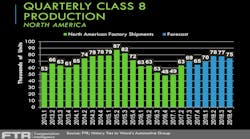

INDIANAPOLIS. North American Class 8 truck production will hit 300,000 units in 2018, a level seen only once in the past 10 years, according to the transportation equipment experts at FTR. In other forecasts presented at 2017 FTR Transportation Conference here this week, commercial vehicle trailer production will see a modest increase, paced by an improving flatbed market, while medium-duty truck production will mirror the U.S. economy, with slow but steady growth.

Indeed, as goes the economy, so goes trucking. In the freight market, spot trends indicate that more loads are being posted with fewer trucks competing for them, resulting in a 19% rate increase over last year, explained FTR Chairman and CEO Eric Starks.

“We are seeing noticeable rate pressure out there. We have not seen it moving into the contract rates, but I believe that we will see that very shortly,” Starks said—and that means carriers are in a better position to pay for things like drivers, and new equipment.

In the FTR analysis of manufacturer backlogs, virtually all production slots are filled for the third quarter this year.

“We have not seen that in long time. This suggests people are pushing for deliveries in the short term,” Starks said. “That is a very welcome sign.”

FTR puts third-quarter Class 8 production at 70,000 units before taking a seasonal dip to 65,000 units in the fourth quarter. For 2018, production climbs back to 70,000 units in the first quarter, then finishes the year with totals of 78,000 in Q2, 77,000 in Q3, and 75,000 in Q4.

“If you look at these numbers, we are not at levels we saw in 2014—but we are still at healthy, healthy levels going forward,” Starks said.

But those FTR numbers might be optimistic, or at least premature, counters Jeff Kauffman, managing director at Aegis Capital Corp. Invited to present an “alternative” equipment forecast, he contends that improving market conditions won’t provide truckers the margins they need to make capital investments until mid-2018, pushing sales into 2019.

“Most fleets have had the [equipment] numbers where they wanted them to be before this year, so there’s no catch-up on the heavy-duty side. We’re not looking at an aged truck fleet,” Kauffman said, explaining that his math puts 2018 Class 8 production at 265,000 units. “We’ve got ELDs coming, people are going to be hurting for drivers. Rates are going to go up, but we’re going to have to go out and hire drivers before we can buy trucks. I just don’t see 300,000 next year—maybe in 2019, after carriers have had a year of P&L under their belt, a year to figure out ELDs, after a year with better margins to put new drivers in training schools. Then I can see that happening.”

Trailers

As for commercial trailer production, FTR CV equipment expert Don Ake noted that he had substantially underestimated the U.S. dry van market in the 2017 forecast, expecting production to be 150,000 units, but which he now estimates to be 177,000 units for 2017—an 18% difference, but virtually the same level as 2015 and 2016.

Ake attributes this consistency in the dry van segment to a lingering replacement cycle, as well as a limited pre-buy ahead of new trailer requirements under the new federal greenhouse gas emissions standards (GHG2), expected to add about $2,300 to cost of a new van trailer.

Additionally, Ake suggested that the expected impact of the looming ELD mandate prompted fleets already using e-logs to add trailers this year, earlier than anticipated by “conventional thinking” which had pushed that demand into 2018, after the rule goes into effect.

And while the replacement and pre-buy impacts come out of next year’s forecast, those losses should be offset by the demand associated with an improving freight market and tight truck capacity. As a result, he projects dry van production to remain flat, coming at 178,000 units in 2018.

In contrast to the dry van market’s consistency over the past several years, the refrigerated market has seen new federal food safety rules and a “cultural shift” in consumer goods that ship as temperature-sensitive freight, prompting record reefer production in 2015 and 2016, before slipping this year after meeting that surge in demand.

“The backlog on refrigerated vans is not looking very good right now,” Ake said, and he forecasts 2018 refrigerated van production to continue to slip, down 3% to 42,400 trailers. “I don’t think we’re going to need as many new reefers as we have in the last few years.”

Flatbed, in contrast, is making a “stronger and faster comeback” than expected, based economy-driven demand for the segment, Ake explained, putting “upside pressure” on the forecast.

“Dealers are back in the game, finally,” Ake said. “They’re ordering trailers, they’re stocking trailers, they’re selling trailers. They’re positive for the first time in a couple of years.”

Ake expects a 5% jump in 2018, to 23,200 flatbed units. He also anticipates “a decent recovery” in the dump trailers (up 5%) and the liquid tank trailer forecast, based on improvement in the energy and chemical sectors, is “looking better, because they were so low,” resulting in 16% improvement.

Medium-duty

FTR COO Jonathon Starks points to a small increase in demand driven by the economy and a “normalized” replacement cycle as the basis for FTR’s forecast of a 1.4% increase in medium-duty commercial vehicle production (212,300 units, up from 209,300) —but that’s a 7.3% improvement from 2016 (197,800).

“We had pretty strong numbers in the first half of this year, with some seasonal weakness built into the second half, so the full year numbers are stronger—and that sets us up for 2018,” Jonathon Starks said. “This isn’t significant growth, but it’s a very solid, stable, slow-growth environment. There’s some positive potential building for 2018, 2019, but it’s not transformational amounts; it’s incremental amounts.”