A new outlook from ACT Research plus various recent reports on the spot and contract markets paint a picture of freight-hauling still in a down cycle that nevertheless stands a chance of recovering soon.

ACT’s June 14 freight forecast took a more holistic view of the entire state of trucking while two other reports, from FTR Transportation Intelligence and DAT Freight & Analytics, bring the spot and contract markets into focus.

The ACT forecast, from its U.S. Rate and Volume Outlook, declared the U.S. freight cycle through April in the first quarter of 2023 “near bottom,” interjecting that elevated Class 8 build rates will limit the near-term upside for the freight-hauling industry.

See also: ‘Rolling recession’ in U.S. economy slows trucking’s recovery

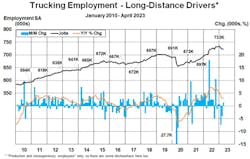

“Spot rates rose in May, but strong new equipment production will slow the ascent initially,” Tim Denoyer, ACT VP and senior analyst, stated. “Class 8 backlogs are sufficient for a while but are starting to dwindle as order activity has declined with industry profitability. That spot rates have largely held onto the gains from [the Commercial Vehicle Safety Alliance International Roadcheck May 16-18, when inspections and out-of-service citations took freight-carrying capacity off the roads] suggests the freight market is close to the elusive balance, but the rebalancing so far has been mainly on the labor side.”

The monthly 58-page ACT Freight Forecast report provides analysis and forecasts for a broad range of U.S. freight measures, including the Cass Freight Index, Cass Truckload Linehaul Index, and DAT spot and contract rates by trailer type.

Deeper dive into volumes, freight rates

Truckload freight volumes rallied modestly last month, and national average spot rates were stable for a second straight month, DAT Freight & Analytics, operators of the DAT One freight marketplace and DAT iQ data analytics service, said in its own June 15 analysis.

DAT’s Truckload Volume Index, an indicator of loads moved during a given month, increased for all three major modes of freight transportation: van, refrigerated (reefer) and flatbed. Van TVI was up 5% from April, as was reefer, while the flatbed index was up 7% from the previous month.

See also: Trucking ‘clearly starting to lose capacity’

Month over month, the van and reefer TVI numbers rebounded from their lowest points since February 2021, according to DAT. Truckload volumes typically decline from April to May, but they increased for the first time since 2019, DAT said.

“This was the second-best May on record for van and reefer freight, according to our TVI,” said Ken Adamo, DAT’s chief of analytics. “There was demand to move seasonal goods at a time when the truck supply on the spot market tightened due to the International Roadcheck inspection event, the Memorial Day holiday, and general carrier attrition.”

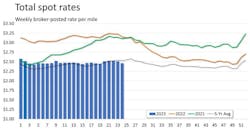

Broker-posted dry van and refrigerated rates also declined for the week of June 16, but those decreases were not especially notable compared to those seen in recent weeks, according to the report. The total broker-posted rate fell 5 cents after easing more than a cent in the prior week. The total market rate was 22% below the same 2022 week and 2.5% below the five-year average.

Contract rates sag closer to spot

According to the DAT analysis, which dives into actual freight rates, the spot van rate in May was $2.05 per mile, down a penny from April, while spot reefer was at $2.44 a mile, up 3 cents, and flatbed sat at $2.65 a mile, down 2 cents from April.

Meanwhile, contract rates declined across the board but were comparatively much better than spot. The contract van rate for May was $2.62 per mile but down 6 cents compared to April, contract reefer was $2.91 a mile (down 10 cents), and contract flatbed was $3.30, down 3 cents from the prior month. Contract van and reefer has fallen for seven consecutive months, according to DAT’s numbers.

See also: May equipment orders rise as build slots dwindle

“Shippers are taking advantage of abundant truckload capacity to establish new contract rates at substantial savings compared to 2022 and to make strategic use of the spot market,” Adamo of DAT added. “We expect these trends to continue through the end of the year.”

Monthly national average line-haul rates, which subtract an amount equal to an average fuel surcharge, increased for the first time this year in May for all three equipment types, according to DAT. The average van line-haul rate was $1.61 a mile, up 2 cents compared to April; the reefer line-haul rate jumped 7 cents to $1.96 a mile; and the flatbed line-haul rate rose 2 cents to $2.12 per mile.

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.