Spot market volumes recovered while rates fell last week

Last week’s spot market kicked back into gear after the holiday disruptions earlier this month.

Freight volumes rose sharply to compensate for lost time from the shortened workweek. Flatbed load postings, for example, shot up by 90-94%, according to last week’s spot market reports from DAT Freight & Analytics and FTR Transportation Intelligence.

Despite the rise in demand, average broker-posted rates declined across nearly all equipment types as the market entered a soft period for rates.

See also: Nearshoring: What does it mean for trucking?

Sharp rise in load postings

Volumes last week made up for the freight decline from the previous week. According to the reports of both firms, there has been a significant rise in load postings in DAT One and Truckstop across all equipment types.

DAT reported that the number of loads posted on DAT One increased by almost 66% to 2.13 million. This spike more than made up for the previous week’s 48% drop. The number of load posts was 6% higher than the same week last year.

The number of truck postings on DAT One also rose by 19% from the week of Independence Day to 327,847. This rise in truck postings did not totally make up for the previous week’s 21% decline.

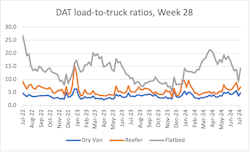

According to DAT, dry van load postings rose a whopping 62.2% week over week to 1.01 million, while dry van truck postings rose 19.1% to 215,244. This was the lowest count of available dry van trucks on DAT One for Week 28 since 2017.

Refrigerated load postings were up 44.4% to 475,682, while truck postings rose 16.2% to 67,489. Flatbed load postings saw the most dramatic increase—rocketing 94.6% week over week to 639,646—while flatbed truck postings only rose 22.5% to 45,114.

The dramatic increase in flatbed load postings is still in line with the week's annual trends, as noted by Dean Croke, principal analyst at DAT.

“Flatbed load post volumes returned to within 2% year over year but were still 38% lower than the Week 28 eight-year average, excluding years impacted by the pandemic,” Croke said. “Flatbed equipment posts were up 23% week over week but 24% lower than last year.”

See also: Diesel prices halt rise at $3.82/gal, gas at $3.496/gal

FTR reported that load and truck posting activity on Truckstop also surged last week. Total load postings increased 61%, up almost 7% year over year but more than 23% below the week’s five-year average. Total truck postings on Truckstop rose 17.4% week over week.

FTR’s report finds that, last week, dry van load postings increased by 47.8% week over week, up 3% from 2023 but 20% below the five-year average for the week. Refrigerated loads increased 25.3%, more than 11% above the same 2023 week but almost 13% below the five-year average. Similar to DAT’s findings, FTR reported that flatbed load postings on Truckstop skyrocketed by 90.4%, marking a year-over-year increase of nearly 14% but remaining 30% below the week’s five-year average.

Dropping rates across the board

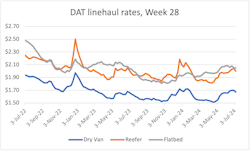

July is a weak period for spot market rates. The average rate for each equipment type tends to decline consistently for a few weeks after Independence Day. Both firms’ reports found that trend last week: declining average rates across all equipment types, except for flatbed loads on DAT One that remained unchanged.

Average linehaul rates on DAT One declined for both dry van and refrigerated loads, while the average rate for flatbed loads remained unchanged. Dry van rates averaged $1.67 net fuel, down 3 cents from the previous week. The average rate for refrigerated loads dropped by 4 cents to $2.00. Flatbed rates remained unchanged at $2.05.

FTR found that, across all three equipment types, the average broker-posted rate in Truckstop declined roughly 3 cents after rising less than 2 cents during the week of Independence Day. The average total rate sat 0.4% above the same week last week, marking FTR’s first positive year-over-year comparison for total average rates since June 2022. However, this average rate was still 8% below the week’s five-year average.

FTR noted that average spot market rates tend to remain low throughout the month of July. Average dry van rates in Week 28, for example, have only seen a week-over-week increase two times since 2008. Despite this, average rates for dry van and refrigerated loads last week were still up year over year.

The average broker-posted rate for dry van loads in Truckstop decreased nearly 6 cents, up year-over-year by 3.3% but still down 9% from its five-year average. The average rate for refrigerated loads faced a more drastic decrease of 13 cents, still sitting up year over year by 5.4% but also 5.4% below the week’s five-year average.

Flatbed rates declined by more than 1 cent, remaining down 1% from the previous year and down 9% from the five-year average. This average flatbed rate was actually the strongest year-over-year performance in nearly two years; flatbed rates in Truckstop faced consistently negative year-over-year comparisons since July 2022.

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.