Study: 2024 presents challenges to shippers, 3PLs, forcing adjustments

The past few years since the pandemic have been a whirlwind for the transportation industry. Logistics companies have learned to grapple with the changes by implementing some of their own, according to an annual 3PL study conducted by Penn State University, Penske Logistics, and NTT DATA.

The study examines relationships between third-party logistics providers and shippers by surveying senior executives and leaders. This year’s study included responses from non-users to “provide valuable insights on why some organizations have elected not to use 3PLs,” the report states.

The topics covered in this year’s report include change management in shipper and 3PL relationships, direct-to-consumer experience, current state of the 3PL market, artificial intelligence in the supply chain, and current supply chain issues. This article will highlight the latter three topics.

“The survey results indicate that both shippers and 3PLs continue to invest in visibility and technology, especially AI," Ramu Pannala, VP of supply chain technology at Penske Logistics, said. "Sustainability and supply chain diversification are also important focus areas for both shippers and 3PLs."

The current state of the 3PL market

What shippers are saying

- 89% of shippers report satisfaction in their relationships with 3PLs compared to last year’s 95%

- 82% of shippers feel that 3PLs contribute to better customer service compared to last year’s 89%

- 66% of shippers believe 3PLs contribute to lower logistics costs compared to last year’s 80%

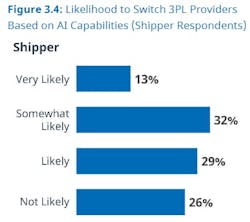

- 74% of shippers report that a 3PL’s AI capabilities (or lack thereof) will likely influence their decision to choose a 3PL provider

Shippers and 3PL providers have a lot to contend with this year.

Impacts of the pandemic, such as inventory management challenges, trucking capacity, and consumer demands, continue to plague the industry. Inflation has impacted the costs of labor, equipment, logistics services, and raw materials. Geopolitical unrest (Russia and Ukraine, Israel and Palestine, and Houthi rebels on the Red Sea) has disrupted trade routes, increasing transit times and shipping costs.

This year has particularly challenged 3PL-shipper relationships. Last year, 95% of shippers felt their relationships with 3PLs were successful compared to this year’s 89%. Last year, nearly every 3PL surveyed (99%) felt their relationship with shippers was successful compared to 94% this year.

Regardless, shippers and 3PLs need each other to succeed in these conditions, Mark Baxa, president and CEO of the Council of Supply Chain Management Professionals, said in the report.

“The inconsistency in the physical distribution of the supply chain worldwide has driven dissatisfaction,” Baxa said. “These are huge issues no single company can solve by themselves.”

It is worth noting that for 3PL providers, shipper satisfaction has changed in a negative direction from this year to last year.

A trend that skewed downward is the shippers’ belief that 3PLs contribute to better customer service (82% this year compared to 89% last year). Shippers noted a more drastic change in their belief that 3PLs contribute to reducing logistics costs (66% this year compared to 80% last year).

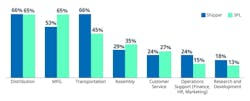

One trend that increased by 25% from last year was that 87% of shippers agreed to increasing outsourced services compared to 62% from last year. Outsourced services include freight and transportation, with a shipper expenditure of 82%, and warehousing, with an expenditure of 61%.

Shifts in shipper/3PL relationship expectations

Do these negative numbers signal a shift in expectations with 3PL services? According to the survey, yes—especially in terms of shipment visibility and technology.

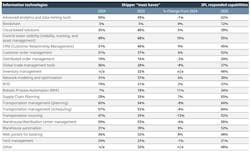

The majority of shippers (68%) most frequently request control tower visibility technology from their 3PL providers, according to the survey. That’s up from last year’s responses of 49%. These technologies include asset management, visibility, and tracking. Shippers also value a 3PL’s ability to provide transportation management planning (54%) and scheduling (53%) and warehouse/distribution center management (53%).

Other notable shifts in shipper expectations include robotic process automation, which only 7% of shippers expected last year compared to this year’s 18%. Shippers are also changing their views on 3PL providers’ customer relationship management, with 40% labeling it as a “must have” this year compared to 31% last year. One area where shipper expectations with 3PLs are dropping, however, is with transportation sourcing, with only 35% of shippers requiring it this year compared to 47% last year.

See also: How 3PLs, shippers are combating challenges with technology

Artificial intelligence in the supply chain

While shippers label some technological features as 3PL “must haves,” 3PLs are also using the technology to increase operational efficiency. Many of these technologies already include AI capabilities. The report states that AI has transformed many aspects of the transportation industry “from sourcing and inventory to transportation and vehicle maintenance.”

