Low rates have hampered for-hire carriers for years. Following the pandemic freight booms, rates below the average cost of operation have forced countless fleets to shutter their operations. Industry analysts expect a rate upturn to finally arrive in the second half of this year.

“Overall, we expect a positive year in trucking, and we expect that [rates] will go up,” Hamish Woodrow, head of strategic analytics for Motive, told FleetOwner. “But that doesn’t mean that within a quarter or a month, you couldn’t see volatility in pricing.”

Forecasts from FTR Transportation Intelligence, DAT Freight & Analytics, ACT Research, and Motive predict for-hire freight rates rising this year—particularly in the second half. However, volatility and competition remain genuine risks.

See also: Fleets Explained: How do freight rates work?

How rates fared last year

Avery Vise, VP of trucking for FTR Transportation Intelligence, described 2024 as a “holding pattern” for trucking.

“It has been a year of under-the-waterline improvement,” Vise told FleetOwner. “We are ending the year in not much different shape than we were beginning the year, especially when we look at the rate environment.”

DAT Freight & Analytics estimated that 2024’s dry van spot rates were still below the segment’s average operating costs for almost the entire year.

According to data from DAT, average dry van spot rates remained persistently year-over-year negative in the first months of 2024, ranging from minus-12% in the year’s first week to minus-2% in mid-May. After May, dry van spot rates began to achieve regular single-digit y-o-y growth—from 1% in June to 9% in November.

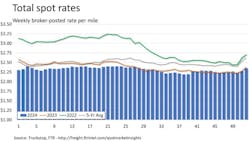

FTR found a similar trend in its spot rate measurements: average broker-posted rates in 2024 were regularly below 2023’s average rates and significantly below 2022’s. Only in the second half of 2024 did average spot rates begin to peak slightly above 2023’s.

The late-year improvement was still not what carriers needed, however.

“That’s not enough to improve the financial condition of a lot of these operations,” Vise said. “They’re in a situation where their costs have really outstripped their rate environment, and so they’re going to need much stronger rate gains or much more sustained gains over a longer period of time.”

What firms predict for future rates

Sustained gains may be in store for fleets this year. Industry outlooks suggest that the second half of 2025 will see stronger rates across most segments. Overall, analysts expect for-hire carriers will feel they are in a stronger financial position by the end of the year.

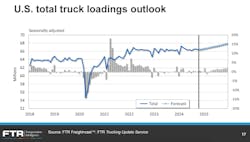

“From a freight perspective, 2025 looks better, and we do continue to expect the rate environment to improve,” Vise said. “The recovery that I’m talking about for next year is going to come primarily from stronger freight, not from a decline in capacity.”

Many industry outlooks predict rising freight volume demand throughout 2025, bringing upward pressure on rates. Meanwhile, analysts also expect trucking capacity to increase, bringing some downward pressure on rates.

The firms’ outlooks broadly agree that rate improvements will be slower in the first half of the year.

“We expect that rates will start to rebalance—initially, probably on the slower side, but going to the back end of this year we could see really positive movements on freight rates,” Motive’s Woodrow said.

Market could flip in Q2. Maybe.

DAT Freight & Analytics in its 2025 transportation outlook predicted that rates could begin their upturn in Q2 at the earliest.

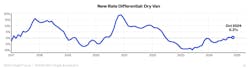

The firm’s measure of contract rates in the DAT iQ database faced nearly two years of consistent rate declines. DAT’s new rate differential for the dry van segment, comparing new contract rates to those they replace, dipped negative halfway through 2022 and only began to turn positive in October 2024.

Optimism from industry surveys

Truckstop's latest Carrier Insight Survey, based on responses from almost 500 carrier professionals, also found high expectations for the year. Over 90% of respondents felt optimistic about achieving their primary professional goals in 2025, and 54% described themselves as “extremely optimistic." About 45% of respondents were focused on increasing revenue this year.

Truckstop’s semi-annual freight broker survey with Bloomberg found that brokers are optimistic about 2025, too. Of the 159 professionals surveyed, Truckstop reported that 77% expected load volumes to be up within the next six months—up 28 percentage points from the first half of 2024. About 67% of broker respondents also expected their gross margins to improve in the next six months.

“Carriers will likely still be operating under austerity measures for a few more months at least,” the outlook said.

Slower improvement for contract rates

FTR similarly predicts rates to rise later in the year.

For the year overall, the firm estimates spot rates to increase by 5.5% and contract rates to increase slightly over 2%. Contract rates could grow at a stronger pace later in the year: FTR estimates that contract rates won’t go positive year-over-year until early Q2 2025.

“By the time we get to the end of next year, we are going to be looking at a run rate of more like 5% or 6%,” Vise said. “It’s just that, for the year as a whole, it’s going to look pretty bleak.”

Rate increases will vary by segment, however.

“We do expect stronger rates in refrigerated,” Vise said, suggesting reefer spot rates to increase nearly 10% and contract rates to rise by about 3%. FTR expects dry van spot rates to rise by 5%—half as much growth as refrigerated spot rates.

“We’re still going to be running negative, or at best flat, year over year for the first three or four months of 2025—but then we should start to see some fairly good gains,” Vise said.

Growing freight demand

ACT Research, in its 2025 forecast, made similar predictions: spot rates increase gradually throughout the year, “driven by incremental improvements in inventory normalization and slight demand gains from e-commerce and retail activity by year-end.”

“With supply slowing and demand growth continuing, we see room for a modest acceleration in rates in 2025,” Tim Denoyer, ACT Research’s VP and senior analyst, said in the firm’s outlook blog post.

ACT expects overcapacity to remain a problem in for-hire trucking, particularly as private fleets expand their operations.

Words of caution

Despite these optimistic predictions, FTR’s Vise warns that the rate environment is far from perfect.

“By no means would we consider 2025 to be a robust market,” Vise said.

He also expects disruptions could make the market appear stronger than projected at times. Events like tariffs are already adding volatility to freight rates by bringing periodic spikes to intermodal demand.

“I think people need to be very careful to analyze why the numbers are what they are,” Vise said. “People need to be careful when they look at spot rates, for example, and not make major decisions based on two or three weeks.”

In addition, FTR’s preliminary data from January suggests that market improvements were slower than predicted.

“Freight rates have been sluggish, however, so the risk of a slower recovery than currently forecast is significant,” Vise said in FTR’s latest Trucking Conditions Index report. “Volatility in economic data due to tariff expectations and response from businesses and consumers injects further uncertainty into the outlook. Despite these concerns, we are confident in modestly stronger conditions for trucking companies at least by the second half of the year.”

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.