Report: How July’s predicted higher retail sales affect the trucking economy

Using retail store stocking data, Motive, an integrated operations platform for the transportation industry, predicts big sales for July, thanks to Amazon Prime Day and Independence Day. These sales boosted trucking in June, but Motive predicts changes in the transportation and retail landscape by the holiday season later this year.

The 2022 and 2023 holiday seasons faced uncertainty surrounding consumer demand, leading retailers to decrease inventories, Hamish Woodrow, Motive’s head of strategic analytics, told FleetOwner. Trucking’s low rates also helped retailers push their holiday inventory prep as late as three weeks due to the low cost of quick shipments. But Motive predicts a different trend for retailers and trucking for the 2024 holiday season.

See also: Spot market volumes recovered while rates fell last week

“I'd say we'll see a slightly earlier season than last year,” Woodrow said. “Retailers have inventory-to-sales ratios at relative historic lows ... I expect with the changing dynamics of the supply chain—both on the ocean and the roadside—they're going to start having to increase inventories, which probably means that what we'll see is probably [a ramp up of inventory restock] in October.”

Woodrow’s prediction is based on Motive’s 2024 summer shopping season data outlined in its monthly economic report.

2024 mid-year retail sales stats

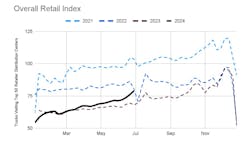

According to Motive’s Big Box Retail index, June saw increased rates of retailer restocking with 10.8% more truck visits to warehouses from May and 16% more year over year. This increase in stocking is typical for the year, yet Motive’s report indicates much higher restocking rates than in years past.

Separating stores into sectors, department stores, apparel, and electronics stores saw a 32.9% restocking increase year over year in June. Home improvement stores were the next highest performer at a 24.4% year-over-year restocking increase. What’s more, brick-and-mortar stores are seeing momentum this year, according to Motive data.

“We’re seeing particularly strong momentum in brick-and-mortar retail as these stores anticipate a very strong summer peak season,” the report stated. “For example, department stores, electronics, and apparel retailers with brick-and-mortar locations saw a 13.8% jump heading into July, representing a 33% year-over-year climb.”

This year-over-year climb in inventory activity is good news for trucking. It further shifts the balance of supply and demand in carriers' favor.

“We see these green shoots,” Woodrow told FleetOwner. “The retail market, especially the brick and mortar, has performed very strongly in June. That's also a positive for the [transportation] sector. A return to better restocking and maintenance of the demand is good for the sector because, at the same time that we're having some positivity on that side, we're continuing to see capacity come down in the market.”

Motive shared in its June economic report that the trucking industry’s lower freight rates have allowed retailers to restock products at the last minute in response to customer demand. This strategy has appeared to work well, with the latest data showing an inventory-to-sales ratio of 1.28%, according to Motive. However, Motive predicts trucking rates to rise as ocean rates have risen, which would force retailers to adjust their stocking strategy, “holding on to more inventory longer as later restocking becomes more expensive,” the report states.

Motive anticipates retailers to implement this new stocking strategy ahead of the 2024 holiday season, and as Woodrow predicts, by October.

Is the freight recession fading?

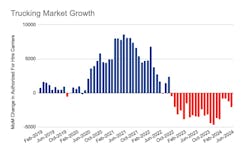

In line with typical market behavior for this time of year, 10% fewer carriers (7,621) left the market in June than in May. June 2024’s percentage of new carriers (2.1%) is similar to June 2019’s percentage of new carriers (2.8%), which indicates stable growth according to Motive.

Nearly 2,000 carriers left the market in June—an increase of 60% from May—yet there are still 58% fewer carriers in the market since December 2023.

“Overall, Q2 saw half as many carrier exits (4,039) compared to Q1 (8,400),” the report stated. “We anticipate fewer exits next month and for this more stable growth to continue.”

But just because the market could pick up, that doesn’t mean the freight recession is behind us.

See also: Industry costs increased more than 6% during freight recession, ATRI says

Unless the industry experiences changes on the “fundamentals side,” such as diesel prices, interest rates, and market capacity, Woodrow told FleetOwner, the recession could last into 2025.

“Because of how low we are, we have a long way to climb to really get out of this,” Woodrow told FleetOwner. “But we really see that coming in 2025 as a bigger impact in Q1 period."

About the Author

Jade Brasher

Senior Editor Jade Brasher has covered vocational trucking and fleets since 2018. A graduate of The University of Alabama with a degree in journalism, Jade enjoys telling stories about the people behind the wheel and the intricate processes of the ever-evolving trucking industry.