Freight is finally seeing year-over-year growth in 2024, according to the Bureau of Transportation Statistics’ latest Freight Transportation Services Index report. It’s still not enough to make up for 2024’s weak year-over-year performance to date—but industry forecasts provide another ray of hope for the coming months.

“The expectation moving forward is we continue to start seeing growth year-over-year on a more regular basis than what we’ve had for the better part of the last two years,” Matt Muenster, chief economist at Breakthrough, told FleetOwner.

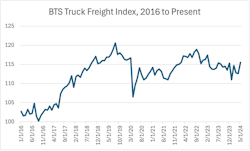

BTS’s data on freight moved by trucks saw modest improvements in May, though still dampened by high inflation and interest rates. As consumer sentiment recovers and rates go down, forecasts suggest that the second half of 2024 might see much better index scores.

See also: Industry faces challenges amidst 2027 emissions standards and freight recession

How freight fared in May

The Freight Transportation Services Index measures the freight hauled by the for-hire transportation industry. In May, the index rose to 137.8, a 1.7% increase from April and a modest 0.2% increase from the previous year.

While 0.2% might not sound like much, it is 2024’s first year-over-year freight index improvement. January through April each reported a 1-2% year-over-year index drop.

May’s improvement is happy news—but doesn’t yet make up for previous months’ losses.

“When we compare the first five months of actuals in the Freight Transportation Services Index to the total year 2023 experience, we’re still down by two index points,” Muenster said.

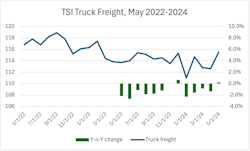

The Freight Transportation Services Index measures the composite seasonally adjusted freight carried by the for-hire transportation industry overall, including trucking, rail, inland waterways, pipelines, and air. Truck freight on its own saw even greater improvements: BTS’s May index for truck freight was 115.5, rising 2.5% from April and 1.6% from the previous year.

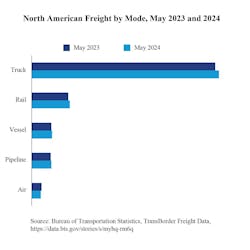

To back up that finding, BTS’s data on transborder truck freight in May was also up: trucks moved roughly $90.9 billion of freight that month, up 2.0% from May 2023. Overall, transborder freight between the U.S. and Canada fell year-over-year, but freight between the U.S. and Mexico grew more than enough to compensate.

The findings resonate with earlier May freight reports. The American Trucking Associations Truck Tonnage Index for May saw the first combined month-over-month and year-over-year increase since February 2023. DAT Freight & Analytics’ Truckload Volume Index found dry van and refrigerated loads increased 13% and 25% year over year, respectively.

Overall, the May freight increase is a ray of hope amid the freight recession’s oppressive conditions.

What’s slowing freight down

“We’ve been in the midst of a greater than two-year ‘freight recession,’ as it’s been called in the industry,” Muenster told FleetOwner. “We’ve been on a slump as far as the amount of volumes that we’re seeing moving, in the truckload and intermodal market in particular in the United States.”

Countless factors influence national freight trends. Inflation and interest rates are two of the major macroeconomic trends stifling the movement of goods.

“First and foremost, the general health of consumer sentiment,” Muenster said. “We’ve had elevated inflation, but we’ve also had real wage growth, so inflation-adjusted wages are growing and have been for over a year.”

According to the Statista Research Department, consumer sentiment began to plummet during the pandemic and further crashed throughout 2021’s inflationary crisis. While sentiment made small gains in 2023 and 2024, it still hasn’t come close to pre-pandemic levels.

“At the same time, we’re just not making the kind of significant purchases in terms of durable goods, focused on home goods," Muenster told FleetOwner. "The housing market has slowed materially because of rates being elevated and the prices of homes appreciating considerably over the last few years.”

High interest rates discourage new mortgage agreements, slowing overall home sales. According to U.S. Bank, new home sales in April 2024 were down 7.7% year over year.

Even if the Federal Reserve cuts interest rates later this year, sluggish economic trends would likely keep the freight recovery slow.

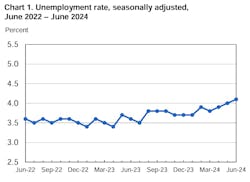

“We are seeing the unemployment rate tick up gradually over time," Muenster said. "That offers more headwinds into this market and will keep freight growth relatively slow.”

According to the Bureau of Labor Statistics, the U.S. unemployment rate in June reached 4.1%. Unemployment steadily climbed since its last trough in April 2023 at 3.4%.

Modest freight recovery ahead

Despite these headwinds, industry analysts forecast a recovery for freight and trucking later this year.

See also: Freight market in 2024 to see ‘not particularly robust’ growth, says analyst

Breakthrough’s Freight Demand Indicator, for example, predicts some green shoots.

“For the rest of the year, with our forecast, we’re projecting some relatively modest year-over-year growth,” Muenster said. “The level of growth will be more comparable to what we had in 2019, pre-pandemic.

“With the Freight Demand Indicator, our next 12-month forecast is to see slightly less than 2% growth on the level of freight that we’ve had over the last 12 months,” Muenster said. “Going back to July of 2023, to our forecast, we’d expect the next 12 months to be about 2% higher, in terms of the level of truckload and intermodal shipments, than what we’ve experienced over the previous 12 months.”

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.