Hydrogen fuel cell proponents offer a 'third way' to zero emissions

With all the electrification questions about batteries, charging infrastructure, and the “range anxiety” expressed at a leading conference of the work truck industry last week, proponents during a summit there were quick to point out that hydrogen fuel cell-powered trucks continue to represent a “third way”—especially for fleet managers who aren’t sure about battery-electrics but still want to ditch expensive gasoline and even pricier diesel.

Record diesel and gasoline prices greeted attendees at NTEA’s Work Truck Week 2022 just as the conference was getting going, and the visitors were bombarded all week with electric everything—exhibits full of vocational EVs themselves and aftermarket products, parts, software, and gear to drive them, outfit them, and route them. Breakout sessions, ride-and-drives, and the exhibit floor at the Indianapolis Convention Center all dealt with electrification in some way and the questions about which kinds of electrics fleets should adopt.

See also: Electrification at a 'tipping point' as fleets explore adoption

One session of the Green Truck Summit was devoted to the merits of hydrogen and how fuel-cell power can impact vocational fleets and the work truck market.

The panelists—Hyzon Motors CEO Craig Knight, Loop Energy COO George Rubin, and Morgan Andreae, executive director of the growth office at Cummins, which supplies many kinds of engines in the work truck space—flew the flag for Team HFC during the March 8 session.

Andreae’s Cummins and its New Power division lead in battery, fuel-cell, and hydrogen production technologies. Rubin’s Loop Energy manufactures hydrogen fuel cells, and his company asserts that its fuel-cell technology increases hydrogen efficiency by up to 16%. Knight’s Hyzon makes fuel cells but also upfits existing builds and platforms for conversion to hydrogen-electric power.

“Hydrogen’s absolutely critical to the transition to clean operations,” said Knight, whose company is new (created in 2020) and who noted that Hyzon has made headway in the Chinese heavy-duty market as well as the U.S. “We convert vehicles to a zero-emissions state, and these vehicles absolutely need hydrogen.”

“There’s a lack of understanding about hydrogen fuel cells,” Andreae added. “There is more capacity to store energy on [an HFC] than an electric battery. There is more energy per electric kilogram stored. There is longer range and the ability to refuel quickly. Refuel times are comparable to conventional diesel.”

The Hydrogen Council estimates there will be 50,000 hydrogen-powered buses and 350,000 hydrogen-powered trucks on the world's roads by 2030.

Versatility and range with hydrogen-electric

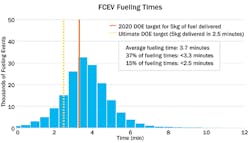

HFCs are commercial, municipal, or vocational vehicles with all-electric propulsion systems that don’t draw their power from batteries but instead use onboard fuel cells, which are filled with hydrogen almost as quickly (less than 5 minutes) and easily (through a nozzle at a pump) as gas- and diesel-burning commercial vehicles.

The fueling infrastructure for HFCs, also called fuel cell electric vehicles (FCEVs), is nascent—just as it is for plug-in electric—but FCEVs have more range (beyond 300 miles) than battery electrics (usually no more than 250 miles in optimal conditions) and perform similar tasks to traditional fossil fuel-burning vehicles.

But HFCs don’t burp emissions like diesel or gas CVs with internal combustion engines. In fact, HFCs emit nothing but water vapor and air, unlike battery electrics, which of course expel nothing. Most if not all classes of CVs can be manufactured for hydrogen and some can be upfitted later and transformed into HFCs.

“The value in hydrogen is its utility, usability, range, and rapid refill," Knight said. "If those elements are critical to your application, hydrogen is very useful. If those aren’t so critical, a battery application is applicable.”

See also: Hydrogen fuel cells are another power option for the trucks of the future

Rubin added later: “Anything can be done with hydrogen. Where we see the biggest drive for it is longer range, as a substitute for diesel. With hydrogen as with diesel, you don’t have to think about range limitations.”

Advice for the transition to H2

Rubin acknowledged that concerns about fueling infrastructure, whether it’s battery-electric charging or hydrogen fill, topped conversation at Work Truck Week 2022.

He said: “Hydrogen requires a big adoption, a lot of vehicles. From a technical perspective, the challenge is great, and it’s difficult to trigger a large-scale adoption.”

Andreae said: “Cost is an obstacle … governments should get involved. But with a volume of fuel cells, the costs will come down.”

Knight noted that the “sweet spot” for hydrogen happens to be the worst “use cases” for diesel power. “The best use cases are drayage, concrete trucks, refrigerated trucks … with very heavy loads, not sitting in the happy zone for diesel, which is on-highway, on cruise control.”

He also noted that anecdotal evidence suggests that the cost of operation for battery-electric trucks is higher vs. HFCs because BEVs are heavier. And even BEV tires wear out more quickly because of the weight, he told summit attendees, while HFCs are lighter and thus a little easier on their rubber.

But what drives the total cost of operation (TCO) for any fleet? Rubin asked. Fuel. “The vehicle is cheaper to operate if you use less fuel,” he said. And that’s the case—especially these days—with anything that doesn’t burn diesel or gasoline. The consensus at Work Truck Week 2022? Once you hurdle the higher cost of adoption with electrics of any kind, they'll start to pay off.

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.