Why the U.S. economy will avoid a recession, but freight will slow in 2023

The overall U.S. economy might not be as bound for a recession in 2023 as the mainstream media has warned much of this year. But the freight economy might have to start the new year working its way out of a hole.

If you watch cable news, you’ll see and hear much economic negativity going into 2023. But FTR Transportation Intelligence analysts aren’t as sour on the future as the talking heads filling up space on your TV.

“We get questioned a lot about why aren’t we more negative than we are,” Todd Tranausky, FTR’s VP of rail and intermodal, said during his firm’s December State of Freight webcast. “Yes, there’s slow growth, but we don’t have a recession in our forecast. It never turns negative again.”

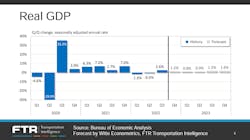

Citing real GDP quarterly changes on record, FTR tracked negative growth in the first two quarters of 2022, followed by 2.6% growth in Q3. Its forecast sees growth between 0.8% and 1.6% over the next five quarters—including the final quarter of 2022.

But Tranausky noted that while GDP is a good metric to see how the general economy is faring, “it doesn’t drill down into what that means for transportation. There are elements of GDP that—even if they’re positive—do not necessarily help transportation. And vice versa.”

Truckload volumes began the year at a higher level after solid growth in 2021.

“Coming into 2022, we were running at a pretty good clip, ahead of the pandemic levels,” according to Avery Vise, FTR’s VP of trucking. “However, ever since the end of Q1, it’s been all downhill—at a very gradual slope.”

The FTR truckload forecast for 2023 is flat, Vise said. “But it’s flat from a pretty strong level,” he noted. “So it really comes down to whether you’re a glass-half-full or glass-half-empty person.”

Three positive U.S. economy signs for 2023

Here is a look at three positive economic signs going into the new year and two signs that should give freight movers pause as they look forward to 2023:

Payroll job growth continues

One of the reasons FTR is less pessimistic than other prognosticators is the solid payroll growth the U.S. economy has seen all year. “If you've read the headlines or you saw the jobs report just last week, you've heard a lot of discussion around how that's going to make it harder for the Fed to slow interest rate hikes,” Tranausky explained. “And certainly, payroll jobs continue to run at a healthy level—not as strong as they have been—but they’re still chugging along at healthy levels.”

This means Americans still are making money to spend, he said. “That’s a good sign for the underlying economy and something that definitely gives us hope that we’re not going to turn negative. We don’t see a recession on the horizon.”

Industrial demand hasn’t been met

Steady job growth isn’t the only reason FTR is more optimistic for 2023. Pent-up industrial demand is also driving the transportation industry forecast. After leveling off earlier this year, new orders for manufactured goods are back on the rise, Tranausky noted.

“It’s certainly stronger than anything we saw before the pandemic,” he said of industrial demand. “The output really hasn’t adjusted to that. It’s rising—but it’s certainly rising a lot slower.”

He said the delta between orders and output would eventually have to be met. “It’s going to sustain continued economic activity—even if we see the economy downshift, you’re going to have some of that demand that’s going to have to work its way through the system,” Tranausky explained.

He said it could take at least half of next year for the output to catch up with demand. “Even if we do get a further downturned economy, there’s still going to be some time before it actually flows through the numbers and flows through transportation.”

Consumers continue to consume

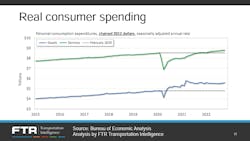

A third reason FTR is more bullish on the 2023 economy is the American consumer. “We still don’t have any indication that consumption has fallen,” Tranausky said. “Even with high inflation. Even with mortgage rates going up. Even with all the reasons to be negative out there, the data doesn’t yet show that consumption is going down. We haven’t seen spending really participate in those declines.”

Taking inflation into account, consumer spending on goods and services is out-performing pre-pandemic trendlines, Tranausky noted. “So spending continues to hang in. At some point out there in the future, this can’t continue. But for the moment, it is holding up very well and shows no signs of holding back. It shows no signs of going back. It shows no signs of declining.

“So that gives us hope as we think about consumer spending, we think about consumption, we think about demand in the economy,” he continued.

Why the freight economy isn’t solid going into 2023

There is a “but,” Tranausky said. “The overall economy is doing very well. But the economy is not so great for freight. We’re not seeing the same sort of fundamentals supporting the freight market.”

Two reasons freight could be more sluggish in 2023 are that consumer consumption of services is outpacing goods, and the sharp decline in imports helps out overall GDP growth but not the national freight market, according to FTR.

That sluggish freight, as Vise noted, is compared to one of the busiest freight economies on record, which started during the pandemic.

Consumers spend more on services than goods

The consumer spending that keeps the overall economy afloat has shifted from COVID-era goods spending to post-pandemic service spending, which benefits goods transportation less than the e-commerce explosion did.

“If you look at the trucking side, if you look at the rail side, if you drill down into the vendors, that shouldn’t surprise anybody,” Tranausky said.

Vise said that while retail inventory-to-sales ratios surged in 2022, the number has fallen in recent months. “I see this as a positive because that means that retailers are already cutting back—they’re not waiting for consumption, which hasn’t fallen off yet, to fall off,” he said. “They know that it’s going to, and they certainly know it won’t grow. So they’re starting to cut back on inventory.”

He said this would cut into freight volume in the near term but also reduces the chances of more drastic “inventory correction, which I think would certainly be a bigger problem.”

Imports are down

After the year began with massive West Coast port bottlenecks, imports have fallen sharply, “which folks in the intermodal space certainly have seen—particularly on the West Coast,” Tranausky said. “That’s not necessarily a positive sign for transportation capacity as we go forward.”

The overall U.S. Real GDP followed up negative quarters in the middle of 2022 with growth in Q3, and FTR forecasts continued growth over the next five quarters through the end of 2023.

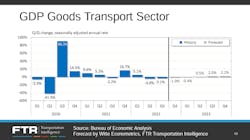

The picture isn’t as “rosy” for FTR’s GDP “goods transport sector,” which contracted in Q2 and Q3 this year and forecasts more contraction through Q1 of 2023.

“That’s four consecutive quarters of declines in terms of GDP goods transport,” Tranausky said. “You see things definitely holding in negative territory but getting better as we get to the end of this year and into 2023. It’s certainly a slower change in outlook than we saw in real GDP.”

But by the middle of next year, FTR is forecasting growth in the goods transport sector in Q2 through Q4 of 2023.

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.