Market reports for the month of May find hopeful improvements for some trucking segments.

Freight volumes are looking up for fleets in both spot and contract markets—particularly for van and reefer loads. Rates remain steady, with modest changes that vary by segment. American Trucking Associations and DAT Freight & Analytics provide monthly market reports that provide these findings.

The two organizations found that freight volumes in May saw long-awaited year-over-year increases. DAT also found a general upward trend in spot rates and load-to-truck ratios.

“While there was clearly an increase in freight before the Memorial Day holiday, it is still too early to say whether this is the start of a long-awaited recovery in the truck freight market,” said Bob Costello, ATA’s chief economist.

See also: Diesel price freefall ends as national average jumps 7 cents

ATA truck tonnage finally up year over year

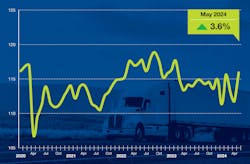

ATA’s seasonally adjusted For-Hire Truck Tonnage Index finally increased both month over month and year over year.

“May was the first month since February 2023 that tonnage increased both sequentially and from a year earlier,” Costello said.

The index equaled 115.9, up 3.6% from April and up 1.5% year over year. Before May, the index faced 14 contiguous months of continued year-over-year declines.

The index uses member fleet surveys to measure seasonally adjusted freight volumes. It primarily represents contract freight.

The not-seasonally adjusted index equaled 120.4 in May, an increase of 7.1% from April.

DAT’s breakdown for loads, rates, and ratios

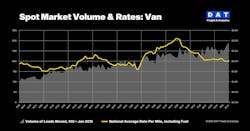

Freight volumes, rates, and load-to-truck ratios varied by trucking segment, according to DAT’s monthly report for May.

While results were mixed, two segments performed notably well. Loads and rates for van and reefer loads in the spot market showed significant improvement, including a 25% year-over-year increase for reefer volumes.

All-time load volume index highs

DAT’s Truckload Volume Index, an indicator of loads moved in a month, found all-time highs for van and refrigerated loads in May.

The TVI for van loads was 289, up 4% from April. The index for reefer loads was 224, up 4% from the previous month. The TVI for flatbed loads, however, was 301—down 2% from April—flatbed’s first month-over-month TVI decline since December 2023. Year over year, the van index increased 13% and the reefer index rose 25%.

“Stronger van and reefer volumes are consistent with May, when shippers move seasonal produce and retail goods, and truckload capacity tightens due to the Roadcheck inspection event and Memorial Day holiday,” said Ken Adamo, DAT chief of analytics. “Carrier attrition created further pressure on capacity.”

See also: Operation Safe Driver Week targets the reckless and careless

Spot rates up for van, reefer loads

DAT’s measured average spot rates followed a similar trend in May, though less extreme. Van and reefer rates had increased slightly, while flatbed rates remained unchanged.

Van spot rates averaged $2.01 per mile, up 2 cents from April. Reefer spot rates averaged $2.41 per mile, an increase of 9 cents from the previous month. Flatbed rates, meanwhile, were $2.52 a mile—the same as April’s average.

Contract rates down for van, reefer loads

The national average rates for contract loads went in the opposite direction of spot rates in May. Van and reefer contract rates were down, while flatbed was slightly up.

Van contract rates averaged $2.43 per mile, down 2 cents from April. Reefer contract rates were $2.79 a mile, down 3 cents from the previous month. Flatbed contract rates averaged $3.16 per mile, a month-over-month increase of 1 cent.

Load-to-truck ratios trending up

National average load-to-truck ratios rose significantly for van and reefer loads and decreased slightly for flatbed loads. The ratio is a measure of truckload supply and demand on the DAT One marketplace.

The load-to-truck ratio for van loads in May was 4.4, up from 1.9 the previous month. The ratio for reefer loads was 6.3, up from 4.8 in April. The ratio for flatbed loads was 18.0, down from 18.5.

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.