR expects inventory levels to come down this spring. "But it's still unclear," he noted. "We're really at the front end of trying to understand the magnitude of everything. I think we feel like we have a good sense of what areas are likely to get hit. What we are unclear on is the exact size of that. And the longer this thing goes, I think that more inventories get run down. And we're just going to have to keep an eye on that."

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.