With the holiday shipping season beginning a crucial stretch this Thanksgiving weekend, freight carriers will share the road with up to 4 million more cars than in 2020. Major U.S. metro areas could see traffic congestion two to four times worse than usual right as LTL and parcel shipments pick up in advance of Black Friday and the Christmas shopping season. On top of all that, some intense storms could hit the Northeast and Midwest this holiday weekend.

“This year’s calendar adds urgency for shippers,” Ken Adamo, DAT’s chief of analytics, told FleetOwner. “After Thanksgiving, just three business days remain in the month and businesses are motivated to get freight out the door before Dec. 1.”

LTL and parcel shipping speeds can slow by 20% this time of year, as retail shipments surge, according to Glenn Koepke, SVP of customer experience at FourKites, a supply chain visibility platform and transportation technology company.

“Full truckload loads experience the opposite operationally,” Koepke said. “Going into December, TL shipping speeds typically increase by 9%, we believe due to expedited freight, avoiding the groupage and parcel congestion.”

See also: Thanksgiving cargo theft trends

With freight disruptions impacting the supply chain well before the holiday season, FourKites shared with FleetOwner some statistics on truck shipments this time of year. Its analysis is based on 15 million FourKites-tracked LTL and TL loads in North America and Europe between June 2019 and September 2021.

“FourKites has started to see similar slowdowns in its network as the holiday season picks up,” Koepke said of parcel shipping. “We expect this trend to continue, if not get worse, given the disruption and delays across modes globally.”

More cars to contend with this Thanksgiving

“The high volume of travelers for Thanksgiving amplifies the importance of taking safe driving measures to ensure everyone can make it to the dinner table,” Earl Taylor, a professional truck driver for Penske Logistics and member of American Trucking Associations’ Share the Road program. “Many families were unable to see family during the pandemic, and we want to be sure they get to their destinations safely.”

AAA predicts 53.4 million people will travel for the Thanksgiving holiday, a 13% increase from 2020. That total would be 5% short of pre-pandemic levels in 2019—but 6.4 million more than traveled by road, air, and rail than last year. With the U.S. borders recently reopening to vaccinated international travelers, the automobile club suggested people prepare for even busier roads and airports.

Despite gasoline costs nearly $1.30 more this year (and diesel is up $1.26) than this week last year, AAA said it could be the most significant single-year travel increase over Thanksgiving since 2005. About 90% of those going elsewhere this weekend will be on four wheels. AAA predicts 48.3 million Americans will travel by car for the holiday—up from 44.5 million in 2020. In 2019, 49.9 million went by car for Thanksgiving weekend.

“This Thanksgiving, travel will look a lot different than last year,” said Paula Twidale, SVP of AAA Travel. “Now that the borders are open and new health and safety guidelines are in place, travel is once again high on the list for Americans who are ready to reunite with their loved ones for the holiday.”

To help spread good driving cheer, ATA’s Share the Road program created a video with professional truck drivers offering tips to Americans driving across the country this weekend. ATA also offered up some tips to passenger car drivers from truckers.

This Thanksgiving, the most popular destinations for U.S. travelers are sunny spots in Florida, California, Arizona, and Hawaii. New York is the only northern city to make AAA’s top 10 list of Thanksgiving destinations. The organization reported that midrange, AAA-approved hotel rates increased nearly 40% this weekend—ranging from $137 to $172 per night.

“Thanksgiving is one of the busiest holidays for road trips—and this year will be no different even during the pandemic,” said Bob Pishue, transportation analyst for INRIX. “Drivers around major metros must be prepared for significant delays, especially Wednesday afternoon. Knowing when and where congestion will build can help drivers avoid the stress of sitting in traffic.”

The best time to travel this weekend, according to INRIX analysis, varies by day—but generally is in the morning—except the day before Thanksgiving. Expect the most traffic delays between noon and 8 p.m. on Wednesday. On Thanksgiving Day, the heaviest traffic is expected between noon and 3. On Friday, 1-4 p.m. On Saturday, 2-7 p.m. On Sunday, 1-7 p.m.

Trucking holiday freight outlook

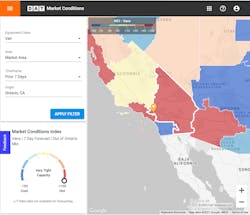

The Los Angeles metro area, home to two of the busiest ports in the U.S., is expected to see a 385% increase over regular rush hour traffic late Wednesday evening. DAT, which operates the largest truckload freight marketplace in North America, is watching the Ontario, California, market, east of Los Angeles, about 50 miles from the ports.

Ontario is one of the largest and most important U.S. markets for warehouses and distribution centers, according to DAT’s Adamo. A lot of van freight coming from Long Beach and Los Angeles ports is warehoused in Ontario and other cities in the Inland Empire. That freight is moving in more significant volumes to retailers for holiday shopping.

