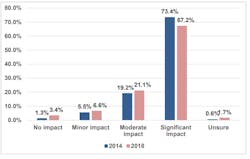

Most drivers have run out of available hours-of-service (HOS) at a customer’s facility due to detention. And that detention, according to a new analysis by the American Transportation Research Institute, had a significant impact on their ability to comply with HOS rules.

ATRI’s analysis found that detention frequency and length have increased between 2014 and 2018, with negative impacts on driver productivity, regulatory compliance and compensation. The research group questioned nearly 2,000 drivers and motor carriers in 2014 and 2018; this report compares the results of the separate surveys.A recent proposal by the Federal Motor Carrier Safety Administration (FMCSA) could adjust HOS rules to provide more latitude to drivers, including when they can take the mandated 30-minute break. “The flexibilities in this proposal are intended to allow drivers to shift their drive and work time to mitigate the impacts of certain variables (e.g., weather, traffic, detention times) and to take the proposed changes would not result in an increase in freight movement or aggregate vehicle miles traveled,” according to the proposal published in August.

However, carriers and drivers in the ATRI surveys noted that shippers and receivers might not understand HOS regulations — and are not held accountable for excessive delays — which adds to driver frustrations and further impacts safety and productivity.

Earlier this summer, Todd Spencer, executive director of the Owner-Operators Independent Drivers Association (OOIDA) told Congress that excessive wait times at shippers’ facilities can often mean truck drivers are putting in an 80-hour workweek while not being fairly compensated for that additional time. These same drivers are being charged penalties for being as little as 15 minutes late for a scheduled drop-off due to traffic, he said.

Spencer, speaking before House Subcommittee on Highways and Transit, called the current system for truckers “broken,” so it should not be a surprise many are exiting the industry after quickly finding out that people are “working their tails off and not getting ahead.”

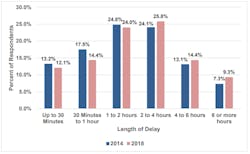

Delay lengths of two-plus hours increased 11.2% over the four-year gap; delays of six-plus hours increased 27.4% over the same period, according to ATRI. And what was causing the delays were nearly identical in both 2014 and 2018, according to the surveys, from which the group inferred that shipping and receiving facilities have made “little to no improvements to run more efficiently across the four-year period.”

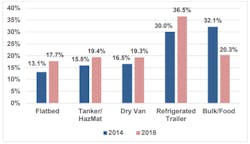

The most significant increase came from drivers (39.6% more in 2018 than 2014) who reported more than 70% of their pick-ups and deliveries were delayed over the past year due to customer actions.

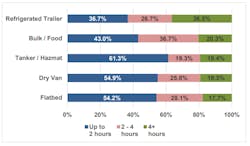

Adding to that, women drivers were 83.3% more likely than men to be delayed six hours or more. ATRI notes this could be because more women drive refrigerated trailers than men — and reefer (along with bulk/food haulers) faces longer detention time than other trailers. Female drivers also told ATRI that their male counterparts are more likely to become impatient and demand swifter action at customer facilities.

Despite these increases in wait time and the broad use of electronic logging devices (ELDs) that chronicle detention, only 17% of drivers reported sharing their ELD data with the customer to document and validate how long they were detained.

Shippers do need to do more to shorten detention time at facilities, Rodney Noble, senior director for transportation and global procurement for PepsiCo, told the House highway subcommittee in June. Speaking for his company that is both shipper and the second-largest private fleet in the U.S., Noble said it is important to not tie up truckers during deliveries so they can spend more time driving.

There is still a call in some trucking sectors for mandated pay to the carrier for detention time, Tom McLeod, the president and CEO of McLeod Software, told industry reporters during his company’s 2019 User Conference in Denver last month. “I doubt we’ll see that kind of mandate — as the trucking industry is subject to all kinds of mandates and they’d love to see the mandate on somebody else,” he said. “But there are so many different kinds of factors and constraints at loading and unloading locations that are unlikely to come about.”

He thinks one of the better ways to combat detention time is for “most carriers to just to continue to not be bashful and step up and talk about best business practices and best ways to serve the customers.”

He added that helping to make sure either the rate carriers charge or specific charges for the detention time itself — along with being able to be compensated the driver for the time spent in detention — would help. “Keeping the equipment moving, that is really what everybody would like to see,” McLeod said.

Earlier this year, McLeod Software introduced an improved Detention Management module for its LoadMaster software. In real-time, the new LoadMaster Detention Management module for drivers automatically warns the carrier’s customer of potential detention problems before they happen and when detention limits have been reached.

The Detention Management Module allows carriers to separate two vital aspects of the detention process: billing the customer and paying the driver. Allowing the billing process to be independent puts focus on the amount of time and effort spent to accurately bill the shipper for the detained driver while knowing the driver will be accurately compensated for lost time.

The average excessive detention fee per hour charged by fleets was $63.71, slightly less than the average per hour operating cost of $66.65 found in ATRI’s Operational Costs of Trucking.

The majority of carrier and driver respondents reported to ATRI that drivers are receiving 40% or more of that detention fee to compensate the driver for the wait. But the negative impact of detention on carrier revenue and driver compensation may be greater among fleets of fewer than 50 power units with 20% reporting that they do not charge for excessive detention in order to stay competitive with larger fleets.

“ATRI's new detention research definitely helps us understand the full financial impact associated with detaining drivers," said Edgar R. McGonigal, chief financial officer of Bestway Express Inc. “From a safety and economic perspective, this research gives the trucking industry new insight into how both carriers and drivers should implement driver detention strategies.”

Among the driver and carrier responses, better facility organization, better management of scheduling and appointments, and more flexible work hours were top customer practices that have contributed to increased efficiency and minimized delays.