Diesel hits lowest average price since February

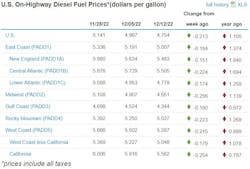

The U.S. average price for diesel fuel has fallen to well below $5 per gallon after a substantial 21.3-cent decline to $4.754 the week of Dec. 12, according to the U.S. Energy Information Administration (EIA).

The latest decline, according to EIA's data, is the largest since a 16.4-cent drop this summer, the week of July 25, and the second straight double-digit decrease following a 17.4-cent drop for the week of Dec. 5. This week’s price slide for trucking’s main fuel also is the fifth in a row after the average bounced around in September, October, and early November.

See also: Diesel drives fleet costs, freight market shifts

Motor club AAA, meanwhile, on Dec. 12 had its U.S. diesel average down by less than EIA's—16 cents—over last week.

More milestones: Diesel is down $38.7 cents in the past two weeks and is at its lowest since Feb. 28, the week before trucking’s main fuel surged 74.5 cents as the Russians were invading Ukraine, according to EIA. That spike accelerated months of sky-high diesel prices until the average reached EIA’s record of $5.81 per gallon the week of June 20. The U.S. diesel average hasn’t yet recovered completely and still sits at $1.105 more per gallon than at this time a year ago.

After gas prices hit record highs this summer and fall—with widespread consumer, economic, and political blowback—they plunged below year-ago levels on Dec. 8, according to AAA’s daily average. And gas keeps plunging, per AAA. The motor club’s daily average had regular gas at $3.262 on Dec. 12, or 6.2 cents below the year-ago number, 14.1 cents lower than a week ago, and 1.5 cents below the day before.

Diesel tumbles by double digits in every region

Not only is the U.S. average for diesel down again by double digits, but it also fell by that much or more in all five regions of the nation that EIA measures and in every EIA subregion as well.

In the Midwest region, diesel was down more than a quarter—25.6 cents—to $4.651, the second lowest per-gallon price behind the Gulf Coast, where the fuel was $4.344 and down this week by 18 cents.

The most expensive region (as it usually is) for the week of Dec. 12 was the West Coast, where diesel nevertheless was down 21.5 cents to $5.287 per gallon, according to EIA. The West Coast also has the most expensive subregion, the state of California itself, but trucking's main fuel was down there substantially as well, $25.4 cents but still $5.562. Interestingly, West Coast diesel is now closer to its year-ago price level than any other region of the U.S., though it is still 88.9 cents pricier per gallon than at this time last year.

Diesel dropped in the the Rocky Mountain region 22.3 cents to $5.027 per gallon.

What’s driving these latest price declines?

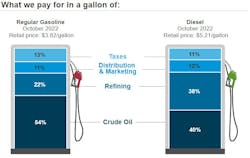

Oil per barrel, as close to any traditional barometer of gasoline and distillate price trends, was as low on Dec. 12 as it has been since before the Russian invasion of neighboring Ukraine (West Texas Intermediate was $73.28 per barrel while Brent crude was $78.10) early this spring. Crude prices were on course for a 10% loss last week, though concern remains that a cap on Russian oil, put in place by the G7 nations in response to the invasion, might soon drive crude prices higher.

EIA’s own forecasts, however, still see Brent crude, for example, averaging $92 per barrel in 2023, though that predication is $3 per barrel less than last month. Crude rose to as much as $120 per barrel this year in all the market uncertainty surrounding the Russian incursion and the world's and oil markets' reaction to it.

Also, another possible driver of higher prices has not materialized. Fears that short supplies of several fuels this fall and winter would drive up prices have not been realized. Supplies of distillates—diesel is one, along with jet fuel and heating oil—fell last month to their lowest levels since 2008, to less than a month’s total supply, though they have recovered since, according to EIA. Supplies of distillates usually drop in colder fall and winter as trucking rolls through its busiest time for freight movement of the year during the holidays and the nation burns through heating oil in greater amounts.

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.