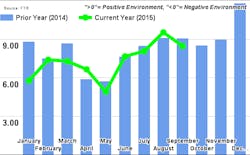

FTR: TCI continues to fall ahead of expected improvements

FTR’s Trucking Conditions Index (TCI) measure for October fell more than three points from September to a reading of 5.06. The TCI was projected by FTR to decline through 2015Q4, so the October reading was not unexpected.Conditions are expected to improve for truckers in 2016 as shippers become concerned with the possibility of tight capacity in the second half of the year. FTR is forecasting 3% or better growth for truck loadings in 2016, reflecting stronger than expected results in 2015 and continued economic growth going forward.

Details of the October TCI are found in the December issue of FTR’s Trucking Update, published Nov.30, 2015. The ‘Notes by the Dashboard Light’ commentary in the current issue discusses the current rate of auto sales and FTR’s expectations on whether the record pace will continue. Along with the TCI and ‘Notes by the Dashboard Light,’ Trucking Update includes data and analysis on load volumes, the capacity environment, rates, costs, and the truck driver situation.Jonathan Starks, chief operations officer at FTR, commented: “The trucking environment has slowed during 2015, but compared to recent history it is still operating at a reasonable level. Spot market activity is well below what was seen during the very tight conditions that stemmed from last winter’s disruptions. The Market Demand Index from Truckstop.com is down nearly 45% from prior year levels and is off even more significantly from the highs seen earlier last year. However, pricing on the contract portion of business has held up better than expected. Shippers seem to be choosing capacity over cost savings – especially when it comes to their core carrier base. This is a relatively easy choice given the downward moving fuel markets. The easy fuel comparisons are expected to change in 2016, and that will make it more difficult for shippers to be as lenient on trucker’s base rates. We expect conditions to improve as we move through the year as the market further prepares for tight truck capacity when the HOS, ELD, and speed governor rules are implemented over the next two years.”“The main risk right now is the weakness in manufacturing and the high inventory levels,” he added. “The inventory situation needs to be corrected before we are likely to get a sizable burst of manufacturing activity. Look for that to happen early in 2016. The recent ISM Manufacturing Index release showing a contraction in November may be the early signal for this necessary correction.”