The trucking freight market could fully recover by late 2021 as truckloads return to pre-pandemic levels, according to forecasts from FTR Transportation Intelligence, which hosted its final FTR Engage virtual session of 2020 on Dec. 10. But capacity could continue to be tight as the driver pool continues to be limited, at least until the COVID-19 vaccine is available on a large scale.

Avery Vise, FTR’s vice president of trucking, expects to see a full recovery in truck loadings by Q3 of 2021. “If you look at the data from the spot market — and I'm sure many of you are following that — you might assume that we've already fully recovered,” Vise noted. “But the spot market is only about a third of the total truck freight market. More important, it mostly is an indicator of disruption. And, of course, we all know that we've had disruption in spades this year.”

FTR forecasts truck loadings to increase more than 5% next year — after a 4% decline in 2020. “The strongest increase is more than 6% for flatbed, but that segment also took the biggest hit this year,” according to Vise. “Dry van, refrigerated and specialized are forecast to grow about 6% over 2020. The outlook for bulk and dump is slightly weaker at about 5%. The weakest growth forecasted is for tank at 3%.”

Vise stressed there is “considerable risk to this forecast. Frankly, I think there’s probably more downside risk than there is upside — but there is risk in both directions. However, if loadings’ growth does not match our projections, the capacity side of the ledger will keep market conditions at least healthy if not robust.”

As FTR Chairman and CEO Eric Starks noted early in the session, which was focused on what’s to come in 2021, “There is no ‘normal’ anymore; we don't even know what the heck that is.”

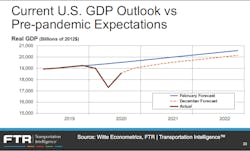

While it doesn’t take a team of economic experts to explain that the pandemic has led to a substantial deviation from “normal” trends in 2020, FTR’s team is attempting to make sense of these unprecedented times with a reliable forecast for the transportation equipment markets.

Driver constraints

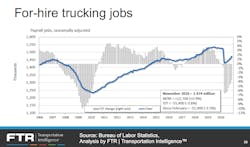

Vise described November as a strong hiring month for trucking while the overall average driver pay ($53,000) is still down about 3.5% compared to pre-pandemic rates in February. “We are skeptical that the pace can continue that we had in November given a whole host of constraints,” Vise said.

Those constraints include a sharp reduction in new CDL drivers because of training and state-level testing limitations due to social distancing. “We know that we’ve lost a lot of drivers to retirements or to other industries such as local delivery or construction,” Vise continued. He expects fewer available drivers because of retirements and other constraints until a COVID-19 vaccine is widely available.

The federal Drug & Alcohol Clearinghouse, which changed how positive drug tests are handled within the industry, has also cut into the driver pool. Vise estimates the clearinghouse has culled about 40,000 drivers from the market, “and probably thousands more have exited because they think they might not pass a drug test. So they’ve moved on to do other things.”

While freight increases late this year into 2021, there is more pressure to find drivers to haul it. GDP goods transport was up 85% in the third quarter this year, Starks noted, which more than made up for losses in the first and second quarter as the pandemic took hold. Interestingly, industrial production continues to lag significantly.

The “disconnect” comes with growth in consumer goods volumes, particularly in e-commerce and home delivery—putting pressure on local delivery services. Local delivery accounted for one in three jobs added to the economy in November; more than half of all new hires come from freight-related businesses when the trucking and warehousing sectors are included, Vise said.

The shift in consumer spending from services—dining out, going to movies and ball games, traveling for vacation—to spending on goods because of additional disposable income (for those still employed) or to assist in the transition to working from home caught the supply chain by surprise, Bill Witte, FTR’s economy expert, noted. “People with higher income … either can’t or won’t spend it on services, so they’re spending it on goods,” he said.

‘Abnormal’ equipment outlook

And that spending comes in a way that few expected or planned for, Don Ake, vice president of commercial vehicles, explained.

“The fleets were a little caught behind being able to handle [the surge in consumer goods spending],” Ake said. “So now you see the fleets having to catch up with equipment. They don't have enough. More importantly, this has also caused a disruption in the supply chain, especially in manufacturing.

“The system is in catch-up mode, and it's far from normal. And this is one of the things that is causing disruption in the supply chain, in the economy and the like—and everything involved with transportation.”

And that’s precisely the point, as Ake detailed in his analysis of equipment trends: The data is “abnormal.” For instance, the 50,000 Class 8 truck order total for November — the third-highest in history — reflects the “potential demand” for the trucks, based on “conditions now.” And those conditions are driven by capacity constraints and OEM supply shortages.

“That's causing the fleets to order their equipment for basically for the entire year,” Ake said. “These orders are reflecting a forecast for 2021 based on conditions being as they are now—and I just said conditions, as they are now, are not normal. We do not expect those to continue.”

The surge in trailer orders is likewise rooted in these unique conditions—only more so. Trailer orders hit an all-time high in October, after posting the third-highest total in September. (November preliminary trailer order numbers were pending at the time of the FTR presentation.) Ake notes that the supply constraints are even greater for trailer manufacturers than for truck OEMs. Again, faced with surging freight demand, fleets are placing orders to reserve slots 9-12 months out.

“We're looking for a strong Q1; truck and trailer build should exceed the pre-pandemic levels, provided that the workers and the parts come on board,” Ake said. “The thing to remember is that we do not expect the current conditions to continue throughout 2021, because these are pandemic and pandemic-recovery issues that we see in the market. They are not normal.

“At some point, hopefully, these things will be resolved and we return to a more regular pattern where the fleets can get the equipment that they need.”

Still, 2021 will be a “good year” for transportation equipment “but not a record year,” Ake explained. The test for the market comes mid-year: If the economy is growing faster than FTR forecasts, then the recent orders “will stick”; otherwise, look for cancellations in the second half of 2021.

Looking forward to 2022

However, a return to normal market cycles by the end of next year bodes very well indeed for 2022.

“The good news is that 2022 is expected to be a very good year—close to a great year — anyway, with demand continuing to go up,” Ake said. “So if we pull forward some of that, then we would kind of look at a balancing of 2021 and 2022. The issue is the second half of 2021, coming out of this pandemic with everything kind of in chaos and trying to re-establish some balance.

“We don't know what that balance will look like. The potential’s there; it's just things have to rebalance at a higher level than we're expecting—then the growth in equipment will stay strong through 2021.”