Oregon is one of the few remaining states with a weight-mile tax for heavy- and light-duty vehicles. But a new lawsuit filed by the Oregon Trucking Association and several Oregon fleets against state lawmakers and the state’s Department of Transportation claims “motor carriers have been overcharged for road use under the state’s weight-mile tax,” according to OTA’s website.

Fleet support

Here are some ways the industry can support fleets in Oregon during this lawsuit:

- Pay attention: Be aware of the current lawsuit against ODOT and discuss this issue with others in the industry to raise awareness.

- Donate: Lawsuits aren’t cheap. The Oregon Trucking Association would appreciate anyone who could contribute as they try to protect the interests of fleets in and out of the state.

- Join: Fleets in Oregon can join the Oregon Trucking Association if they haven’t already to support the organization in this endeavor.

The Oregon Trucking Association’s leader told FleetOwner that over-the-road trucking fleets could end up overpaying the state $500 million in state taxes by 2025. When contacted, ODOT declined to comment for this article.

Specifically, this lawsuit is against Gov. Tina Kotek, Senate President Rob Wagner, House Speaker Dan Rayfield, the state of Oregon, and the Oregon Department of Transportation. The fleets involved in the lawsuit with the OTA are A&M Trucking, Sherman Bros. Trucking, and Combined Transport (No. 244 on the 2023 FO 500 For-Hire list).

A timeline of what happened

Jana Jarvis, OTA’s president and CEO, outlined how long these overcharges have been a problem for Oregon fleets.

Due to the state’s weight-mile tax, a highway allocation study is conducted every two years to ensure fair charges. Oregon has a constitutional amendment that requires the state to ensure heavy and light vehicles pay weight-mile taxes that are fair and proportional, Jarvis explained to FleetOwner.

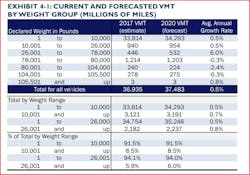

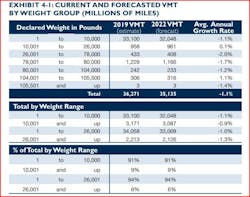

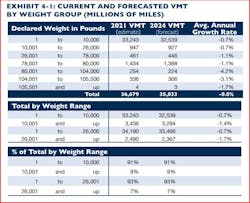

The 2019-21 Highway Cost Allocation study forecasted that trucks would overpay 3.5% and passenger vehicles would underpay 1.5%. When Jarvis questioned if these differences were enough to consider revising the rates, she was told, “‘Either cars or trucks have to pay 5% or more before we’ll consider any kind of revision to the rates.’”

The 2021-23 Highway Cost Allocation study initially projected that trucks would overpay by 10%. Jarvis said the analysis was done again to ensure this wasn’t an error, and the second study showed that heavy vehicles would overpay by 16% rather than 10%.

“I started talking about what we needed to do to fix that,” Jarvis said. “At the same time, our Department of Transportation started talking about not having enough money for maintenance.”

Since Oregon has the second-most passenger EVs in the U.S., ODOT concluded that the state’s highway maintenance revenue was falling because EVs don’t contribute to the fuel tax.

The 2023-2025 Highway Cost Allocation study expects trucks would overpay by 32.4%. Jarvis wanted to address these overcharges then, but she said, “Nobody wanted to talk about it, and ODOT was complaining about not having enough money, so they pushed it off and said ‘we’ll deal with it when we do a new transportation package in 2025.’ When you look at the numbers, if they wait until the 2025 legislative session, heavy vehicles will overpay in this state in excess of a half a billion dollars.”

When communication with ODOT, lawmakers, and the governor’s office failed, Jarvis said she, the OTA, and Oregon fleets felt their only other option was to file a lawsuit.

Why hasn’t this problem been fixed?

According to Jarvis, this lawsuit didn’t come out of nowhere. It’s been brewing since 2017.

That year, Oregon’s legislature passed House Bill 2017, a transportation funding package. According to Jarvis, this legislation “instructed ODOT to divert most of the additional tax increases into new construction projects, primarily.” These construction projects included the Rose Quarter, I-205, Highway 217, etc. Jarvis told FleetOwner that these construction projects were not fully funded, and tax rates increased 53%.

“We have been historically the most expensive state in the nation for trucking taxes and fees for many, many, many years,” Jarvis said. “And yet, we went ahead and agreed to House Bill 2017 primarily around the ability for us to fix the congestion problems in the Rose quarter… It’s just hugely important to Oregon’s economy. And so that was the piece that we wanted to have fixed the most, and we devoted a penny out of the gas tax increase to pay for the construction project at the Rose Quarter.”

Jarvis claims ODOT underestimated the cost of this project, and money had to be redirected from the Rose Quarter construction to the Abernathy Bridge on I-205. Currently, there is no funding for the Rose Quarter construction, and ODOT is struggling to determine how to pay for these unfinished construction projects.

See also: Samsara files patent lawsuit against rival Motive

What’s the solution?

“They need to roll the rates back,” Jarvis said. “We need to just bite the bullet and get us back into an equitable position in the way we’re being taxed here in the state. And then we’re willing to have a conversation about how we’re taxed.”

Jarvis believes a fuel tax would be the most cost-efficient way to tax vehicles in Oregon, rather than the current weight-mile tax or a fuel tax with a modified VMT.

“But first and foremost, in Oregon, we have to start caring about having roadways and understanding the connection between roadways and economic development in our state, and that seems to be sadly missing here,” Jarvis said.

About the Author

Jenna Hume

Digital Editor

Digital Content Specialist Jenna Hume joined FleetOwner in November 2023 and previously worked as a writer in the gaming industry. She has a Bachelor of Fine Arts degree in creative writing from Truman State University and a master of Fine Arts degree in writing from Lindenwood University. She is currently based in Missouri.