The trucking industry was not immune to employment struggles since the COVID-19 pandemic shut down local and national economies this spring. And while there has been some recent growth across the transportation industry, like most of America, those numbers are still well behind the mid-winter levels before the novel coronavirus changed the national landscape.

While most trucking segments have seen more jobless claims over recent months, there has been one glimmer of growth: last-mile delivery. That less regulated segment, which was already seeing a boom in opportunities before the pandemic, has continued to grow in recent months as Americans rely more on e-commerce.

Since the pandemic started shutting down the economy in March, nearly 49 million Americans filed first-time unemployment claims. As of June 27, there were 18 million continuing to get unemployment payments. Pre-COVID-19, the highest continuous, seasonally adjusted unemployment claims were 6.6 million, Vise noted.

Unemployment still historic

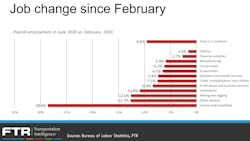

Looking at the national job market, almost 5 million jobs have returned to American payrolls since unemployment rates peaked at almost 15% in April. But if you break down labor statistics between the pre-COVID-19 times that ended in February and the post-COVID-19 months, employment levels are down by about 10%.

"No major sector of the economy has fully recovered," noted Avery Vise, the FTR Transportation Intelligence vice president of trucking, said during a State of Freight webinar on July 9. "Leisure and hospitality, which had that huge gain last month and over the last two months, is still down nearly 30%."

Even as more people are returning to work — or finding new jobs — there are still historic unemployment claims across the country, Vise noted. The June unemployment rate was 11.1%, down from 13.3% in May and 14.7% in April, he said, adding: "The most reassuring thing you can say about it is that every week during this period has been lower than the week before — but it's not coming down much. And even 16 weeks into this, we're still fairly close to double the record rate of initial claims before the crisis."

Trucking jobs

Trucking added back 8,100 seasonally-adjusted payroll jobs in June. While unadjusted numbers have been higher, Vise said: "You can't really look at the numbers that way because June is always going to be a big month because it is a peak month in the market." He said comparing the seasonally adjusted numbers is the best way to analyze the data.

Those jobs added back to payrolls were "just a fraction of the jobs we lost in trucking in April and March," Vise said, adding that a more substantial decline offset the slight increase in trucking jobs in May. "So if we look at February versus June, we're down by 86,600 payroll jobs or 5.7%."

Among the most significant segments hit by unemployment have been household and office goods moving in LTL, which were down 17% from February to May. LTL as a whole was down 10%. Unemployment claims by segment ranged from 5.6% for local general freight to 4.1% for truckload.

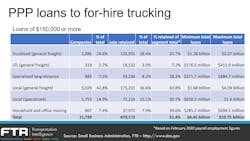

The Paycheck Protection Program (PPP), which was created in response to COVID-19 to incentivize small businesses to keep workers on their payroll, has supported nearly a third of transportation companies in the U.S., according to data gathered by FTR.

Nearly 12,000 truck transportation companies got PPP loans of at least $150,000 — of which nearly 43% of those are local general freight companies. In total, according to government data, these loans retained almost 480,000 jobs. "In theory," Vise said, the PPP supports more than 31% of trucking payroll employment.

But Vise cautioned that the data is more theoretical than complete because it is unclear how individual borrowers and lenders are reporting the PPP information. Wells Fargo, for example, gave out at least $56 million in PPP loans but reported no jobs associated with those loans. That was just one of more than 100 banks that did not report jobs data, Vise explained. Plus loans less than $150,000 were not reported publicly, which could cover independent contractors.

Congress also loosened PPP rules, which initially would have put more pressure on companies to use PPP loans to hire back employees to the same staffing level as before the pandemic. "The takeaway for trucking is that it could mean that capacity remains a bit tighter than initially anticipated because carriers won't necessarily hire back drivers as fast as they might have done so under the original terms of PPP," Vise explained.

Last-mile boon

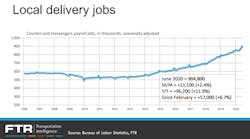

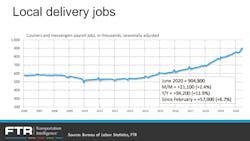

One of the few trucking segments to not suffer in the COVID-19 world is local delivery. "This category — that's officially known as couriers and messengers — was not only not hurt by COVID but was, not surprisingly, helped because of all the e-commerce," Vise said. He added that this was one of the few segments in the U.S. to see job growth since the shutdown.

Local delivery jobs are up 6.7% since February and nearly 12% year-over-year as of June. "One thing I want to plant the seed on is that it's not inconceivable that we could be seeing truck drivers taking these jobs," Vise said. "Normally, we don't see these two industries as competitors because, on average, trucking pays considerably more than local delivery does."

But with more last-mile delivery jobs available and with the last-mile lifestyle allowing drivers to return home every night, it is becoming a more attractive industry and potential second job for professional drivers. It also — except for major parcel carriers — is a federally unregulated industry, Vise noted, which means drivers don't need a CDL, there are no electronic logging devices, and often there is no drug testing.