The transportation sector can look forward to “better days” in 2024, but that’s mainly because “better” isn’t much of a stretch compared to 2023, explained the sector analysts at Stifel in a recent presentation.

Even so, the trucking industry’s perception of the downturn might’ve been skewed last year, coming out of the post-pandemic trucking boom.

“Freight volumes actually weren't that bad in that absolute context [in 2023], better than in 2018 and better than the pre-pandemic freight pullback in 2019, of course,” Stifel Director Bruce Chan said. “But, compared to the boom years of 2022 and 2021, the comps were incredibly difficult.”

How 'not that bad' was it?

Additionally, 2023 got off to an unexpectedly bad start that prompted a lot of carriers to develop a more realistic outlook. Chan attributed the macroeconomic slip to “residual destocking” that had begun late in 2022. Inflation and high diesel prices added to the pain.

But a “fairly modest but pronounced firming” in freight volume marked a return to seasonality later in 2023—and an easing in inflation and fuel prices point to the beginnings of a margins recovery. Still, ongoing “mixed signals” have prompted the Stifel analysts to take a “more conservative” view of freight volume growth in 2024.

“Inventories in the last cycle peaked out in early 2023 and, for the most part, destocking is complete. Of course, we're still waiting for some clear signals that a restocking has begun—and that's been a little bit harder to come by,” Chan said. “Given some of the indicators that we're seeing on the consumer side of things, and given many shippers have trepidation about the direction of the economy, those inventories will probably be a little bit slower to recover.”

On the manufacturing side of the macro outlook, growth has been below the historical average. Still, the ISM index finished the year above forecasts as the industrial slowdown has stretched into the “longer side” of historical periods of contraction.

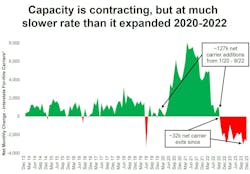

Still, as Chan pointed out, trucking is approaching the end of a typical market trough. However, the market still faces overcapacity, which Chan attributed to the “elevated retained earnings” banked by many independent truckers during the boom.

“By and large, the survival of a lot of these small players has surprised us—so it could just be a matter of time. As this trough wears on longer and longer, the likelihood of capacity exits really starts to grow—and that should be a big inflection for spot prices, even in a flat volume environment,” he said. “A lot of the small carriers are contending with some elevated costs—and that's really across the board with inflation. The recent move down in diesel prices might provide some temporary reprieve on operating costs, but any additional increase in fuel or other costs would accelerate those exits.”

See also: While low spot rates reveal a silver lining, truck build cuts appear imminent

Keys to keep an eye on

In summary, 2024 is likely more of a “transition to better days” than a full-blown market rebound, as the presentation characterized the year ahead. Stifel’s critical points for the trucking segment included:

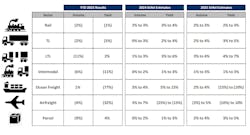

- Spot rates should return to a “seasonally normal cadence,” but fleets and truck drivers shouldn’t “expect fireworks” this summer. Positives heading in 2024 are:

- 1. Van spot rates exhibited signs of normal seasonality, rising moderately before the holidays;

- 2. Import TEUs finished higher than expected in the final four months of 2023; and

- 3. Confirmation of the Fed's pause in interest rate hikes and a “potentially firming macro backdrop.” Stifel forecasts van spot rates to grow in the low single digits in 2024 compared to last year, with a typical spring weakness, midsummer spike, and late summer cooling ahead of the holiday peak.

- For spot rates to turn materially higher and buoy contract rates, further capacity exits will be necessary ahead of any demand improvement. Demand will remain weak through the year's first half, given the seasonally weaker time frame and “generally sluggish but stable” conditions. Again, spot rates will depend on supply, and diesel prices will be a crucial indicator for capacity changes. Ultimately, the historic spread between spot rates and contracts will take longer to converge during this cycle.

- Contract rates have formed “a new floor” around pre-COVID cycle peak levels and would react quickly to a spot rate recovery—but are most likely to “persist sideways” for a bit longer. Therefore, the first half of 2024, particularly the first quarter, will be “a tougher period.” But once demand snaps back, the cycle could be extended by challenges to capacity growth, such as high interest rates and employment growth in labor-competitive sectors like infrastructure and construction.

- Reshoring activity continues “picking up steam” driven by supply chain “de-risking,” regulatory efforts, and relative cost advantages—a positive for truckload freight.

- The brokerage business faces “a little bit of a longer runway” towards recovery, as a recovery for asset-based trucking has to come first.

- For the intermodal segment, the question is always whether the business can take market share from truckload. But lower truckload rates make the “trade down” in service with intermodal “less desirable.” However, as the rails begin to invest in improved service, intermodal becomes a more attractive option. Stifel anticipates a single-digit recovery in intermodal volume, compared to “a fairly low bar” set in 2023.

About the Author

Kevin Jones

Editor

Kevin has served as editor-in-chief of Trailer/Body Builders magazine since 2017—just the third editor in the magazine’s 60 years. He is also editorial director for Endeavor Business Media’s Commercial Vehicle group, which includes FleetOwner, Bulk Transporter, Refrigerated Transporter, American Trucker, and Fleet Maintenance magazines and websites.

Working from Beaufort, S.C., Kevin has covered trucking and manufacturing for nearly 20 years. His writing and commentary about the trucking industry and, previously, business and government, has been recognized with numerous state, regional, and national journalism awards.