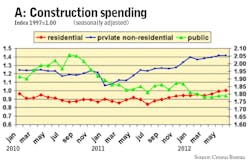

Construction activity is in the early stages of a gradual recovery as it continues to rebound from supply and demand imbalances that remain a drag on private construction activity. At the same time, the closing of state and local government budget deficits are weakening public construction activity. Home foreclosures will remain evaluated for an extended period of time as banks slowly work off their nonperforming loans. The available supply of home foreclosures entering the market will be a drag on new construction spending (Chart A). While mortgage rates are at low levels, credit availability remains relatively tight and household balance sheets relatively weak. As a result, the low mortgage rates are not stimulating a boom in housing demand. This implies a gradual recovery in new housing construction.

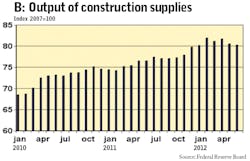

Private nonresidential construction activity is gradually recovering as imbalances between supply and demand factors are slowly decreasing (Chart B). Excess supply of retail, industrial and office space is slowly decreasing as the economy gradually expands, but sluggish economic growth implies excess supply will weigh on the private nonresidential construction recovery for some time.

The recovery in construction activity is being led by maintenance activities and alterations to existing structures. Homeowners and building owners put off maintenance activities during the recession, but that means those structures, both residential and private nonresidential, are in need of upgrades. Maintenance activities related to depreciating structures implies a moderate steady recovery in construction activity.

Public construction spending is decreasing as state and local governments battle budget deficits. Depreciation of existing structures is putting upward pressure on spending, but state and local governments do not have the revenue to support higher construction and reduce deficits. In the short term, governments will reduce construction spending. In the medium term, governments will increase fees/permits to enhance revenues so they can increase infrastructure spending. The trend of forming public/ private partnerships as a method to help increase expenditures will also continue.

While state and local governments are in the process of reducing their budget deficits, the federal government has not begun to reduce its budget deficit, which is at unsustainable levels. The downturn in state and local government spending on construction projects will bottom out in the near future, but the federal government will reduce infrastructure spending as it begins to adopt policies to reduce budget deficits. The Federal Highway Trust Fund, which has been operating in the red for the past few years, will require an increase in revenues and/or reduction in expenditures to swing it back into the black.

There are headwinds to the recovery in construction activity, but these headwinds are slowing the growth rate of the recovery in construction activity.