Freight market in 2024 to see ‘not particularly robust’ growth, says analyst

Will spot rates come back up in 2024 and, if so, by how much?

“Last year was essentially a flat year ... and this year is going to be pretty close to flat as well,” Avery Vise, FTR Transportation Intelligence’s VP of trucking said during an FTR State of Freight webinar on May 9. “But we are going to start seeing later this year a bit of improvement and start to see year-over-year growth starting in the third quarter.”

According to Vise, the freight recession will begin to see some improvements later this year.

To explain this forecast, Vise described key data on carrier capacity, truck utilization, operational costs, and rates. Here is what he shared on carrier capacity:

See also: Paccar executives confident they’ll make more share gains

Excess capacity keeps freight rates down

Excess capacity in the freight market contributes downward pressure on rates. Excess capacity has hurt rates for years.

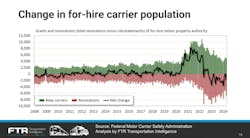

“The driver population associated with very small carriers soared early in the pandemic, but has fallen since the middle of 2022,” Vise said. “Meanwhile, larger carriers did not even get back to pre-pandemic levels until that period of time, middle of 2022, and they have seen modest growth since then.”

There are still roughly 15% more drivers today than in March 2020, Vise observed.

Capacity volatility since 2020

From late 2020 through 2021, a large number of single-truck operators who previously worked for large carriers established their own businesses in the spot market, Vise explained.

“That dynamic peaked in 2021 for the most part,” Vise said. “You can see from this chart that far outstripped anything we had ever seen in the market, in terms of just absolute numbers of new carriers coming in.”

Pressured by rising diesel prices and falling spot rates, many carriers began leaving the industry shortly after the Covid-19 freight boom. In early 2022, freight demand stabilized and larger carriers raised their active capacity, pushing rates down. Combined with rising diesel prices, many small carriers’ margins dropped.

“Then, by the time we got to late 2022, we started to see the carrier base start to decline consistently on a net basis,” Vise said.

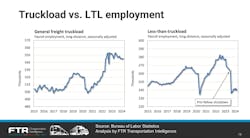

However, this did not translate to an equivalent drop in overall capacity. Vise pointed out through Bureau of Labor Statistics data that measured freight truckload employment increased.

“Most of the drivers who gave up their own authority simply took driving jobs for larger carriers, filling trucks that previously were empty,” Vise said. “That happened especially rapidly in the second and third quarters of 2022 ... as small carriers were whipsawed by the twin challenges of record diesel prices and falling spot rates.”

Within the last year, carriers’ recorded payroll employment has stayed relatively flat while the for-hire carrier population continued to drop.

“In general, more carriers are failing than are entering the market,” Vise said.

But the carrier population is still significantly higher than before the spike in late 2020.

“Yes, we’ve been losing a lot of carriers, but we still have roughly 92,000 more authorized for-hire trucking firms—again, most of these are one, two truck operations—that still hold active authority today [than before July 2020],” Vise said. “That’s an increase of about 42% in the carrier base.

“So we still have substantially more very small carriers than we did before the pandemic, but we also have substantially more payroll employees in trucking, especially in general freight truckload where the overcapacity issue of course has been most significant.”

FTR’s freight forecast

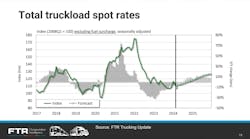

Vise’s 2024 forecast for the freight recession is a slow path to growth for carriers.

“The period of time where we’re sluggish is starting to transition to growth,” Vise said. “I would say it’s not going to be overall particularly robust growth—certainly not in the more specialized segments, especially flatbed, bulk, dump, which are actually still going to be negative this year—but we are going to see growth this year in dry van, refrigerated, tank, for example.”

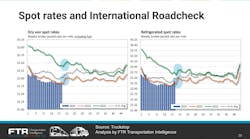

He pointed out one wildcard dynamic that might sustainably boost rates: 2024’s International Roadcheck, held May 14-16 by the Commercial Vehicle Safety Alliance.

“That event always results in a spike in spot rates,” Vise said. “Throughout the system, many truck drivers don’t want to deal with the hassle or maybe worse of being pulled over for an inspection, and so they take time off, or call in sick.”

Roadcheck lowers some freight capacity and pushes activity into the spot market, driving up rates. Normally this is a temporary blip for rates that soon settles into normal trends. However, 2023’s Roadcheck seemed to contribute to a sustainable bump in rates.

“We didn’t see that dynamic last year,” Vise said. “Roadcheck basically reset the market in spot rates, and then we moved more or less seasonally thereafter. ... We very much could see something similar to the pattern we saw last year.”

While FTR’s freight outlook for 2024 expects only modest growth, 2025 might be more promising.

“We do see a stronger market next year,” Vise said.

FTR’s Trucking Update chart forecasts greater rates and higher year-over-year growth for next year.

The full FTR webinar shares much more data on trucking—and the freight industry generally. Watch the event's replay here.

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.