The slow decline of freight volumes is likely over and the major freight-monitoring indexes will likely show that when the fall data is released, according to Commercial Motor Vehicle Consulting (CMVC). The American Trucking Assns.’ Tonnage Index, Cass Freight Index and other statistics that measure freight movements have been showing a slowdown in freight growth during the summer. These freight indexes provide only a rear-view mirror image of the freight environment since the information is collected from carriers and represents historical data. CMVC analyzes statistics within the supply chain to provide a forward-looking view of the freight environment.

Readers of this column anticipated decelerating freight growth during the summer as CMVC predicted a moderate inventory correction in response to slowing consumer spending due to high energy prices during the spring.

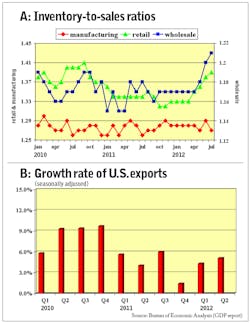

CMVC believes wholesalers and retailers slowed freight growth into their distribution centers as sales were partially satisfied by drawing down inventories (Chart A). That inventory correction caused a disruption in the supply chain. That is now over and CMVC believes the inventory correction was completed at the end of the summer or beginning of the fall.

Wholesaler and retailer inventory is now in equilibrium with sales, so moderate sales growth will stimulate restocking, thereby stimulating freight volumes. This will drive manufacturing output as final goods producers increase shipment volumes.

With inventories in equilibrium throughout the supply chain, final sales to domestic purchasers will again be pulling commodities through the supply chain from manufacturers, to wholesalers, to retailers, and ultimately to end users.

While the end of the inventory correction will strengthen the growth rate of freight volumes, CMVC predicts only a moderate acceleration in freight growth. This is due to sluggish-to-moderate expansion of final sales to domestic purchasers and the slow growth rate of exports (Chart B) caused by the European recession and the overall moderating growth rate of the global economy. The European recession will be a drag on the global economy for an extended period of time.

Residential and private nonresidential construction activity is no longer a drag on freight growth as those sectors are gradually recovering. The recovery in auto sales shows consumers’ balance sheets have improved since the recession as well as the availability of credit.

Excluding a shock to the U.S. economy, final sales to domestic purchasers can sustain sluggish to moderate growth as business balance sheets are relatively strong. Personal income is expanding at sluggish growth rates stimulated by moderate employment gains.

Statistics within the supply chain imply a moderate acceleration in freight volumes during the fall, but the risks in the medium term are on the downside since households’ balance sheets remain fragile, state and local governments are reducing expenditures to close budget deficits, and export growth is moderating.