With freight volumes rising, Class 8 vehicle production and sales are expected to rise in February.

ACT Research’s latest North American commercial vehicle forecast predicts a bump up for Class 8 production and sales, thanks in part to growing demand in Mexico.

In addition to consistent domestic vocational strength, Kenny Vieth, ACT’s president and senior analyst, said that the forecast’s boost is due to the industry’s ability to sell into Mexico and export markets.

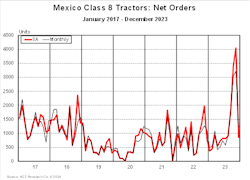

“The 2024 market is atypically bifurcated: considerable strength remaining in U.S. and Canadian vocational markets and Mexico helps offset otherwise weak demand in U.S. and Canadian tractor markets, LTL excluded,” Vieth said. “With more time-sensitive manufacturing loads to haul, pent-up demand, and a strong peso, the forecast anticipates Mexico-bound Class 8 production will rise considerably in 2024.”

Growing demand from Mexico

The production and sale of Class 8 vehicles is expected to rise in part thanks to demand from Mexico.

Since the COVID-19 pandemic contributed to supply chain problems centered around U.S. seaports, more manufacturers have moved operations closer to consumers. Mexico became the U.S.'s leading source of imported goods, overtaking China in 2023. Part of that growth is an overall North American trend toward nearshoring.

Nearshoring after the COVID-19 pandemic contributed to the growth of North American demand for goods from Mexico. The rise of nearshoring has been a promising sign for U.S. freight.

“I am very bullish on U.S. manufacturing, North American manufacturing," said Bob Costello, chief economic for the American Trucking Associations, at the ATA annual convention in October 2023. "This idea of nearshoring or reshoring—whatever you want to call it—is real. It is happening. It doesn't happen overnight, but we know it is, in fact, happening.”

Demand south of the border can also be attributed to Mexico's booming economy. The World Bank reports that the country's economy grew 4.7% in 2021 and 3.1% in 2022. BBVA Research estimates Mexico's 2023 GDP growth is near 3.4%. The peso is continuing to grow in strength relative to the U.S. dollar.

See also: Trucking By the Numbers 2023

The pandemic not only fueled North American nearshoring—it also led to pent-up demand for vehicles.

"When we think back to the pandemic period, surging consumer goods demand and globally constrained supply-chains, considerable pent-up demand occurred in all NA markets: The OEMs and suppliers could not build trucks fast enough in 2021 to satisfy all the demand, so that demand rolled into 2022 and then, 2023 in the US and Canada," Vieth told FleetOwner. "As the OEMs were working off pent-up demand in the U.S. and Canada (during last year’s freight recession), and as the peso strengthened, demand from Mexico started to build in [the second half of] 2023, bringing us to where we are today: An overcapacitized and a young U.S. tractor fleet, and the best new truck demand environment in a decade in Mexico."

Forecast follows January surge

The forecast comes after signs suggesting a warming freight economy in January of this year.

January’s Class 8 orders were up

Class 8 unit orders were already high in the first month of 2024.

ACT Research and FTR, two leading commercial vehicle research firms, showed significant increases for Class 8 orders in January. The firms reported a 35-45% year-over-year increase for Class 8 units in their preliminary reports.

Spot freight volume up in January as well

DAT Freight & Analytics reported all-time highs for spot freight volumes in January. The DAT Truckload Volume Index for van, refrigerated, and flatbed equipment were all up 11-14% month over month and 1-6% year over year. DAT’s measured load-to-truck ratios had also increased in January when compared to December.

Ken Adamo, DAT chief of analytics, suggests that the spot freight volume increase is in response to winter weather coinciding with seasonal demand shifts, rather than sustainable growth.

“Winter weather increased the need for trucks at a time when shippers were moving holiday returns and springtime retail goods through supply chains, and for-hire carriers were rejecting a higher percentage of contacted loads,” Adamo said. “This was not a case of freight volumes sustainably trending higher. Barring some other disruptive event, we expect demand for truckload capacity to meet seasonal expectations during the months ahead.”

Cautious optimism for the year

ACT’s forecast of rising Class 8 production and sales is still tempered by a general freight downturn for the U.S. However, major carriers and OEMs also expect demand to grow firm in 2024.

Old Dominion Freight Line, No. 10 in the FleetOwner 500: For Hire list, expects its yields to accelerate modestly as the year progresses.

Paccar's CEO Preston Feight anticipates solid demand for the company going into 2024, rather than a slowdown.

“As far as a slowdown in orders, I'm not sure I can recognize that in our major North American markets,” Feight said in January. “We see good order intake and good visibility.”

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.