Report: Independent repair shops desperate for techs, parts

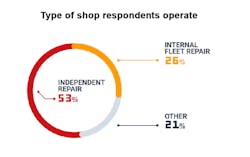

“Most of the trucks on the road are fixed, maintained, serviced, and repaired by independent, typically ‘mom-and-pop’ shops.”

Fullbay's executive chairman and its founder, Jacob Findlay, prefaced his remarks with this fact as he dove into the insights gleaned from the company’s second-annual State of Heavy-Duty Repair Industry Report, which he reviewed at American Trucking Associations’ Technology & Maintenance Council 2022 Annual Meeting & Transportation Technology Exhibition last month.

TMC and MOTOR partnered with Fullbay, the Phoenix-based heavy-duty repair shop software provider, on the study, which provides a comprehensive look at what’s going on with independent shops, which number in the tens of thousands nationwide.

Fullbay has a customer base in the thousands and leveraged 500 of its customers’ anonymized repair data for quantitative analysis (the customer must have used the platform for 12 continuous months), while 900 respondents from throughout the industry (commercial freight, logistics, and repair industries) contributed to the qualitative portion via a survey.

The 65-page report is accessible here: Fullbay 2022 State of Heavy-Duty Repair Industry Report.

Among the report's primary insights were:

- 82% reported at least some disruption due to parts shortages, with 17% listing extreme disruptions.

- 4% of shops boasted of no parts disruption.

- 51% said hiring technicians was their top challenge, while 65% overall found hiring difficult.

- 46% also flagged lack of skills as a technician trouble area.

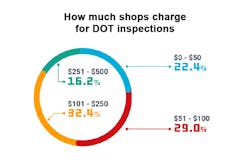

- 22% of shops that don't charge for U.S. Department of Transportation inspections.

- 22% of independent shops don’t charge for diagnostics.

- 23% don't use a labor guide.

- 31% do not know how efficient their technicians are.

- 73% provided a wage increase (meaning 27% did not).

The technician and parts responses should not come as a shock to anyone with even a cursory knowledge of the industry.

Findlay summarized it like this: “We know that the quantity of technicians and shops ... able to maintain equipment is going down at the same time that the quantity of equipment on the road is going up, so you have this tension happening.”

He did offer a possible reason for why one in four shops surveyed did not increase labor costs, which according to the latest TMC/Decisiv benchmarking reportwent up 14.2% across the industry.

“They're doing great work, but they feel bad charging their customers more,” Findlay offered. “And maybe they gave some incremental increases to their technicians, but they're not thinking necessarily in terms of fair change value.”

Fullbay recommends that for every 50-cent increase in technician wages, shops should increase labor rates by $1.

It’s also important to know how effective those technicians are, though 31% of shops said they did not track that metric.

“That means they're paying technicians 40 hours a week, but they don't know how much time their technicians are actually spending working on the trucks,” Findlay said.

Strategy to increase revenue

Another way for shops to increase revenue is by charging fairly for the service rendered. As previously mentioned, the report found 22% of shops did not charge for DOT inspections, and 22% did not charge for diagnostics.

Findlay added that the DOT inspection could be a great opportunity for an upsell that fleet customers would appreciate.

“You're probably going to find other things that the shop can work on and can make money on,” he said. “But it also helps the fleet prevent unscheduled downtime, which is an order of magnitude more important than anything else in the fleet.”

About the Author

John Hitch

Editor

John Hitch is the editor-in-chief of Fleet Maintenance, providing maintenance management and technicians with the the latest information on the tools and strategies to keep their fleets' commercial vehicles moving. He is based out of Cleveland, Ohio, and was previously senior editor for FleetOwner. He previously wrote about manufacturing and advanced technology for IndustryWeek and New Equipment Digest.