Despite the noise, well-positioned carriers should be optimistic about freight in 2025

PHOENIX—A little clarity could go a long way. But no matter what happens with tariffs, the freight economy and for-hire capacity are overdue for a shakeup. There are many reasons for well-managed fleets to be optimistic about their 2025 outlook.

“If you take away what’s going on with tariffs, in particular … I would have come out here and told everybody: It’s not going to be great. It’s not going to be the pandemic boom. But we are absolutely moving in the right direction,” Bob Costello, American Trucking Associations chief economist, told for-hire carrier executives March 17 at the Truckload Carriers Association’s annual conference here.

He noted that capacity is leaving the market, and volumes are growing as U.S. consumers move past the post-pandemic desire to spend more on experiences than goods. Costello expects growth in goods spending to outpace experience spending in 2025.

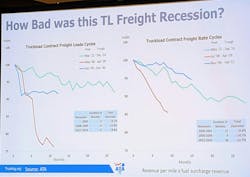

With 13 straight quarters of weakening demand, trucking has been mired in a freight recession as the rest of the U.S. economy has slowly grown. While the trucking industry has faced more significant drops in demand, this freight recession has lasted longer than any this century.

“The trucking industry has been in a world of hurt for some time,” Daniel Murray, SVP of the American Transportation Research Institute, said March 18 during the Truckload Carriers Association’s annual convention here. “If you think the numbers are bad for medium to large fleets, anybody that’s playing the spot market—which is always owner-operators, small fleets—they’ve been taking a bath over the last few years.”

Failing fleets cut capacity as demand rises

The day after Costello spoke to truckload carriers, ATA announced that its For-Hire Truck Tonnage Index jumped 3% in February, the most significant month-to-month increase in several years.

“This outcome fits well with our growing optimism for the truck freight market after a two-year recession,” Costello said March 18. “Some of the gain in February was due to accelerated imports early in the year as shippers rushed to bring products into the U.S. before tariffs hit. Even accounting for this, the first two months of the year were positive, all things considered, indicating that the freight recovery has indeed begun.”

Cash reserves built up during the pandemic boom are dwindling for some ill-prepared smaller fleets on the “cusp of failing,” which could remove capacity from the industry even as freight demand improves, Costello said during Truckload 2025.

“Capacity has been leaving the industry. Now, what’s happened is you haven’t always felt it because demand wasn’t very good. But that’s why I was also getting more optimistic: Just as demand starts to pick up, I’m like, ‘You’re going to start to feel it.’”

And while capacity has been slow to leave the industry, many fleets have been slow to keep up with maintenance and financing payments, Costello said. “So even if the market starts to improve, as I suspect, you could still see some of these folks go under. In fact, I fully anticipate that.”

Small carriers had been making good money on the spot market, and some could have benefited from COVID-era Paycheck Protection Program loans for a while (Costello noted that those are hard to track). “But I honestly think that’s pretty much dried up,” Costello said. “Smaller fleets that are generally just getting all their freight from the spot market … are on the cusp of failing.”

Factors impacting for-hire supply

ATA chief economist Bob Costello said these factors will impact for-hire truckload carriers’ business in 2025.

Supply has been slow to leave

- Lenders don’t want the used equipment

- Decent cash flow, even if carriers are losing money

- Unlike past down cycles, it’s easier to get freight even if they lose money on the load

Expect continued slow exit rate

- Fleets have been trying to reduce costs as much as possible. Some efforts are good, but other cost-cutting will cause long-term problems, e.g., maintenance.

- Many fleets are in trouble as debt piles up. Some can’t afford new trucks, and maintenance will catch up with them.

- Freight rates fell, but costs jumped. Interest rates won’t go down much more.

- All these factors will lead to more capacity reductions—even if freight volumes improve.

Illegal capacity

- Some fleets are suspected of illegally using Mexican B-1 drivers to haul domestic loads, which has added capacity. Known as cabotage, American Trucking Associations is working with Homeland Security to crack down on this.

“Assuming the tariffs do not hit hard, we’re going to continue to see freight improve,” Costello said. “At the same time, you’ll still see, not a lot, but a little bit of capacity leave. And that’s why things will start to feel better.”

How some small carriers are surviving and ready for better days

For-hire truckload carriers are looking for reasons to feel better. It’s been a tough few years since the pandemic freight boom. In 2024, contract loads were down 3% and the spot market plummeted by 30%, Costello noted, magnifying the potential financial woes of fleets living off the spot market.

However, those smaller carriers that have found ways to diversify their operations and focus on customer service appear ready for the next phase of this freight economy.

Before the freight downturn, Trailiner Corporation, a refrigerated long-haul carrier with 70 trucks and an additional 75 asset trailers pulled by owner-operators, had 90% of its freight contracted, with the rest coming off the spot market.

“Due to the nature of the marketplace, that has shifted a little bit lower to more like 75/25, which I don’t enjoy,” Amber Edmondson, Trailiner president and chief executive, said during a Truckload 2025 panel focused on small carriers.

