While the freight recessions roll on, industry analysts expect conditions for carriers to improve slowly.

At Stifel’s Truckload Transportation Market Update and 2H24 Outlook conference call, topics included how slowly the market could recover.

“It feels like it’s rolling along the very bottom of the economic curve,” Brent Hutto, chief relationship officer for Truckstop, told listeners on the call.

Freight rates remain low, but analysts at the Stifel call projected slight improvements for the trucking industry over the next two years.

See also: ‘Death, taxes, and distribution’: Analysts on what election means for trucking

What’s wrong?

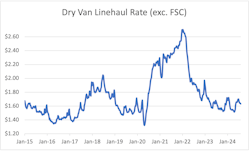

What many in the industry refer to as the "freight recession" is the trend of persistently low rates.

This is particularly noticeable in the spot market, where rates today are comparable to those from January 2015—without adjusting for inflation.

“Where we have had challenges in this marketplace is in pricing,” Hutto said.

A long road to equilibrium

Freight rates are at a low point in its economic cycle, and industry players expect rates to recover. However, many analysts expect this to be a very slow recovery as opposed to a boom.

Noël Perry, principal of Transport Futures, shared a similar sentiment on Stifel’s call.

“Compared to 2023, there is no indication yet that we are on an upswing,” Perry said. “We’re bumping along just about where we were last year.”

Overcapacity is still a major contributor to low rates. Continued depressed rates help to resolve this issue by forcing smaller carriers to exit the industry—though this correction can be slow.

Even if continued low rates push one-truck owner-operators out of the space, many such drivers just join larger carriers, drawing out the overcapacity problem.

“The trucks don’t disappear; the hours that they can operate do, and that’s what creates these big markets,” Hutto said.

“This marketplace still has a lot to correct before pricing really makes any changes,” Perry said. “It’ll be a while before this correction takes place because one-truck owner-operators are resilient … The takeaway here is that we’re not going to get back to what I would call equilibrium for another two years.”

Few factors can quickly raise freight rates

Very few predictable developments can bring a rapid change in freight rates. Outside of major surprise disruptions like a pandemic, freight market adjustments play out over a long period of time.

One factor that could quickly raise rates is greater regulatory demands on carriers.

“When we get booms in the truckload space, it’s a combination of good economics ... and a change in regulation that reduces capacity,” Perry said.

Good economics drive greater demand for hauling freight. Tightening regulatory requirements lowers carriers’ capacity, bringing down supply. This combination leads to higher prices.

“If we’re talking about if we want to get this marketplace back to a boom, it has more to do with what the government does than it does with the economy—because the economy is already doing OK,” Perry said.

Measures of U.S. economic health continue to reach record highs in 2024, including stock market indexes and gross domestic product.

Previous regulatory changes in this millennium illustrate how regulations can influence rates, Perry points out.

“It happened in ‘17 with ELDs, it happened in ‘04 and ‘14 with hours of service, and it happened in 2021 with the drug and alcohol database and with training regulations,” Perry said.

Speed limiters would reduce capacity

The Federal Motor Carrier Safety Administration does not have many major regulations in its agenda that could significantly reduce industry capacity, save for one: a speed limiter mandate, which is still several years down the line.

See also: All of FMCSA’s current regulatory plans

“There’s no evidence that [a major new regulation] is going to happen in the next couple of years unless [Kamala] Harris gets in and they do speed limiters,” Perry said. “Unless we get speed limiters, the market’s not going to boom.”

Even if the next president leans toward stronger regulation of commercial vehicles, Congress has shown opposition to the rule and FMCSA’s speed limiter rulemaking is still a long way from the final rule stage.

The agency does not yet have an exact maximum speed proposed, and its timeline for the second notice of proposed rulemaking is set for some time in 2025. If the proposed rule is published around that time, it would still have to pass lengthy regulatory hurdles before taking effect.

Tightening regulatory constraints seem like a counterintuitive solution for carriers. However, a reduction in overall capacity may be what the industry needs for a swift upturn.

“Whether you like it or not, when we get more regulation, it’s good for the carriers,” Perry said. “They hate it because it makes their life more complicated. But it takes time to get adjusted, and in the time it takes to adjust, prices go up.”

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.