The trucking industry has seen robust growth coming out of 2017 and in the first few weeks of 2018. The market is at nearly full active truck capacity, truck orders are continuing to rise, and spot market rates have soared for the past year or so.

So what does this mean going forward for 2018?

“We have an expectation of those numbers coming down a little bit from where they are, but we still have a strong expectation of a very strong spot market as we go throughout 2018,” Jonathan Starks, COO of FTR Transportation Intelligence, explained during FTR’s Jan. 11 State of Freight: Trucking Outlook for 2018.

But such a strong market brings with it some cost pressures and constraints, particularly around pay raises and major bonuses used to recruit and retain drivers. According to Avery Vise, vice president of trucking research at FTR, the market is tight – very close to full active truck capacity – and 2018 looks to be a strong year for truck orders. However, there aren’t enough drivers to operate those trucks.

“With this backdrop, we see the overall trucking conditions improving in 2018,” Vise said. “A strong market brings with it some cost pressures in the form of higher driver wages, there are some equipment acquisition costs, and quite often, because the trucking conditions follow general demand, we often see higher fuel costs as well. But between the rates increases and the new tax relief, we believe that those will more than offset the rising costs in the near term at least.”

Vise noted that the sharp cut in the corporate tax law will be beneficial to all businesses going forward, emphasizing that it will be especially beneficial for trucking due to the cost pressures associated with driver wages.

However, one of the problems that could arise with the corporate tax law is the loss of deducting unreimbursed employee expenses. So, in the context of trucking, that means meals and consequential spending for things that happen on the road will no longer be deductible, Vise explained.

“Carriers that do not offer per-diem pay might encounter driver dissatisfaction once [drivers] understand what has happened,” he added. “How that plays out is something to watch, particularly when it comes to recruiting and retention.”

When it comes to the impact of the ELD mandate on the market, Vise explained effects will show up in reduced miles for carriers that have not strictly complied with the hours of service rules in the past. In addition, another effect of the mandate could be an exodus of drivers in the market. But Vise pointed out that it may take a while before the industry knows exactly what the extent of such an exodus would be.

“Anecdotally, we have heard of some owner operators and smaller carriers calling it quits with the implementation [of ELDs],” Vise explained. “Presumably, most of those who would consider doing so would hold out at least until April because that’s when the enforcement is going to become strict and will become an out-of-service violation.”

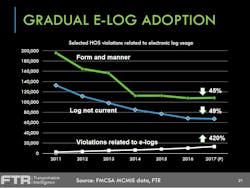

Vise also stressed that carriers who adopted electronic logs early are now in a position to reap the rewards from their investment. For instance, since about 2011, there has been a drop in errors and CSA violations that are often made on paper logs for those carriers who already adopted ELDs. And not having current log book or record of duty status violations have also fallen sharply over the last few years because of ELDs, Vise explained.

Meanwhile, he said, violations related to e-log use have skyrocketed from 2011 to 2017.

“The point of that is to reinforce what we already know, which is a major segment of the market has already adopted electronic logs,” Vise said. “There are definitely going to be some benefits. I think the most immediate benefit is that unlike carriers that haven’t had electronic logs and haven’t been obeying strictly to all of the limits, they won’t have the same kind of disruptions. They’ve already adjusted their lanes to accommodate the limits, for example, on driving time. That’s one immediate, competitive benefit.”

And while analysts are continuing to keep their eyes on what will happen over the course of 2018, there is no major capacity relief on the horizon, Vise noted. So, at least in the near term, the market is expected to continue to expand.