She added that since she and some family members bought the fleet from her grandfather in 2018, they have focused on diversifying their contracted customer base and freight mix. “We were heavy in produce—and we still are pretty significantly in that market—but we have tried to find other business out of those same areas that is not as seasonal and is more consistent throughout the year.”

The tough spot market has been a good reminder of how important customer service is for small fleets, according to Adam Blanchard, chief executive of Double Diamond Transport, who moderated the small carrier panel on March 17.

“Talk about no loyalty amongst thieves. They’ll dump you for 25 or 50 bucks—no matter how long you’ve been working with them,” Blanchard said of freight brokers and the spot market. “I would say it’s been a very unforgiving market on the spot side, whereas the customer side has been much better to us.”

Good and bad Trump policy impacts on trucking

ATA chief economist Bob Costello said there are a number of risks that come with President Trump’s policies, noting that some risks can be positive for trucking operations.

Potential positives

- Taxes: Trump tax cuts are up for renewal this year with favorable Congress

- Regulations: Slowed down, but roll-backs take time

Potential negatives

- Labor: Deportations and less immigration could mean a tighter labor market and fewer consumers.

- Tariffs: Biggest ‘what if.’ If additional tariffs on Canada and Mexico go into effect in April, it would significantly drive up tractor and trailer prices, aggravate inflation, and reduce consumer demand.

- Port fees: Ocean vessels associated with Chinese carriers or using Chinese-built ships are assessed at $1 million to $3 million. This could reduce port calls, impact East Coast exporters, and change freight patterns.

Potential impacts

- Worst case: Economic and freight recession

- Optimistic view: Tariff clarity sooner and limited impact on North American trade would allow the freight market to continue improving

- Inflation: Price gains could impact policy

- Interest rates: Uncertain times but the potential for one more rate cut before a pause

Graig Morin, president and co-founder of Brown Dog Carriers & Logistics, is focused on building transparent partnerships with his fleet’s customers. This includes informing the customers about what the carrier needs to make a profit.

“Everyone’s here to make money,” Morin noted. “We will haul your freight safely. It’ll get to where it needs to be on time. Here’s what we expect in return: And that’s a decent rate that we all agreed on. And it works.

“We’ve refused more work than we’ve brought on,” he continued. “We could have grown with a very large customer and put many trucks in there, but they didn’t pay what we wanted them to. It was almost insulting to listen to what they wanted to pay, and they told us what they were going to pay us. That’s not how we work. You might be able to get that out of somebody else.”

He acknowledged business attitudes like that might be why his fleet has held steady at 25 trucks and not grown to thousands. “But I won’t sell ourselves short,” Morin said. “We know what we need to make. That’s what we’re going to make. We’re all here to make a living at the end of the day—that’s the customer as well as us. So we just partner with customers that have our same mindset.”

Why does this freight downturn feel worse than the others?

Costello said that fleet owners and executives continually tell him this has been the most challenging market in a long time. The economist said it surprised him that carriers would think this recent freight recession was worse than the one caused by the Great Recession in 2008 and the market crash in late 1999.

In those other examples, the freight dropped more significantly but quicker, and the freight bounced back within a year—like quickly ripping off the Band-Aid. “[In] the period we’ve just gone through, we didn’t even fall 10% but it lasted 27 months. That is just a slow, slow tearing off of the Band-Aid. And it’s why it felt so bad.”

During the previous two significant freight recessions, average rates per mile didn’t fall as much as loads—but this most recent cycle saw rates crater more than volume.

ATRI’s Murray called this prolonged freight recession “death by a thousand needle pricks.”

But Murray said he’s optimistic about trucking’s bounce back thanks to a lot of good signals, such as increased housing starts, and the potential for interest rates to come down, which could also help the slugging housing market. When people build or buy homes, not only does it help construction fleets, but it boosts other trucking operations because every time someone moves, they also buy more appliances, furniture, and other products.

“If we want pricing to go crazy, maybe get five or 10% of the capacity out of the industry,” Murray said. “Well, sure enough, we’re seeing that right now during the bad economy. And we’re seeing this possibility that when the economy turns, there’ll be less capacity, and all of a sudden, pricing will go way, way up for us.”

If those small carriers and owner-operators with aging equipment living off the spot market leave and the economy can withstand tariff uncertainty, this protracted sluggish freight economy could finally be history.

“I think we’re set for a turnaround that will feel good—and very, very quickly in ‘25,” Murray predicted this week.

And for small fleets that have weathered the storm, Brown Dog’s Morin reminded his fellow truckload carriers to focus on their operations and customer value instead of worrying about big carriers.

“Focus on your customer. Don’t focus on the big guys because a lot of those things are out of reach,” Morin said. “They all started small too … Your most valuable piece is customer service. For us, if a customer has a problem, they’re going to pick up the phone and call me directly.”

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.