Diesel prices halt rise at $3.82/gal, gas at $3.496/gal

After four consecutive weeks of rising diesel prices, the U.S. Energy Information Administration noted that costs dipped nationwide. U.S. on-highway diesel fuel averaged $3.826 per gallon on July 15, according to the agency, which is 3 cents less than last week.

Prices across the country have not changed much since last week, with cost shifts limited to less than a cent to 5 cents in total. New England, where diesel prices rose less than a cent to $4.109, and the West Coast without California, where prices rose 1 cent to $4.030, were the only areas where diesel prices rose.

Meanwhile, prices dropped less than a cent along the West Coast overall to $4.450 per gallon and fell 2 cents in California and on the East Coast. In California, diesel prices averaged out to $4.932, while on the East Coast, they were $3.908 per gallon. The Midwest saw the most significant price dip of 5 cents to $3.745, while prices dropped 4 cents along the Gulf Coast (to $3.551 per gallon) and in the Rocky Mountain region (to $3.750). However, the Gulf Coast is still the cheapest place to buy diesel fuel at $3.551 per gallon, while California is the most expensive at $4.932.

In comparison, the AAA motor club's current diesel average is $3.858 per gallon, roughly 3 cents more expensive than the EIA’s estimate. This figure is also 1 cent more expensive than last week’s average of $3.844 and equitable to prices from this time last year.

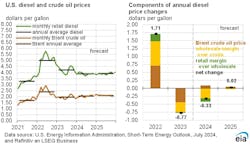

While regional diesel prices shifted down, the EIA’s Short-Term Energy Outlook found that Brent crude oil prices (which encompass 50% of the cost of diesel) will average $89 per barrel in the second half of 2024, up from $84 per barrel from the first half of the year. According to the report, this could be due to global oil inventories decreasing by 0.5 million barrels per day in the first half of 2024, with the worldwide inventory expected to drop another 0.7 million barrels per day in the second half of 2024 because of OPEC+ production cuts.

Additionally, the rise in crude oil prices could be attributed to the international need for shipping fuel, Matt Muenster, chief economist at Breakthrough, told FleetOwner.

Fuel is "being stretched at the moment, with more freight heading around the Cape of Good Hope in Africa because it's being rerouted due to geopolitical conflict in the Red Sea,” Muenster noted. “And ultimately, that's impacting the amount of freight that can move through the Suez Canal, so those vessel voyage times are stretched, and fuel consumption increases with it. So those are a few of the factors that will put upward price pressure onto the barrel of crude oil at this time.”

See also: Diesel prices up for fourth week, gas $3.49/gal

However, the economist doubted that this would last, especially as refineries tend to ramp up gas and diesel production during the summer before the season for peak freight demand.

“Usually, the summer months are an opportunity for diesel stocks to build, creating some downward price pressure on diesel premiums,” Muenster said.

This could help explain why the STEO anticipates that monthly retail diesel prices will remain at or just below the annual average before creeping up into 2025.

Gasoline prices mixed, overall demand down

For gasoline, the EIA found that the national average went up less than a cent last week, reaching $3.496 per gallon. This price is 6 cents lower than this time last year, and prices across the country varied less than a cent up to 5 cents compared to last week.

The price per gallon dropped 4 cents in the Rocky Mountains to $3.386, 4 cents in California to $4.487, and 3 cents on the West Coast overall to $4.191. But prices rose 1 cent along the East Coast to $3.466, less than a cent in the Midwest to $3.369, and up 5 cents on the Gulf Coast to $3.110. Even so, the Gulf Coast is still the cheapest place to buy gas, while California remains the most expensive.

The AAA’s gas average is higher than the EIA’s at this time at $3.521 per gallon, up 2 cents from last week. But it is 4 cents lower than the motor club’s prices from last year at $3.566. The club also noted that the country was lucky to see the prices it did, especially given the recent holiday weekend and weather events.

“The damage from Beryl caused limited damage to Gulf Coast energy facilities,” said Andrew Gross, AAA spokesperson. “And while a record 60 million travelers were forecast to hit the highways for the July 4th holiday, the overall demand number for gasoline dropped. That is a rare feat for a holiday week and may point to a change in demand trends.”

About the Author

Alex Keenan

Alex Keenan has been associate editor for Endeavor's Commercial Vehicle Group, which includes FleetOwner magazine, since 2022. She has written on a variety of topics for the past several years and recently joined the transportation industry, reviewing content covering technician challenges and breaking industry news. She holds a bachelor's degree in English from Colorado State University in Fort Collins, Colorado.