Study: Does technology help improve your fleet’s mpg?

The North American Council for Freight Efficiency is back once again with its Fleet Fuel Study. Fourteen fleets participated in the study for 2024, and the results are impressive. The average miles per gallon of participating fleets in 2024 was at an all-time high of 7.77 mpg. This is because efficiency technologies have been adopted, according to the report.

“We're starting to approach with the fleet average where we were during Run on Less and getting within reaching distance of at least the very first SuperTrucks,” Yunsu Park, NACFE director of engineering and lead author of the report, said in a media roundtable discussing the study. “It's really pretty impressive the gains that the industry has been making.”

Park’s references are significant. The Run on Less program is one of NACFE’s “best-of-the-best" freight efficiency demonstrations, and the SuperTrucks program is a government-backed program that challenges OEMs to improve heavy-duty Class 8 efficiency.

NACFE released its previous Fleet Fuel Study in 2022, when diesel prices were astronomically high, which could have spurred some of the efficiency technology adoption among fleets in 2022 and 2023, considering NACFE cites a “growing use of fuel-saving technologies and practices” in its latest report.

The 2024 Fleet Fuel Study analyzes the technology adoption of fleets and ways fuel economy is impacted.

See also: What causes fuel inefficiencies and how to combat them

Fuel efficiency technology adoption

Just as every fleet is different, their technology adoption rates will also be different. Even among the 26 fleets that NACFE has watched over the course of 20-plus years, one fleet that might have a high adoption rate in five years might lag or accelerate technology adoption depending on various circumstances.

What is worth noting, however, is that “the adoption rate for the [participating fleets]—of all the technologies—is at an all-time high at 42%,” Park said.

The technologies employed by these fleets will differ from fleet to fleet, and no fleet can use all available efficiency technologies on a single tractor, “as some are ‘competing’ solutions for a single function,” the report states.

“For instance, a truck would not have both a diesel auxiliary power unit and a battery heating, ventilating, and air conditioning system,” the report explained further.

The maximum amount of technology adoption among a single fleet is around 65%, according to the report. This year’s fleets range from employing 22% to 59% of available technologies on their tractor-trailers.

NACFE analyzed participating fleets’ technology adoption according to their equipment purchases. The 2024 report compared technology purchases from 2022/2023 and 2020/2021 to determine the efficiency technologies with the largest increase of adoption among fleets. The results are reflected in the graphic below.

While fuel study participants show a nearly 100% use rate of predictive cruise control across their fleets—an increase of 42% since 2020/2021—one technology to watch is automatic transmissions, which saw an adoption rate increase of nearly 500%.

Other technologies to watch are trailer wheel covers, with an adoption rate increase of 144% and a use rate of 22.2%, and trailer noise cones, with an adoption rate increase of 138% and a use rate of 22.2%.

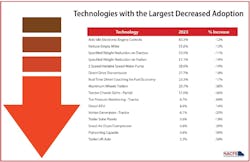

The report also shows the technologies with the largest decrease in adoption rate, which are reflected in the graph below.

See also: TruckWings tops 1 billion aerodynamic miles

How technology impacts fuel economy

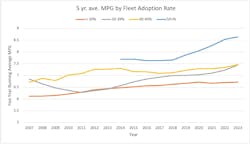

A multitude of technologies are available that can positively impact a fleet’s fuel economy. According to NACFE, the more technologies a fleet adopts, the more likely it is to experience improved fuel economy. In fact, comparing high-adopting Fleet Fuel Study participants to lower-adopting participants showed that “fleets with a higher overall adoption rate of all technologies achieve better fuel economy than ones with lower adoption.”

NACFE drew this conclusion by analyzing participants’ responses and data going back to 2003, separating the participating fleets into four adoption rate groups: less than 30%; 30-39%; 40-49%, and 50% and higher.

The chart below displays the correlation between technology adoption and better mpg, with each line representing a different adoption rate group.

NACFE does advise caution, however, when viewing these results, as the data consists of averages reported by various types of fleets operating various equipment with various duty cycles. This means the data indicates “an overall relationship and does not prove causation.”

Fuel impacts from other factors

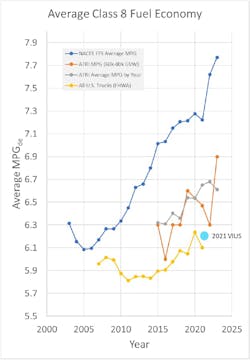

The graph above illustrates the fuel economy of the average U.S. truck (black line) and the average mpg of fleets participating in the Fleet Fuel Study (blue line).

The decrease in the mpg of participating fleets from 2003 to 2006 indicates the impact “of the engines meeting EPA04 and EPA07 emissions level requirements,” the report states. In the years following, as fleets began to adopt more efficiency technologies, coupled with the introduction of diesel exhaust fluid in 2010, their mpg increased.

See also: Unlocking AI’s complex interpretations to increase efficiency and productivity

When analyzing this data, it’s important to understand that the “average” U.S. truck’s fuel efficiency—and even the average mpg of the fleet trucks participating in the Fleet Fuel Study—is difficult to determine.

This is because there are multiple variables to consider in trucking. One such variable is weight. NACFE offers this example: Consider a truck hauling a full load to its destination at 80,000 lb. Once it reaches its destination, it’s unloaded, then travels back unloaded at 30,000 lb. The “average” weight of the truck in this scenario is 60,000 lb., but “that number in no way reflects the actual operational loads encountered by the truck in either direction of the trip,” the report states. And that’s just one truck. When considering the variables of weight across fleets of trucks in mountainous regions, flat regions, different climates, different speed limits, different haul types, etc., that national “average” gets complicated.

Each of these variables—along with the driver’s behavior—affect a truck’s overall fuel efficiency.

The industry’s “average” mpg also varies according to the source, as NACFE outlines in the graph below.

See also: Increase fuel efficiency using a fleet management system, electrified fleet products

Efficiency technology cost vs. ROI

These efficiency technologies come with a cost regardless of whether fleets invest in these technologies at the dealerships when ordering their trucks or if they purchase them as aftermarket products.

Some technologies can cost fleets thousands of dollars, yet they offer fuel efficiency benefits that could save the fleet money in the long run. NACFE cites automated manual transmissions and diesel auxiliary power units as two such technologies. Then there are other technologies that are less expensive and easier to implement yet still provide a benefit, such as wheel covers and vented mudflaps, NACFE notes.

A simple technology payback analysis from NACFE determined that, on average, fleets will see a 2.8-year payback when investing in efficiency technologies; however, NACFE believes this payback will improve as these technologies are more widely adopted and their upfront purchase price is lowered.

NACFE’s recommendations

The 2024 Fleet Fuel Efficiency study concludes with a list of recommendations for fleets interested in or currently evaluating the benefits of fuel-efficiency technologies.

First, fleets should collect and monitor their fuel consumption per vehicle. This allows fleets to understand which applications and duty cycles would best benefit from efficiency technology implementation.

Next, fleets should budget for and commit to an mpg improvement plan by setting long-term goals. NACFE notes that many of the available efficiency technologies exhibit a high ROI, which will eventually improve the fleet’s profitability.

After purchasing new technology or during a trial period, fleets should develop a test route and a test driver to evaluate whether new technologies would benefit their fleet.

NACFE also recommends that when purchasing used equipment, fleets should buy from a seller known for having good fuel economy, as those are the fleets “continually testing technologies and ... adopting ones that are successful.”

Finally, allow for failure because not every technology will work for your application or duty cycle.