We wince at the exponentially rising number of infected and dead (globally more than 550,530 and 24,903, respectively, at last check). We cringe at the Dow Jones’ precipitous fall from nearly 30,000 on Valentine’s Day to a low of 18,591 on Mar. 23 before rallying the last three days. We agonize for the 3.3 million of our fellow Americans who filed unemployment claims last week, about 2.6 million higher than the previous record set in 1982. And because this is the trucking industry, we do our best to ignore the catastrophic COVID-19 statistics and trudge on.

That’s good advice to succeed in the daily battles to get goods where they are needed, but truck drivers can’t be like Han Solo, who famously said, “Never tell me the odds” in the face of certain doom. This is a data-driven industry now, with sensors to tell fleet managers and drivers how much air is in the tires and how many miles until the powertrain needs to be serviced. GPS data even prompts the transmission to shift. Just as those help maintain truck uptime, COVID-19 data can help fleet managers make the best decision.

If the Center for Disease Control and Prevention identifies a city’s rate of infection ballooning, for example, the fleet manager needs to get ahead of potential issues such as notifying the driver of current conditions to take more precautions, as well as finding out if there will be anyone to offload the truck.

Data is more important than ever, but we seem to be lacking in it. That has to change.

On Wednesday, the American Transportation Research Institute (ATRI) and the Owner-Operator Independent Driver Association (OOIDA) Foundation announced they are urgently requesting anyone involved in trucking operations to fill out this survey.

"Our goal is to complete the data analysis as quickly as possible, as it can provide important guidance to public and private decision-makers. The COVID-19 pandemic is a moving target, and we can't afford to design policies and supply chains around guesswork," said Dan Murray, Senior Vice President at ATRI.

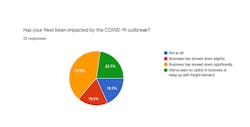

This week we also circulated a survey hoping to get a snapshot of the current state of the industry. While getting a scant 22 responses, it can at least provide a quick glance at the road ahead.

Most respondents were for-hire (61%) with 22% identifying as service providers.

The big takeaway is how business is really going as during the economic downturn due to the high number of responsible citizens self-quarantining.

The trucking industry is a standard bellwether for the economy’s health, as the busier trucking operations serve vital commerce. Despite 62% marking down a slight to severe downturn in business, any fleet connected to groceries is struggling to keep up with demand.

“Food-related carriers have doubled their orders,” said Archerhub CEO Nick Darmanchev. “We have too much business because of this incident.”

The digital freight broker based out of Denver connects drivers with customers needing to fulfill extra capacity or recover freight, and going has been good. Like the experts at DAT Solutions who track spot rates, he likens the period to the high watermark of 2018.

“Tyson foods, Anheuser-Busch—they're all of a sudden increasing the amount of freight, so it's crazy out there,” Darmanchev said. “They’re starting to drive the prices up.”

The problem with only looking at one data set, like spot rates, gives a false impression. Because of the pandemic and people getting sick or having to stay home and watch their children as schools have closed, loading and unloading times have been impacted. And the situation changes by the week, if not by the day.

In an interview on March 17, Darmanchev who manages a fleet of about 50 trucks to further assist clients, observed trailers were taking 24 to 48 hours to get loaded. This week, conditions have changed due to corrections in the supply chain.

“While manufacturing and warehousing are experiencing understaffing, at the same time everyone is working together more efficiently and quicker than before,” Darmanchev said on Mar. 26.

Some changes speeding up the process are distribution centers are accepting trucks a day earlier than scheduled, the FMCSA waiving HOS rules for critical goods such as medical supplies, water, and food products, and the nationwide staycation has also led to empty highways and faster deliveries.

“Currently, these factors are actually offsetting the shortage in manufacturing and warehouse labor,” Darmanchev said.

At some point, inventory will be depleted, though.

“I am worried about what’s going to happen if the virus isn’t contained immediately,” he said. “The supply side will be affected and that has a trickle-down effect. He predicted in the next two or three weeks, “we’ll see a drastic downturn.”

In our survey, 64% listed limited access to freight as a supply chain issue to look out for, with 23% marking access to vehicle service parts. BestDrive, Continental’s commercial tire dealer and retreader, affirmed it was staying open as an essential business to support the transportation industry, as did Goodyear. The latter suspended production due to decreased demand, though.

