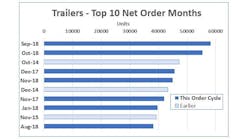

November trailer orders best in industry history, per ACT, FTR

Final trailer orders reached 45,000 units in November, according to ACT Research and FTR.

US trailer orders slid sequentially for the second consecutive month, ACT said, but that still makes November 2018 the fifth-highest net order month in industry history, following September’s all-time record and October’s second-best total.

More information is available in ACT Research’s State of the Industry: US Trailer Report.

“Seasonals call for a small sequential net order gain to close the year, but several factors make that a challenge,” said Frank Maly, ACT’s director of commercial vehicle transportation analysis and research. “With the last three months all ranking in the top five all-time, how likely are fleets to continue to increase commitments that currently stretch into fall 2019? Several factors, including softening freight rates, some interest-rate driven uncertainty, and the continuing potential of tariff wars, cloud the economic horizon.

“It is important to remember that year-to-date volume already ranks 2018 as the highest net order year in history, with one month remaining. The orderboard is just above twice the level of this point last year, and eight of 10 trailer categories are in the black y/y, with dry vans, reefers, heavy lowbeds and liquid tanks all posting triple-digit percentage improvement.”

Trailer orders, down 17% in November from October’s “impressive” activity, hit 427,000 units for the past 12 months, FTR reports. November 2018, up 5% year-over-year, ranks as the best November in industry history.

Trailer orders were elevated for the third month in a row as dry van fleets placed large requirements orders for the second half of 2019, FTR said. Orders for other trailer segments retreated to more normal totals, after being near record levels the previous two months.

“There are still shortages of trailers in some markets as fleets continue to struggle to keep up with growing freight demand,” said Don Ake, FTR vice president of commercial vehicles. “Fleets are expecting they will need significantly more trailers throughout 2019. At some point, supply has to catch up with demand and that could begin to happen around mid-year.

“Expect trailer orders to fall for the next few months because most fleets already have their orders in for next year.”