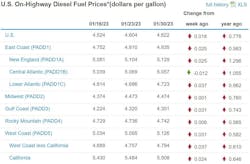

The increase in the U.S. average for diesel fuel wasn’t as severe for the week of Jan. 30—just 1.8 cents to $4.622 per gallon—but trucking’s main fuel did rise for the second week in a row and for the third time in the new year, leaving the average almost 78 cents over the level of a year ago.

This week’s rise in diesel nationwide follows an 8-cent increase for the week of Jan. 23, which followed a week when diesel was down slightly, 2.5 cents, according to new U.S. Energy Information Administration (EIA). Motor club AAA, meanwhile, has its diesel average for the U.S. up 4.2 cents to $4.678 per gallon, and AAA's daily average had been trending up all week.

See also: Take the fork in the road to zero

So, increases for diesel (and gas) all around, in every region of the U.S., according to EIA. Gasoline, EIA reported for the week of Jan. 30, also is up 7.4 cents to $3.489 and is now 12.1 cents above the average for that fuel of a year ago. Gas, used by some commercial fleets and widely by consumers, had fallen below the year-ago mark for several weeks to close out 2022, but has since headed in the opposite direction.

Regional increases on par with national rise

Diesel escalation in several U.S. regions exceeded the national average for the week of Jan. 30, EIA also reported. Along the traditionally most expensive West Coast, the price of trucking’s main fuel rose 3.1 cents to $5.126 per gallon. It wasn’t far behind along the opposite coast, where the fuel rose on the East Coast by 2.5 cents to $4.835. On the Gulf Coast, diesel surged, 3.1 cents to $4.351. Elsewhere, in the Midwest and the Rocky Mountain region, the fuel was flat or up less than a penny.

Stabilization ahead for oil prices

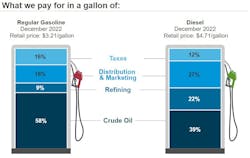

Stable oil prices traditionally mean predictable patterns for distillates such as diesel, so the outlook for the fuel might mean stable or slightly elevated or slightly lower prices for the new year, barring market-shocking events such as the Russian invasion of Ukraine early last spring.

EIA is predicting that oil prices should stay stable in 2023—and below the levels of 2022, when West Texas Intermediate Crude, for example, averaged about $95 per barrel. WTI sat as January ended today at about $78 per barrel. U.S. oil production also is expected to rise again this year—and may even set a new annual production record, despite inventories that have trended down. So diesel remains high historically but tenuously stable.

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.