As North America attempts to fend off the COVID-19 onslaught until the cavalry, in the form of one or more vaccines, arrives, the holiday season is upon us. And what typically is a time to be merry and bright could give way to ominous forces poised to disrupt the holiday supply chain.

That’s the chilly message delivered by Paul Kroes, Thermo King’s market insights leader for North America, who distilled years of transportation industry data from several sources that indicate a challenging Q4 of an already trying 2020.

The leading causes are 80,000 fewer drivers than last year and holiday hoarding, which means less stock on the shelf due to a combination of holiday demand and factories still recovering from shutdowns could cause consumer panic. Furthermore, holiday gatherings could spread the infection and create the need for more shutdowns.

Typically, carriers have enough extra capacity and drivers to handle the holiday crunch, but months of waging war on COVID-19 have caused a “severe imbalance,” which spot rate data supports. The last time spot rates, which vary based on demand, overtook contract or fixed, prices, trucking was experiencing the initial 2018 “Trump bump” after the administration's sweeping tax cuts took effect. At that time, truck capacity was also impacted by fewer trucks and a driver shortage. The industry used the profits made from those robust rates during the booming economy on new equipment.

The September 2020 comparison of dry van rates supersedes even that and overall has driven freight rates to record highs.

That seems like a win for trucking, but might be untenable in the long-term.

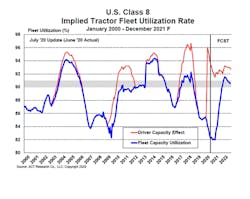

“For nearly every driver that fleets have, they're putting them to work constantly,” Kroes said. “That means there's no more flex capacity, there's very little ability to react to changes in the supply chain or new business.”

That means driver capacity currently has a much bigger impact on utilization rates than fleet capacity.

And the driver shortage is worse than in 2018. Kroes said these factors include a deficit of 80,000 drivers due to the closure of driver training schools, stricter drug testing, and better-than-usual unemployment benefits. Many in the industry, including Kroes, believe the closure of driver training schools and commercial driver’s license testing sites will drop the supply of new Commercial Driver's License (CDL) holders by 40%.

The drug and alcohol clearinghouse created by the Federal Motor Carrier Safety Administration became active earlier this year to track those who have failed drug tests across the industry, preventing them from seeking new employment after testing positive. Kroes attributed a loss of 40,000 drivers to that alone.

Kroes noted hair follicle testing, which extends the range of drug testing from days to weeks and even months, is being examined.

“I shudder to think what happens when you have 100,000 to 200,000 additional drivers removed over time as a result of drug testing, and CDL schools won't be able to replenish them,” he said.

Combine this with an already depleted supply chain that may be asked to support the hardy holiday demand and a new wave of consumer hoarding, and Kroes said it has created a “perfect storm.”

“It's going to probably get worse here coming into the holiday season,” said Kroes, citing retailers and manufacturers’ lack of retooling to overcome the pandemic along with already tight inventory. “If you thought the hoarding and shortages were bad in Q1 and Q2, they're going to be way worse now in the holiday season, which no one wants to hear. But that's probably what's going happen.”

Human nature may be a big driver here. Kroes explained that when there are only two or three of a certain product on the shelf, a consumer is more likely to grab all of them, so as not to run out later.

“The general population is much more aware of how bad it can be,” Kroes said. “You do know that maybe it's going to be tough to find toilet paper and other things that are going to be short supply and so you start to participate.”

The supply chain will course-correct, Kroes said, “but it's probably going to get worse before it gets better. And that's going to further exacerbate the freight environment and rates even higher.”

The bright side

The good news is that high freight spot rates will increase driver pay and therefore bring more people to the industry. And the vaccine developed by Pfizer, which reported a 90% effectiveness rate, could get approved by mid-December.

Thermo King has direct involvement in the logistics of Project Warp Speed, the Trump Administration’s system to speed up vaccine development, approval by the Federal Drug Administration, and dissemination to the American people.

“I'm very hopeful; it seems to be well organized,” Kroes said. “But time will tell. Vaccines require multiple shots and that can get logistically very confusing.”

The vaccine, which will need to be delivered globally via billions of vials, needs to be stored at -70 degrees Celsius, while many major carriers, such as FedEx and UPS, only have refrigeration units that reach -30 degrees Celsius. Kroes posited that a solution comprising dry ice and these reefer units could work and provide some redundancy.

Thermo King also has solutions, such as ocean shipping containers, that do reach -70 degrees Celsius.

“Considering the urgent, global need for a COVID-19 vaccine, the world can’t afford breaks in the cold chain,” said Dave Regnery, president and CEO of Trane Technologies, the parent company of Thermo King. “Our new cold storage solutions can maintain temperatures of -70 degrees Celsius for an extended period of time, can be leveraged to help reduce degradation of a vaccination, and most importantly, could prevent vaccine ‘deserts’ or lack of accessibility.”

It remains to be seen if and when the vaccine will arrive, but one thing is clear: it can’t come soon enough.

“Vaccine distribution is the driver for your broader economic recovery, and your post-2021 outlook,” Kroes said. “You need the economy to recover, you need things to get back to what they used to be, and the only way you're really going to get there is through a vaccine.”