The pandemic and winter storm-driven supply chain problems of early 2021 are not getting worse — but it’s not getting much better either. This is particularly true for the commercial vehicle industry production, Don Ake, FTR’s vice president of commercial vehicles, said during the transportation intelligence firm’s May market update.

Despite the supply chain kinks, the U.S. economy continues on an upswing from the pandemic-plagued 2020 and a lot of that upswing is on the backs of the trucking industry.

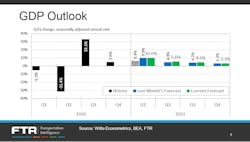

“We’re looking for a very strong economic environment to continue,” he said. While GDP in the U.S. grew about 6.4% in the first quarter of 2021 — compared to the last quarter of 2020 — Ake said that FTR expects to see another bump of 5.6% in Q2 2021, followed by 4.6% in Q3 and 3.3% in Q4.

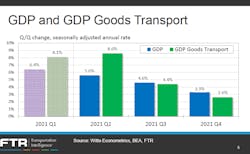

Looking at the GDP Goods Transport sector, Ake said that FTR expects “tremendous growth that is just going to carry that momentum into subsequent quarters and provide a big boost to freight.” Ake noted that FTR expects the goods transport sector’s growth to outpace total GDP for at least the first half of 2021.

In Q1 2021, the goods transport sector grew 8.1% — nearly 2% more than the overall GDP growth. In the current quarter, which is about halfway complete, the transportation sector is expected to grow by another 8.6% (compared to the 5.6% GDP growth forecast). Things will start to level off in the second half of the year, according to forecasts: Transport growth is pegged at 4.4% in Q3 (compared to 4.6% for total GDP) and 2.6% in Q4 (compared to 3.3% GDP).

Year-over-year truck freight is currently on the rise in Q2, which in 2020 was the first full quarter of the COVID-19 pandemic. Truck freight was up 1.6% year-over-year in Q1 2021. “Then, of course, the big number where we’re comparing to last year’s pandemic, you’d expect a jump,” Ake noted. “The good news is that momentum carries through to the second of the year.”

FTR is forecasting a 16.2% jump in truck freight in Q2 2021, compared to 2020, followed by an 8.5% increase in Q3 and a 6.7% increase in Q4. “Freight was growing last year at decent levels coming back from the pandemic,” Ake said. “So we’re looking at a strong freight year also.”

While the May forecasts for freight and overall GDP that Ake presented earlier this month are a bit lower than the forecasts FTR put out a month ago, “the good news is it’s down a little bit from very high levels.”

In April, Ake said transportation equipment was “stuck in traffic because so many things are clogging the supply chain.” That “gummed up” supply chain of early spring is starting to move, he announced. “We are not moving fast and it’s not to say there won’t be delays — but we are moving.”

Persisting supply chain problems are keeping transportation equipment at a slow pace this month, Ake reported. And while there is no complete list of all the items causing supply chain problems, he said FTR does know of more than 20 components and parts for trailers “where the deliveries are spotty and people can’t get entirely what they need when they need it.”

On the truck-building side, he said, there aren’t as many supply chain kinks as trailer production is facing. “But if I had to estimate, I would say that there are probably 20 suppliers — it could be more — that are facing similar shortage issues.”

A number of these problems started in the winter and are impacting the spring and possibly the summer. Some Texas suppliers are still digging out after being affected by harsh winter storms. Plastic and plastic resins are also harder to get right now, Ake said. “Many of those Texas manufacturers were operating at full capacity [this winter] and then had to shut down for almost a week,” Ake explained. “When you’re running at full capacity, you can’t catch up until things slow down. So this just added to an already tight situation.”

Other supply chain problems include recent reports of a natural rubber shortage, which could limit tire production.

Richard J. Kramer, the Goodyear Tire & Rubber Co., CEO and president, recently said this problem isn’t as pronounced as some have feared. “We're certainly not experiencing any limitations that you might have read about in some of the stories that are out there,” he said of natural rubber during a Q1 earnings call. “We're certainly aware, some of the issues on tight supply that came up last year as the industry started ramping up, which was sort of normal course, I would say. But again, we took a lot of proactive measures anticipating that to ensure we have the supply and to not make it an issue.”

Ake said the statement from Kramer that rubber is “tight but not limiting manufacturing” is promising “so we’ll just have to see how that plays out.”

Steel is getting harder to allocate, particularly “specialty steel,” Ake said. “So if you need those products, those materials in your products, you’ve got issues.”

A worker shortage might be the next problem to face some in the industry. Ake noted that at least one major trucking industry supplier has turned to an expensive direct mailing campaign to find workers.

“The supply chain overall, the situation is not getting worse but it’s not improving a lot,” Ake said. “But the goods news is that it is improving.”

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.