COVID-19 infection rates are falling across the country more than a year after the first case of the novel coronavirus was detected in the U.S. But supply chain difficulties continue to be widespread for trucking and trailer suppliers — 90% of whom believe that an OE production bottleneck is either imminent or already in progress, according to Richard Anderson, director of market research for the Heavy Duty Manufacturers Association.

Anderson recently presented data from February’s HDMA Pulse Report — which includes information gathered through surveys of North American trucking and trailer manufacturers in February — during an HDMA Pulse webinar.

“The level of concern is about as high as we have ever seen it on any specific issue,” Anderson said. “Supply chain problems have resulted in very long shipping delays. Outbound shipping delays are starting to grow both in terms of prevalence and the length of time. So we’re starting to see suppliers react and make changes to their supply chains.”

Anderson stressed that outlooks for the commercial vehicle business are difficult to compare with the past because 2019 and 2020 were so different — one was the last pandemic-free year and the other was defined by COVID-19. However, the various expectations of manufacturers for the rest of 2021 is narrowing in opinions.

Most of the HDMA members surveyed this month believe the second quarter of 2021 will be better than the same period in 2020 — but it will take until the second half of 2021 before the CV business improves compared to 2019. “There's really nothing that has significantly changed how people are feeling about this quarter — or about the overall year,” Anderson said of manufacturers’ anticipations for the short-term.

COVID effects

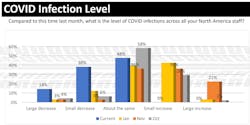

But Anderson did have positive news about negative infections: “The infection rates are down for a majority of suppliers” for the first time since HDMA started tracking the numbers, he said, adding: “No one reported an increase in COVID-infection rates” this February.

More than half of HDMA respondents reported at least a small decrease in infection levels in February across their North American staffs; 48% reported infection levels are about the same.

Anderson said that suppliers expressed concerns about their staff’s health and safety since the start of the pandemic. “This is nice to see that there’s finally some relief on that front,” he said. “The human cost of COVID has not been forgotten, even amongst all of these business metrics. And this is really the one that kind of speaks to that.”

Absentee rates have remained about the same for 70% of manufacturers, according to the Pulse survey — but 20% reported a decrease in sick days. Anderson anticipates these numbers to lag the overall COVID rates.

Vaccine rates in the U.S. are trending at 1.3 million per day, according to Bloomberg News’ COVID vaccine tracker, which estimates the current rate would take 10 months for 75% of the U.S. population to be vaccinated (with a two-dose vaccine). “The 75% number is where they are putting a ‘return to normal,’” Anderson said of estimates from infectious disease experts such as Dr. Anthony Fauci.

While the current rate — which does not consider the single-shot Johnson & Johnson vaccine that the FDA is reviewing on Feb. 26 — for mass vaccination in the U.S. is 10 months, Bloomberg’s data says it could take five years to reach that 75% level worldwide. “We’re looking at quite a long time before vaccinations are widespread,” Anderson said. “This is to be expected though. We knew this when the vaccines rolled out.”

Supply chain worries

“The whole supply chain has been disrupted because the retail market has driven other sectors to really prioritize freight that hadn’t been prioritized before,” according to Eric Starks, the chairman and CEO of FTR Transportation Intelligence, who joined Anderson on the Pulse webinar.

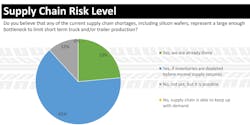

The slow return to normal is keeping supply chain risk levels high, according to HDMA members — 88% of whom said there is either already a supply chain bottleneck for truck and trailer production or there will be if already-depleted inventories don’t return to normal soon. The other 12% say the bottleneck isn’t here yet — but it’s possible.

But no one surveyed believes the current supply chain will be able to keep up with demands this year. “I kind of put that in there with a wink and a nod,” Anderson said of the “no problem” survey option. “I did not think anyone who survived 2020 would actually answer that. But I was also not expecting 88% of people to say that it is either imminent or in the midst of a supply bottleneck.”

Silicon wafers and other supplies used in engine control modules, safety systems and telematics are the “headliner” of supply chain woes, Anderson said. Electronic subcomponents only rate a 6 out of 10 for supply conditions, according to the HDMA Pulse survey. This compares to ratings of 7 to 8 for non-electric subcomponents, Anderson noted.

While electric subcomponents are the hardest to get these days, other raw materials such as metals are getting harder to source. “It’s not quite as bad — but we are looking at other major supply chain bottlenecks in things as fundamental as raw materials,” Anderson said. “The metal supply is particularly problematic.”

Anderson added that there is a belief among surveyed suppliers and manufacturers “that there's little relief ahead and the current order levels aren't sustainable by what's available in the supply chain. Unless there is some kind of adjustment ... our suppliers believe that they're in for a long haul. This could be a difficulty that we’ll ride out for some significant time because the capacity to fix the problem simply doesn’t exist.”

President Biden, on Feb. 24, signed an executive order aimed at improving domestic supply chains for critical domestic goods, including semiconductors. The order directs his Cabinet members to engage in 100-day reviews of the relevant products’ supply chains.

This move came after manufacturers and Congress members signaled growing alarm at critical shortages of semiconductor chips used in vehicle manufacturing. He also urged Congress to fund $37 billion in short-term funding to increase domestic semiconductor manufacturing.

Truck utilization near capacity

While the subcomponents are getting all the headlines, Anderson said the most significant supply chain problem is with international freight and logistics suppliers. “If you are importing, you are having problems,” one Pulse member wrote in the survey, which Anderson said best sums up the current supply chain in North America. “The widespread delays across multiple products, across multiple regions, really is something that is causing major business headaches for suppliers worldwide through their global business.”

This has led to a delay in 16.3% of inbound shipments for HDMA members. Those delays last up to 15 days; 8.8% of outbound shipping face delays of up to a week. This is leading companies to consider relocating their supply chains, according to a recent survey of 100 CFOs. That survey showed that nearly a quarter are considering a move that would reduce their risks and exposures to supply chain disruption.

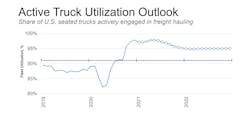

These delays are growing despite historically high active truck utilization, according to FTR’s Starks. The active utilization numbers show how much freight is in the U.S. supply chain, how many loads are moving, and how many trucks are moving those loads around the country.

“We’re sitting close to 97-98% utilization,” Starks said. “For active trucks, that means if you have a driver in the truck, 98% of those are going to be moving freight right now. And the other 2% are going to be looking for a load. This is huge. This is way above our historical average, which is closer to 90%.”

Starks said this shows how much pressure is on the supply chain. “The ability for you to go out and find another piece of equipment to move your load is becoming increasingly more difficult,” he said.

But what this utilization data isn’t showing is that there is more equipment out there to move freight if the industry had more drivers. “We could at least another 5-10% amount of capacity back into the system if you can find the drivers.”

It’s not just about manufacturing, Starks notes. It’s about drivers, many of whom have dropped out of the industry over the past year because of COVID concerns, increased drug testing, and retirements. But it’s not just older drivers leaving the industry, he said.

After a surge of commercial drivers 34 and younger joined the industry in 2019, many of them left in 2020, Starks said. “In essence, anybody that got in in 2019 pretty much left. And we haven’t seen them come back. Probably because we’re seeing competitiveness from other sectors that they could be moving into.”