Big shopping season predicted, Mexico becomes No. 1 U.S. importer, trucking market recovery appears nigh

Transportation technology company Motive predicts a strong holiday season for retail, a record year for Mexican imports, and growth for the trucking market by November.

Motive, an integrated operations platform provider, released its monthly economic report this week, summarizing July’s trucking and economic behaviors based on the Motive network, the Federal Motor Carrier Safety Administration, and other publicly available data from government agencies.

Motive predicts a big 2024 shopping season

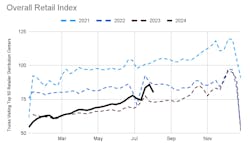

Retailers significantly grew their restocking quantities in July, with “truck visits to the top 50 retailer warehouses rising 10.2% year over year,” the Motive Big Box Retail Index shows. The year-over-year increase for apparel, electronics, and department stores is even more significant, with a restocking momentum increase of 30.7% from July 2023. Superstores and grocery stores’ restocking also rose by 16.6% year over year, which Motive notes is the best monthly performance of 2024.

While Motive predicted a strong holiday season for retail in its last report, Hamish Woodrow, Motive’s head of strategic analytics, told FleetOwner that the numbers in this month's report were quite strong.

"Despite the fact that it was trending stronger, the strength of the July uptick on retailer restocking surprised me," Woodrow said. "It was interesting to see that despite all the noise at the start of August around recession alarm bells, this has yet to permeate to buying trends across the top 50 retailers."

See also: Report: How July’s predicted higher retail sales affect the trucking economy

Even with concerns over inflation, Motive suggests retailers expect higher sales this year than in the 2023 holiday season. Consumers are backing this up. Their spending increased by 2.3% year over year in Q2 2024, the National Retail Federation reported.

The restocking surge seen in June, spurred by Amazon Prime Day and Independence Day, was largely typical; yet it's July’s restocking surge that has Motive suggesting retailers expect “earlier-than-usual holiday shopping, beginning as soon as mid-October.” Planning ahead for the holiday season could also have an impact on retailers' restocking efforts, likely due to “less capacity in the freight market and a tighter supply chain,” the report stated.

With carrier capacity leaving the market and leading to higher freight prices, Motive predicts the cost of goods will rise as a result. However, “we don’t expect the increased costs to take hold until next year and don’t predict an impact on consumer spending this holiday season,” the report stated.

With record truck border crossings, Mexico becomes no. 1 U.S. importer

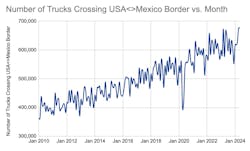

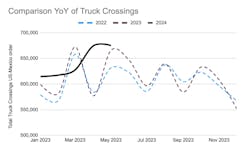

A whopping 675,000 trucks crossed the U.S.-Mexico border, carrying $32.5 billion worth of goods in May alone. This is a 7.2% year-over-year increase and a record for Mexico-to-U.S. imports, establishing Mexico as the U.S.’s top importer, Motive reports.

“Factors driving this trend include attempts by U.S. companies to diversify supply chains, more protectionist trade policies, and even the types of products being imported,” Motive stated in the report.

With the U.S. interest in artificial intelligence, AI-related commodities are seeing the greatest year-over-year growth in imports from Mexico. Computer-related machinery saw a 20% year-over-year growth, and electrical machinery saw an 8% year-over-year growth in imports, according to Motive.

“Computer-related parts and machinery is one of the most dominant categories driving up the volume of trade seen from Mexico,” Woodrow told FleetOwner. “While it isn’t solely brought in from Mexico, Mexico is becoming a hugely important supply line for these, especially given the increasing demand from companies as they adopt/innovate with AI.”

Will the upcoming presidential election impact Mexican imports and nearshoring? Motive said it’s unlikely.

“While there is speculation that more protectionist trade policies may impact the [United States-Mexico-Canada Agreement], both parties seem likely to continue tariffs on Chinese imports, and we predict nearshoring will gain more momentum going into 2025,” the report stated.

See also: Where candidates stand on trucking issues

Is the trucking market in recovery yet?

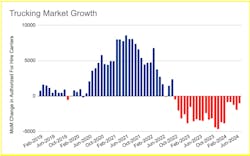

The trucking industry experienced a net exit of 915 carriers, which is a 56.3% drop from June and a 74% year-over-year drop, Motive reports. This is the lowest amount of exits since October 2022. Trucking registrations rose by 4.5% from June to July and saw a 3.6% year-over-year growth. Motive expects positive industry growth throughout 2024 due to increased demand, and Woodrow told FleetOwner the industry could begin a significant rebound before the new year.

"I believe in 2025 we will be talking about capacity issues and price increases in the freight market," he said.

Despite the forward momentum, trucking unemployment grew 0.2% from June, with a 1.9% year-over-year increase, Motive reports, and industry morale remains cautious.

About the Author

Jade Brasher

Senior Editor Jade Brasher has covered vocational trucking and fleets since 2018. A graduate of The University of Alabama with a degree in journalism, Jade enjoys telling stories about the people behind the wheel and the intricate processes of the ever-evolving trucking industry.