See also: Industry trends to watch

“This month, many of the knowns and unknowns of holiday imports will enter the constrained West Coast ports,” FourKites’ Koepke said. “In the event that volume doesn’t meet the distribution center receive-date requirements to hit shelves on time, or to fulfill ecommerce orders, any excess stock will lead to post-holiday sales that will be larger than any year we have seen in the past.”

The van load-to-truck ratio in Ontario reached 8.6 over the last seven days and is trending higher as rates on major outbound lanes increased, DAT told FleetOwner on Nov. 22. DAT’s Market Conditions Index shows capacity as “very tight” for vans out of Ontario.

Ontario to Phoenix, a 330-mile haul, averaged $5.37 a mile over the last seven days, according to DAT’s RateView pricing tool. That’s about 81 cents higher than this time last year. The load-to-truck ratio for vans is about 14.5 in Phoenix, meaning there are plenty of loads out of the market.

Ontario to Chicago, Ontario to Dallas, and Ontario to Atlanta are other lanes where rates are trending upward as retailers draw down inventory for the holidays.

“Look for van and reefer load volumes on the spot market to rise in the near term and to jump substantially next week, which is typical when you compare a holiday-shortened week to a full business week that includes a month-end,” Adamo said.

Holiday season supply chain disruptions

“We anticipate shipping volumes will increase significantly through at least mid-December, as smaller shippers and last-minute product buys are pushed through from overseas,” Koepke added.

FourKites has already started to see slowdowns in its network as the holiday season picks up. “We expect this trend to continue, if not get worse, given the disruption and delays across modes globally,” he added.

FourKites has seen 56% growth in retail load volume on its platform since January 2021. The modal distribution is changing—with a three-times increase in LTL volume and two-times growth in full truckload volume, according to company data.

Truckload shipping speeds, which typically speed up a bit in December, are expected to return to normal in January and February, according to FourKites analysis. The same analysis sees parcel and LTL, which typically slow during December, return to normal in the New Year.

“Shippers who book appointments or send products 30% earlier than planned during this holiday season can help mitigate inventory disruption and deliver goods on time and revert back to normal patterns during mid-January,” Koepke said.

The national average van load-to-truck ratio was 5.1 during the week of Nov. 14-20, which is up almost a whole point over the previous week, according to DAT. That means there were 5.1 available loads for every available van on the DAT load board network. The reefer ratio was 11.6, up from 10.7, with food distributors positioning fresh food for the Thanksgiving holiday. “Look for demand to continue in the coming weeks as grocers restock their shelves,” Adamo said.

“Despite increased prices for consumer goods, the demand for truckload services remains robust as we head into the holidays,” he added. The seven-day national average spot van rate was $2.93 a mile last week, while the average reefer rate was $3.40 a mile, an all-time high.

Supply chain unknowns

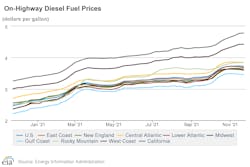

With national diesel prices averaging near yearly highs of $3.72 per gallon (ranging from $3.46 in the Gulf Coast to $4.78 in California), fleets running the latest, most fuel-efficient equipment could have an advantage this holiday season, according to Kenny Vieth, president of ACT Research.

“Spot freight rates for dry vans, flatbeds, and reefers reached highs in September,” Vieth said. “Higher diesel prices enhance the value proposition of today’s fuel-efficient new trucks, as fuel savings translate into bigger ROI numbers—especially for long-distance hauls.”

Newer trucks can also help fleets attract drivers, he said. “The driver shortage is a perennial issue for fleets and operators,” Vieth noted. “Current ultra-tight labor market conditions have fleets competing fiercely for drivers. Offering a new truck, spec’d with state-of-the-art technology for driver safety, ease, and comfort is a factor that helps driver recruitment and retention.”

The biggest concerns of the commercial vehicle industry at the moment are supply-chain constraints and the inflationary ramifications that flow from them, according to ACT’s Transportation Digest, released this week.

“Reviewing forecast risks, the two most visible and worrisome unknowns in the near term are” ongoing supply challenges for OEMs and suppliers impacting commercial vehicle production and “the threat posed by COVID, especially if holiday gatherings are a catalyst for another wave,” Vieith explained.

Even with fewer Americans traveling for Thanksgiving in 2020, the nation saw COVID-19 cases rose after the holiday gatherings last fall—months before vaccines for the deadly virus were available. The Centers for Disease Control and Prevention recently updated its advice for those looking to keep COVID risks down while celebrating this season. COVID cases have been slowly rising nationwide since the start of November.

The Cass Freight Index has been on the rise for nearly 18 months—as consumer spending continues to focus more on goods than services. The supply chain could continue to see constraints as the pandemic continues, Vieth said. “The nationwide focus on the supply chain in the business press and the general media is unprecedented,” he said. “And most of the links in supply chain nodes from ports to factories to distribution centers to retailers and households are trucks and trailers.”