Shippers and 3PLs largely agree on their uses of AI in that it is a tool for mundane tasks (39% shippers and 36% 3PLs), that it can identify patterns through data analysis (46% of shippers as well as 3PLs), and that it can replace human intuition in decision making (9% shippers and 14% 3PLs).

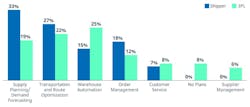

Shippers and 3PLs identified practical uses for AI. The use deemed the most important by both entities is supply and demand forecasting. Additionally, while shippers deemed AI’s use case for transportation and route optimization as important, most 3PLs considered it “business critical.” Warehouse automation was another area of AI use cases where 3PLs seemed to find more value in AI than shippers.

“We're looking at doing predictive maintenance now to where we can get ahead of some of these repairs, which keeps our trucks on the road, which helps our revenue,” Cowart explained.

Those 3PLs that don’t integrate AI capabilities into their operations could soon find themselves at a competitive disadvantage. According to the report, a 3PL’s AI capabilities (or lack thereof) are likely to influence 74% of shippers in their decision to choose a 3PL provider. This was a surprising result for Penske, according to Pannala.

Current issues in the supply chain

The report predicts trends that will make waves in the industry across the next few years. This year, the study team evaluated nearshoring and cross-border traffic.

Nearshoring

There are also differences in the shippers’ demands for AI implementations and where 3PLs plan those implementations. The largest discrepancies are in AI integration with supply planning and demand forecasting, which is demanded by 33% of shippers and planned by only 19% of 3PLs, and AI integration with warehouse automation, which is demanded by only 15% of shippers but planned by 25% of 3PLs.

The report states that this discrepancy could be because 3PLs might have already invested in some AI technologies. In last year’s report, 54% of 3PL respondents indicated that they had already invested in advanced predictive analytics, 50% indicated an investment in supply chain control towers, and 41% noted an investment in warehouse automation.

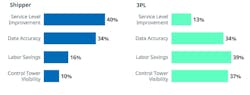

As with any investment, businesses expect a return, and AI is no different. Shippers largely expect ROI from AI with service level improvements (40%), and 3PLs expect ROI from AI with labor savings (39%). According to the report, 3PLs also use AI for predictive maintenance and robotic process automation to automate repetitive tasks.

Examples of RPA where carriers expect to see labor savings include services like customer relationship management and “ways to supplement what our people are doing,” Jeff Cowart of Action Resources, a Birmingham, Alabama-based trucking company, said during an industry event in September.

The rise of nearshoring in the U.S., or moving operations to a nearby country as opposed to a more distant one, e.g., Mexico versus China, has “transformed” the global supply chain, the report states. Shipper respondents identified that nearshoring has been a response to supply chain struggles, customer service needs, and trade policies.

A benefit of nearshoring is that it helps streamline supply chains and mitigate risks, but this trend has also caused 3PLs to “rethink their overall network,” the report states. To better serve their customers in this new trade market, 3PLs are using technology, such as AI, to help identify routes, sourcing locations, and warehousing sites.

For shippers, relocating operations can come at a significant cost and could include sourcing new suppliers and transportation providers, the report states.

Cross-border trucking

A record 675,000 trucks crossed the U.S.-Mexico border this past May, solidifying that Mexico is now the top importer to the U.S., according to transportation operations platform Motive. Additionally, multiple carriers and 3PLs have announced operational expansions across the border as well as acquisitions of companies that specialize in cross-border operations to capitalize on this shift in the supply chain market.

Further, in 2023, trucks moved 84.5% of goods across the Mexican border, according to preliminary data from the American Trucking Associations.

“Volumes crossing the southern border have outperformed the domestic freight market for the last few years,” Kaitlyn Holmecki, senior manager of international trade and security policy at ATA, said. “Seaport growth will continue to grow in the years ahead, but we can probably expect truck freight movements across the southern border to increase at a faster clip.”

According to industry experts, cross-border operations present a great opportunity for carriers and 3PL providers, depending on their capabilities.

“Cross-border operations present opportunities for fleets, but capturing these opportunities depends on their capabilities in customs compliance, having multilingual staff, and utilizing technology to manage documentation and tracking," Pannala said.

About the Author

Jade Brasher

Senior Editor Jade Brasher has covered vocational trucking and fleets since 2018. A graduate of The University of Alabama with a degree in journalism, Jade enjoys telling stories about the people behind the wheel and the intricate processes of the ever-evolving trucking industry.