EIA anticipates higher oil production, lower pump prices in 2025

The U.S. Energy Information Administration's first Short-Term Energy Outlook report of 2025 brings generally positive news for the transportation industry.

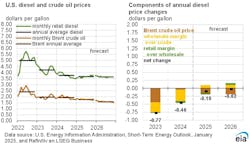

In broad strokes, the administration anticipates crude oil costs will decrease over the next two years while U.S. production increases. These factors may pull down retail gasoline prices through 2026, although diesel prices may increase above the annual average toward the end of 2025 before falling again.

Since the cost of crude oil routinely encapsulates almost half of the cost for a gallon of fuel, let’s first examine what EIA expects for oil production over the next two years:

- Firstly, the administration anticipates that oil production will increase through 2026 both globally and in the U.S., even after U.S. crude oil production reached a record average of 13.2 million barrels per day in 2024.

- This year, the administration anticipates the U.S. will produce 13.5 million barrels per day and 13.6 million barrels in 2026, with growth slowing in the latter year.

- As for the rest of the world’s oil production, EIA expects global production of liquid fuels to increase by 1.8 million barrels per day in 2025 and then 1.6 million barrels per day in 2026.

- OPEC+ is expected to increase its output in 2025, too, but this amount may be less than the organization’s original production targets to avoid inventory build-up.

How oil production could impact pricing

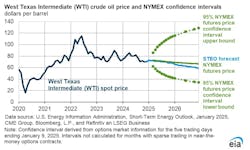

The West Texas Intermediate crude oil price is expected to average $62 per barrel in 2026, down from $70 per barrel in 2025. The administration expects this price drop to manifest in the global oil market as well, where the production growth will outpace demand, pushing oil prices down through 2026 while also slowing growth.

"Although crude oil prices increased significantly during the past month, we still expect relatively slow international demand growth and available supply to counter upward price pressure stemming from geopolitical uncertainty," concurred Matt Muenster, chief economist at Breakthrough.

For example, the Brent crude oil price average could be as low as $74 per barrel in 2025, which is 8% lower than in 2024. However, EIA expects prices to drop even lower in 2026 at $66 per barrel, a price point that hasn’t been recorded since 2021. At the gasoline pump, these decreasing prices translate to $3.30 per gallon in 2024, $3.20 in 2025, and $3 in 2026. But this doesn’t guarantee that diesel fuel prices will fall to where fleets need them.

See also: Diesel prices continue to climb, gas prices stable

“It needs to be down slightly under $3 and stay there for the truckers and other consumers to feel that,” Mike Kucharski, VP of JKC Trucking told FleetOwner in December. “When diesel prices start falling, they start going very slowly. And for us to feel it, there's always a lag, and that lag is what kills us.”

This lag could mean that slowly decreasing crude oil prices over the next two years may bring transportation some relief at the pump, even if it does come after several months.

“I expect it will take six to nine months for [diesel prices] to stabilize and for fuel to stop jumping up and down,” Kucharski estimated.

However, it is also worth noting that the EIA's first 2025 STEO came out before "before the United States issued additional sanctions targeting Russia’s oil sector on January 10," as the administration noted on its report. Muenster noted that these sections, as well as the sensitivity of the Trump Administration to higher oil prices, could have further implications for both crude oil and commercial fuel prices going forward.

"Some potential outcomes include: other OPEC countries return products to the market to make up for the supply loss, Russian products may continue to find other consumers and on balance the latest sanctions may not tighten the market as much as some estimates suggest, finally, it is also possible for the sanctions to have a lasting impact and fundamentally shift crude oil and refined products’ price floors higher than anticipated in 2025," Muenster explained.

Finally, one of the last points in the STEO was that as oil production increases in the U.S. in 2025, EIA noted that the country’s carbon dioxide emissions will increase slightly and then decrease the following year. The administration expects this will be due to greater coal and petroleum-product consumption in 2025 but decreased use of natural gas for electricity and improvements in vehicle fuel economy in 2026.

About the Author

Alex Keenan

Alex Keenan has been associate editor for Endeavor's Commercial Vehicle Group, which includes FleetOwner magazine, since 2022. She has written on a variety of topics for the past several years and recently joined the transportation industry, reviewing content covering technician challenges and breaking industry news. She holds a bachelor's degree in English from Colorado State University in Fort Collins, Colorado.