The COVID-19 pandemic has greatly strained supply chains and last-mile delivery. It also has pushed many retailers and consumer businesses into home delivery, even those who weren’t necessarily serving that space before.

During a webinar hosted by Terrapinn Holdings, the group behind the Home Delivery World trade show, last-mile delivery experts discussed how their companies are navigating the pressures COVID-19 has put on supply chains and their operations.

John Cail, vice president of mobility and last-mile delivery for national fleet management company Merchants Fleet, explained that since the outbreak of COVID-19 in the U.S., there has not only been an emergence of additional last-mile suppliers delivering to homes, but there has been anywhere between a 10 and 40% increase in need for assets among fleet clients.

Through the course of the webinar, attendees were polled about specific challenges they are facing. When asked what part of the supply chain has been most impacted for them during the pandemic, the majority of participants pointed to last-mile delivery and demand forecasting.

“I am not really surprised, we have been seeing demand forecasting changing tremendously due to COVID-19,” explained Arnaud Deshais, chief supply chain officer at RedBubble, a global online marketplace for print-on-demand products.

“It has really impacted different categories in retail and included a lot of variables in the different supply chains,” he continued. “At this stage, there’s even more volatility in terms of what to expect in the next couple weeks and months.”

Panelist Kristin Smith, chief operating officer of Fernish, a furniture and décor rental company, stressed that one of the biggest challenges over the course of the pandemic is that every week it seems like a different part of the supply chain has been stressed.

Fernish sources different furniture from all over the globe. As COVID-19 was really starting to impact China, Smith explained that it was critical for Fernish to understand what the supply chain was like for all its suppliers, as well as potential interruptions that would occur.

“As China was slowing down in terms of closing manufacturing plants and other facilities, you really saw this bullwhip come through,” she said. “There was nothing at the ports, and so many empty containers were sitting there and blocking new containers from coming in. You just saw this ripple effect throughout the supply chain there.”

In response, Fernish began to closely monitor its customer demand, which became increasingly difficult to forecast.

“We were really managing our inventory levels to manage the potential disruptions in our supply chain inbound but also trying to pay very much attention to what was going on,” Smith noted. “The great thing about us is that, for the most part, we do our own last-mile delivery and assembly. We had to put in no-contact deliveries, and that became our default option. We had to explain what that was because it was not something we had done internally or with our customers before.”

Tamir Gotfried, senior vice president and general manager of global field operations for Bringg, a logistics technology provider that helps retailers manage deliveries, emphasized that technology has played a key role and will continue to do so.

In order to operate efficiently, Gotfried referred to five main pillars that are critical to watch: customers, orders, inventory, location, and fleets.

“When you orchestrate those five pillars, and when you connect them and digitize them, it becomes a data game, where you can make real-time decisions that impact your operations,” he explained. “Technology is the glue that brings it all together, and that’s when the magic happens.”

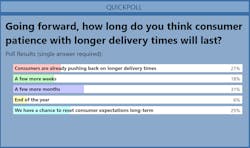

In another poll, webinar moderator Jennifer Bartashus, senior equity research analyst for Bloomberg Intelligence, asked: How long will consumer patience last with longer delivery times?

Poll results here indicated a bit of a contradiction—that consumers are already pushing back on longer delivery times, but attendees saw this pandemic as an opportunity to reset customer expectations.

“In the short term, I’m not sure there are enough assets on the road or enough independent contractors to fulfill the demand and the increased capacity may not be there, so I am not sure there is a lot of choice for the consumer at this point,” Cail said. “Certainly, the manufacturers and e-commerce businesses are doing their best to push out the product as fast as possible. In the long term, last mile is here to stay.”

“I do think that long term it’s a competitive space, and I do think that people’s patience level will fall and that he who can deliver sooner will win,” he added. “Right now, there is not a lot of choice, but I think that in the future, consumer behavior will drive [delivery times].”

Smith, who helped lead the project that launched same-day delivery at Amazon in 2005, quipped that she has been competing with herself ever since.

“Customers obviously understand what is going on right now, and we are very lucky to have a website that allows the customer to choose the day they want their delivery and assembly,” she said.

However, she noted that amid all the disruptions and unknowns, consumer moods have begun to shift, with customers becoming slightly less patient as more time goes on.

“Transparency is the biggest thing that I learned from Amazon—set an aggressive promise that you know you can keep, and then keep it,” she said. “My thought is that people will go back to expecting things faster and that consumers are going to shift to online more.”

When it comes to the forces that have been impacting the supply chain before COVID-19, looking at the current space, and then looking to the future, Deshais pointed to three factors that may have helped the global supply chain prepare for this pandemic:

1. Tariffs and the trade war between the U.S. and China became a driving force behind more manufacturing and shipping capabilities in the United States.

2. In Europe, Brexit has caused people to look at the supply chain differently.

3. The move toward reducing businesses’ carbon footprint has heightened the ideas of more local and sustainable business practices.

On the transportation side, Cail explained that with OEMs temporarily shutting down, the production of new vehicle assets has dwindled industrywide.

“It’ll catch back up but it’s not something that turns on right away,” he pointed out. “We created a little bit of a recycling plan where we refurbished a lot of our parcel vans and our box trucks that we typically would have sold off in the market. We are keeping them in play because we understand the supply is going to be tight.”

Cail also explained that before COVID-19, Merchants Fleet’s traditional reconditioning of trucks did not include a total disinfectant process. The company has since transitioned to disinfecting the entire vehicle to keep drivers safe.

In a post-COVID-19 world, experts emphasized the need to keep a close eye on demand moving forward. One challenge will be the impact of the virus in different regions of the world, Deshais explained.

“This is the time to really take a good look at where the demand around the world is and what the needs of customers are,” he said, adding it’s also important to watch the impact from possible COVID-19-related recessions. “Try to put a plan in place to support that with maximum flexibility and set contingency plans for different opportunities.”

Over the next six to 12 months, Smith also reiterated that flexibility and customer understanding will be critical.

“Nobody really knows how long these ‘new normals’ are going to last—whether in our personal lives or in the supply chains of the world,” she said.