Rates and loads increased last week, thanks in part to Roadcheck

Load posts and rates in the spot market increased last week—but posts and rates remained down year over year—according to the latest reports from FTR Transportation Intelligence and DAT Freight & Analytics.

International Roadcheck pushed down driver availability for the week, bringing a greater number of loads to the spot market and slightly increasing rates. However, the latest International Roadcheck was not as influential as previous years’.

See also: 2027 Prebuy strategies: How fleets can prepare before regs kick in

Load posts up, truck posts down

FTR and DAT both reported a significant increase in spot load posts and decrease in available truck posts.

FTR finds rising load-to-truck ratio

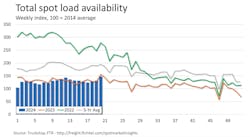

FTR’s recorded total spot load activity increased 11.6% from the previous week but declined 5.5% from the same week last year. Total spot load activity was 24% below the week’s five-year average. Meanwhile, total truck postings declined 3%.

FTR’s recorded dry van loads rose 20.6% from the previous week, decreased 6% from the previous year, and were about 19% below the five-year average. Refrigerated loads saw a greater weekly increase but also greater long-term decreases, rising 24.2% from the last week, decreasing 24.2% from the previous year, and sitting 25% below the five-year average. Flatbed loads rose 5.3% from the last week, dropped 3% from the previous year, and were 30% below the five-year average.

With increasing load and decreasing truck postings, the ratio of load to truck postings on Truckstop increased to its highest level since early 2023. The ratio was highest for dry van and refrigerated equipment.

DAT’s rising load, dropping truck posts

DAT Freight and Analytics noted a similar change in its load-to-truck ratio. Spot load posts spiked week over week, while equipment posts decreased.

DAT’s recorded dry van load post volumes increased 30% week over week, while carrier equipment posts decreased 8% week over week. This increased DAT’s dry van load-to-truck ratio by 40% to 5.01. Refrigerated load post volumes increased 33% from the previous week, while carrier equipment posts decreased 15%, increasing the refrigerated load-to-truck ratio by 57% to 8.04. Flatbed load post volumes increased only 8% week over week, while equipment posts dropped 11%, increasing the load-to-truck ratio by 22% to 20.05.

See also: Top strategies to reduce fleet expenses

Spot rates up from last week, down from last year

A less effective Roadcheck

The Commercial Vehicle Safety Alliance’s International Roadcheck is an annual commercial vehicle enforcement initiative sponsored by the Commercial Vehicle Safety Alliance. During the event, law enforcement stops and inspections become more frequent.

“That event always results in a spike in spot rates,” Avery Vise, FTR’s VP of trucking, said in a FTR webinar. “Throughout the system, many truck drivers don’t want to deal with the hassle or maybe worse of being pulled for an inspection, and so they take time off or call in sick.”

During International Roadcheck, FTR’s broker-posted spot rates rise considerably over the previous week.

However, the event had significantly less influence on rates this time. Rate increases for the week of International Roadcheck were their smallest since 2020 for dry van and refrigerated loads and since 2019 for flatbed loads, according to FTR.

In the week of 2023’s International Roadcheck, dry van spot rates rose 16 cents, refrigerated rates rose 29 cents, and flatbed rates rose 4 cents. This year’s rate increases were less than half that across all three equipment types.

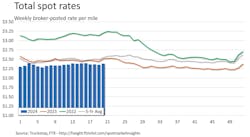

Both FTR and DAT reported the same change in spot rates across all three equipment types: rates are up slightly from the previous week, but still down year over year.

FTR finds modest rate increases

FTR’s total broker-posted spot rates were slightly up week over week but down from the same week last year and below the week’s five-year average. Total rates increased 3 cents from the last week, decreased 5% from 2023 and was 6% below the five-year average.

For dry van, spot rates rose 7.5 cents from the last week, decreased 3% year over year, and were 8% below the five-year average. Refrigerated rates rose nearly 13 cents from the last week, decreased 2% year over year, and were almost 3% below the five-year average. Flatbed rates increased almost 2 cents from the previous week, decreased 6% year over year, and were 6% below the five-year average.

DAT’s spot rate increases

DAT’s reports also noted a surge in linehaul spot rates week over week, though still down compared to 2023.

The national average dry van linehaul spot rate was $1.63/mile, rising $0.06/mile from the previous week and dropping $0.04/mile year over year. The average refrigerated linehaul spot rate was $1.97/mile, an increase of $0.08/mile week over week and a decrease of $0.08/mile year over year. The average flatbed rate was $2.06/mile, up $0.03/mile from the last week and down $0.11 from the previous year.

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.