Archerhub, being technology-based and centered around food and beverage deliveries, can survive about three months under these conditions, he said. But even for a digitally transformed company, the cloud and teleconferencing have their limits.

“If this lasts for months to come, it will be difficult to hire new employees and provide adequate training, Darmanchev said. “We will cross this bridge when we get there, although I hope we never get there.”

Other issues

Though our survey lacked in sample size and solid data, respondents did provide some telling remarks in the fill-in section that the industry needs to follow up on:

Driver shortage

“Biggest challenge impacting my business is the continued shortage of qualified Class A drivers. With DMVs closed across most/all states, it’s impossible for drivers to test for necessary endorsements to legally drive on the road.”

The industry already had trouble finding drivers, though it’s likely service-industry folks who lost their jobs may be looking for a new career in trucking. States have to fund a way to train and certify drivers in a safe manner.

Detention time

“Loading/unloading times are impacted at big chain DCs [distribution centers]. Longer wait times. Due to short staffed/higher truck volume!!!”

“[C]oncerns regarding getting loads and not being able to get them off due to no show at destination. Communication is imperative, but sometimes the crew is just not there.”

Amazon has increased hiring and pay, but recently shut down a Kentucky non-essential returns center after three workers tested positive for COVID-19. As infection rates increase around the country, it’s likely more warehouse workers will get infected, as experts predicted 40-70% of Americans are likely to contract it. This means the supply chain needs to come up with immediate solutions, such as deploying more automated vehicles in the warehouse to pick up the slack.

Stay calm and keep driving

The grim stats, the falling stocks and barren streets can all induce panic, but they don’t have to. The coronavirus has not altered the job of delivering goods from point A to point B.

“Right now we're trying to have the guys operate as close to normal HOS as possible,” said K.C. Cousins, vice president of operations at Fleanor Brothers, a for-hire fleet with about 55 trucks and 65 drivers. “They have enough to worry about being out there during this time to not further complicate things with their hours of service. There’s a reason those regulations are put in place.”

Cousins does admit he has spent a lot of time “chasing down” the truth with so much misinformation out there. He said a rumor that Florida was shutting down all trucking facilities concerned a driver down there.

Drivers will be notified via email and electronic logging devices if they are heading into a CDC-verified “hotspot.”

On the maintenance side, Cousins said the threes shop mechanics keep a safe distance from each other and larger jobs are outsourced to the nearby MHC-Kenworth Joplin, which has equipment to perform jobs it may take all of his mechanics to do.

The biggest key for Cousins was President Trump calming businesses’ fears of a prolonged shutdown, offering a potential re-opening of non-essential businesses on April 12, Easter Sunday.

The CDC data, unfortunately, shows that the infection rate is still climbing in America, which now has the most reported cases, and opening the economy could result in a second, more brutal second wave outbreak similar to the Spanish Flu pandemic of 1918.

Wuhan, China, where the coronavirus is believed to have been originated in November 2019 and spread uncontrollably due to the communist regime’s lax governmental polices on “wet markets” and allowing 5 million people to leave the province after the outbreak but before the quarantine, is considering lifting its lockdown on April 8.

The odds are that the lockdown will go for at least another month, as even Ohio, one of the first to shut down schools and businesses, is predicting cases of 6,000 to 8,000 new cases a day as of May 1.

But in this time for panic and confusion, sometimes optimism is a better motivator to trudge on than the odds.

“Until the president spoke and made overtones that hopefully we'd be able to see the other side of this thing here in the next several weeks, I was a little concerned how much they were going to tighten the vice on us,” Cousins said. “Obviously things are subject to change, but talking about putting people back to work and getting the country back open again was music to my ears.”

About the Author

John Hitch

Editor

John Hitch is the editor-in-chief of Fleet Maintenance, providing maintenance management and technicians with the the latest information on the tools and strategies to keep their fleets' commercial vehicles moving. He is based out of Cleveland, Ohio, and was previously senior editor for FleetOwner. He previously wrote about manufacturing and advanced technology for IndustryWeek and New Equipment Digest.