National diesel average flat, up only a fraction of a penny

The U.S. average price for diesel fuel has broken the fever of double-digit increases of the two prior weeks, essentially coming in flat for the week of Oct. 24, according to new U.S. Energy Information Administration data.

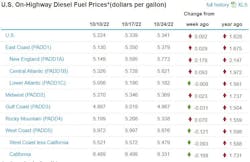

According to EIA, the national average did go up, but only a fraction of a penny (two-tenths of a cent), to $5.341 per gallon, compared to $5.339 the week of Oct. 17, which was an 11.5-cent increase from the prior week. The surge for the week of Oct. 10 was 38.8 cents, the largest since Russia invaded Ukraine early this spring, according to EIA. Motor club AAA on Oct. 24 had diesel up more—4.2 cents to $5.326 per gallon—compared to the week before.

See also: Smaller carriers face more risk as fuel prices resume rise

EIA's weekly numbers had fallen almost uninterrupted for five months until the increases began again the week of Oct. 10. The average as measured by EIA set a record this summer, with the week of June 20 rising to an all-time high of $5.81 per gallon. And with all the helter-skelter of prices, the average still sits at $1.628 per gallon more than a year ago and might be settling at around $5 per gallon for the foreseeable future, unless other forces, such as a recession, drive the average down.

Gasoline, used widely by consumers and some commercial fleets, headed down again, this time by double digits, for the week of Oct. 24. The U.S. average for gas was down 10.2 cents to $3.769, or $1.572 per gallon cheaper than diesel, according to EIA.

With skyrocketing fuel prices a familiar refrain for months, a newly released survey shows just how trucking—both professional drivers and commercial carriers—thinks record diesel and gasoline costs have helped to sour business fortunes in the industry, especially for independent and smaller operators, who also have been buffeted by volatility in the spot market for freight loads.

Fuel prices were the top concern of more than 4,200 industry leaders and drivers who participated in the American Transportation Research Institute’s 18th annual Top Industry Issues report, which was unveiled Oct. 22 at American Trucking Associations’ Management Conference & Exhibition in San Diego.

ATRI's survey primarily targets, and ATA's members consist mostly of, larger trucking fleets, which are better able to weather fuel-price volatility because they primarily contract for freight loads, are able to utilize fuel surcharges, and get better deals on fuel negotiated in bulk from truck stop chains and other vendors.

See also: 10 fuel-saving tips for the holidays

The best that can be said about fuel and smaller fleets is they are coping, said Adam Blanchard, who is co-founder and CEO of Double Diamond Transport, a long-haul and regional motor carrier based out of San Antonio. Blanchard's fleet exclusively uses owner-operators to haul its freight in 75 trucks and 285 trailers. In an interview with FleetOwner from San Diego and MCE, Blanchard said some independent operators "are able to take shelter" by running freight for a fleet like his, but current business conditions are pushing a lot of them out of the industry entirely.

Diesel down again in several areas of the nation

The week of Oct. 24, diesel fell in two regions, the Gulf Coast (a 3.1-cent decrease to $4.987 a gallon) and the West Coast (a 12-cent drop to $5.876), and in three subregions, the Lower Atlantic (down less than a penny to $5.182), the state of California (a 16.8-cent decrease to $6.331), and the West Coast not including the Golden State (down 9.3 cents to $5.479) , according to EIA’s new data. In two other regions, trucking’s main fuel was higher. It rose 2.9 cents to $5.379 per gallon on the East Coast and 2.3 cents to $5.369 in the Midwest.

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.