MARCO ISLAND, Florida—Freight markets and the related equipment demand have bottomed out, but recovery will be slow, a transportation forecaster told trailer dealers here Thursday. But the good news is that the current activity level, while low in the cycle, is not so bad compared to previous downturns.

Speaking at the National Trailer Dealers Association's annual convention, FTR Transportation Intelligence CEO Jonathan Starks opened his transportation equipment outlook here with a quick audience survey. Yea, or nay: The price of trailers increased by 50% in 2020?

The dealers knew their market and overwhelmingly confirmed the spike. Starks noted that trailer prices have decreased slightly but not significantly since the peak, and he doesn't anticipate carriers getting much of a pricing break in 2024.

"There is no quick fix on the inflation environment, but we have seen a drastic renormalization within goods—which is a positive for our industry," Starks said.

As to the labor challenges employers have faced since 2020, Starks explained that payroll activity has "slowed considerably" over the last year or so and that slowing will continue over the next several quarters.

"We're getting close to the point where if we slow much further, we could see negative employment growth in the U.S. economy," he said.

Don't expect freight growth until demand rebounds

As for inventories, which are "critically important" to the transportation markets, Starks suggested that the COVID-driven surge in online shopping led to significant growth in warehouse space to support local delivery, and keeping warehouses stocked has likely generated some excess supply in the system. However, with no real growth in demand, "we have a very manageable inventory environment," he noted. And that means no increase in freight until demand rebounds.

Plugging in the various GDP factors into FTR's modeling of transportation demand—and, in turn, equipment demand—Starks reported "slowing, but still positive growth" over the next few quarters, with a base forecast of 1.5% GDP growth over the next four quarters and a return to "trend levels" of output later in 2024.

However, GDP growth of around 1% indicates a "growth recession," meaning the economy is still growing, but it's not growing enough to create any real demand, Starks explained.

"Without growth in demand, then it's really tough to stay out of a recessionary environment for portions of the markets," he said. "So as we get at or below that 1% mark, we've got to pay real close attention to how different markets are operating because they're not all going to be operating the same at that point in time."

Looking specifically at the indicators that make up FTR's goods transport indicator, Starts noted "a slightly different picture" than that of the broader economy, with a negative environment "for pretty much all of the last year."

"They have definitely had struggles with demand within that marketplace," he said. "As you look out over the next few quarters the numbers are positive, but they're not very positive; you're probably going to get a weak quarter or two and a positive quarter or two. And that, again, indicates that there's no real demand pressure for a lot of that market and for your customers until you get to the midpoint of next year."

Where trucking equipment markets stand at start of Q4

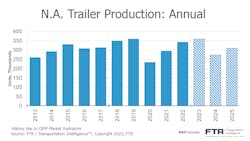

As for the equipment markets, Starks noted that production has been running well above FTR's demand indicators over the last couple of years. He also pointed out that the rapid declines in backlogs need to be seen in a broader context, namely that backlogs have essentially returned to normal levels from record highs.

Likewise, "replacement level" demand for equipment means 2024 will be the low year in the cycle but will still run well above the lows during the Great Recession.

"This isn't something to overly stress about because you think about some of what's happened, especially coming out of 2008 and 2009, that the market had to deal with," Starks said. "These are market dynamics that many of you have dealt with over the last couple of decades, and they can be managed—but it does say that there is weakness expected to come into the marketplace."FTR's latest outlook also included:

- The truck loadings outlook for 2023 has turned from marginally negative year-over-year to marginally positive. The truckload rate forecast weakened slightly primarily due to flatbed. Rates for 2023 are highly negative year-over-year, and 2024 looks only somewhat positive. The LTL rate forecast is fluid due to the uncertain impact of Yellow's failure.

- Class 8 orders exceeded expectations, while builds came in lower than forecasted. The 2023 forecast moved slightly lower as OEMs struggled to meet production schedules. The Class 8 forecast eased by 2,700 units in 2023; no change for 2024.

- Medium-duty sales moved lower but were above expectations and increased y/y. Demand remains healthy, and the 2023 forecast saw a significant jump of nearly 12,000 units. The forecasts for 2024 and beyond also saw upward movements.

- Trailer orders recorded an unexpected increase in July. Builds came in lower than expected, but the underlying near-term pressures remain for most trailer types. Trailers also saw the build forecast edge lower by 1,000 units for 2023 with no change to 2024 or 2025.

About the Author

Kevin Jones

Editor

Kevin has served as editor-in-chief of Trailer/Body Builders magazine since 2017—just the third editor in the magazine’s 60 years. He is also editorial director for Endeavor Business Media’s Commercial Vehicle group, which includes FleetOwner, Bulk Transporter, Refrigerated Transporter, American Trucker, and Fleet Maintenance magazines and websites.

Working from Beaufort, S.C., Kevin has covered trucking and manufacturing for nearly 20 years. His writing and commentary about the trucking industry and, previously, business and government, has been recognized with numerous state, regional, and national journalism awards.