Trump tariffs vs. ‘self-inflicted uncertainty’ casts cloud over business decisions

Trade war uncertainty has engulfed U.S. business decisions since President Donald Trump returned to office and threatened tariffs on neighboring and global trading partners. The trucking industry could be an economic casualty if this cold trade war heats up next week.

“Trump risk is truly self-inflicted uncertainty,” Ken Vieth, ACT Research president and senior analyst, said during his firm’s Market Vitals seminar in Columbus, Indiana, on February 20.

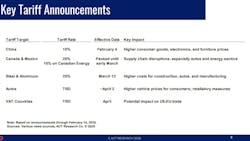

After the president granted a one-month reprieve from the 25% tariffs he wanted imposed on goods from Canada and Mexico and doubled the 10% tariff he already imposed on Chinese imports, Trump said Thursday that he plans to enforce them next week.

See also: Why Trump’s tariffs spell bad news for trucking’s recovery

While Vieth was speaking before Trump’s March 4 deadline, his team of ACT Research analysts warned of potential problems that could arise from the tariffs:

- Class 8 vehicle prices in the U.S. would increase 8% to 10%.

- Mexico and Canada’s economies would likely fall into recessions.

- Trump’s advertised policies would likely boost U.S. inflation, keep interest rates elevated, and stifle growth.

“We try to avoid politics because trucking is about moving freight,” Vieth told the audience of industry executives, supplier and OEM analysts, and dealers. “It’s about Maslow’s hierarchy. It’s about putting food on our tables and clothes on our bodies, finding us a place to live. That’s what we’re focused on. But certainly tariffs, inflation, interest rates, medium-term uncertainty, short-term pull forwards—this is not the way to conduct business.”

Since Trump returned to the White House in January, tariff threats have fueled inflation concerns as U.S. consumer confidence fell. “Based on all the indicators showing declining consumer and business confidence and sentiment, we are expecting a slowing economy,” Carl Weinberg, chief economist at High Frequency Economics, told clients this week after The Conference Board’s consumer confidence index fell far below economists’ expectations.

Tariffs could halt the trucking industry’s freight recession recovery as it’s picking up, Chris Spear, the American Trucking Associations’ leader, said. “A 25% tariff levied on Mexico could see the price of a new tractor increase by as much as $35,000, he said February 1. “That is cost-prohibitive for many small carriers, and for larger fleets, it would add tens of millions of dollars in annual operating costs.

Vieth, who estimated that 80% of the Market Vitals seminar audience was Republican, added: “I don’t think I’ve talked to a single person in this room in the last two days that was like, ‘Yeah, we’re just loving this.’”

Uncertainty and ‘tariffs on steroids’

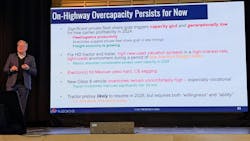

A big theme of the two-day seminar focused on the uncertainty of what’s happening in Washington as the industry climbs out of a prolonged freight recession. While analysts see signs of a better rates and fundamentals for carriers in 2025, the industry needs more certainty.

After granting a reprieve to Mexico and China after initial tariff threats weeks ago, it was unclear if Trump’s March 4 deadline would be enforced or pushed back another month at the last moment, which has put businesses in a holding pattern.

“Don’t leave everybody hanging because you can’t make decisions if you don’t know what it will be,” Vieth explained. “If it’s going to be tariffs, make it tariffs and we can make decisions from there. If it’s not going to be tariffs, we can go from there. But don’t leave everybody not knowing what’s going to happen.”

See also: Is 100,000 egg heist a sign of rising economic woes?

David Teolis, ACT Research's chief economist, said tariffs were among the critical policies that could make or break the improving freight economy. “If we don’t get tariffs and things are kind of normalized, we’ll have a pretty safe economic outlook for 2025 to 2026,” he said.

However, the economist called Trump’s 2025 plan “tariffs on steroids” compared to the 2018 and 2019 tariffs imposed during his first term. Teolis said tariffs could create three key risks for U.S. transportation industries:

- Inflation remains high: Tariffs could increase short-term inflation, raise long-term prices, and draw fewer Federal Reserve rate cuts.

- Higher equity-price volatility: More households are exposed to equities markets, which would likely suffer under tariffs, cutting into Americans’ wealth and spending. (When Trump reiterated tariff plans on February 27, the S&P 500 index fell 1.6%, wiping out nearly all its gains since Trump’s election.)

- Consumer confidence falls: Households already struggling with high prices could become more pessimistic and spend less.

But how could tariffs benefit trucking?

While the economic outlook for tariffs remains uncertain, reducing imports—particularly from China—could boost trucking movement within the U.S.

Randy Flanagan, VP of sales for SAF-Holland, used washing machines sold in the Midwest as an example. When imported from Asia, they arrive at a U.S. port by ship and are likely transported by train to Chicago, where they are loaded onto a truck that delivers them to a retail point of sale.

“That’s really just one truckload that happened,” he noted.

However, tariffs could push for more domestic production of products such as washing machines. “If our friends at Amana in Iowa start building washing machines like crazy, there might be 400 truckloads that move to Amana Colonies with paint and steel and copper wire for the motors, etc., etc.,” he described. “That could potentially raise what we all do here.”

Steve Tam, ACT Research VP and analyst, noted that the commercial vehicle and freight industries are sucked back into a never-ending news cycle of uncertainty.

“You’re going to have to sort through some of this stuff for a while before we can come up with anything that’s concrete, anything that’s actionable,” he said on the first day of the Market Vitals seminar. “It doesn’t mean you can say, ‘Oh, this is too hard,’ throw your hands up, and walk away. We still have to work to come up with scenario planning and probabilities of what might happen, what’s not going to happen.”

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.