Most global manufacturers operating here in the U.S. have been focusing on how they will decarbonize their equipment offerings by the 2040s. Despite alt-fuel futures facing headwinds since the Democrats' unrealistic regulatory agenda was crushed at ballot boxes last fall, OEMs and other zero-emission solutions are playing the long game. While most fleets don't have the luxury—or capacity—to look decades into the future, how you approach your next five years could determine how your 2030s play out.

No matter who is president this year or five years from now, trucking will be different. While more zero-emission technology matures, autonomous trucking solutions are nearing reality. As President Trump storms back into the White House determined to end EV incentives and dare our North American neighbors into a trade war, the future could appear unclear. However, a good place to look is where manufacturers focus their money and efforts.

Even though tariffs could make fleet equipment more expensive and shift supply chains internally, the U.S. still needs trucks more than anything else to fuel the economy. However, the business models around how trucks are sold, operated, and powered will continue to evolve during the second half of the 2020s. So, one thing is clear: Things are changing.

“A lot of the newer profits will start to come from newer sources of revenue for the OEMs and the broader ecosystem,” according to Prasad Ganorkar, a partner with McKinsey & Company. The management consulting company briefed select industry media on the commercial vehicle market at the Fosgard House of Journalists in Las Vegas last month during CES 2025.

See also: How AI could streamline your trucking operations in 2025

New OEM and TaaS opportunities

While Trump 2.0 has halted or cut his predecessor’s public charging infrastructure funding and various EV incentives and decarbonization pushes, the trucking industry’s biggest OEMs have already invested years and billions of dollars in decarbonization efforts. The transition is creating new profit opportunities.

Ganorka pointed out that truck makers don’t directly distribute the diesel fuel that powers heavy-duty transportation—but they have new business opportunities with alternative fuels. OEMs are already building charging infrastructure (look at Daimler Truck’s investment in Greenlane’s charging and hydrogen network) and battery factories (look at Volvo Group’s purchase of Proterra and Paccar, Cummins, and Daimler’s massive battery plant project).

After all, Elon Musk’s Tesla rose to lead the consumer EV market with a similar strategy last decade by focusing on battery technology and building charging infrastructure—rather than waiting for the government to do it.

“As you transition to electricity, the OEMs start to also think about what part of that value chain you can play,” Ganorka explained. “How can they contribute to electric charging? How can they contribute to hydrogen retailing? Starting to play that also allows a different set of revenue as well as profit pools that they can play.”

McKinsey researchers believe that as zero-emission trucks become more prevalent (Don’t forget, OEMs have invested billions of dollars in decarbonization since the start of Trump’s first term and are unlikely to abandon their own global decarbonization paths based on U.S. politics), truck makers will continue shifting toward offering more integrated solutions to capture profits beyond just truck sales.

As trucks become more complex with advanced electronics and software, fleets could become more interested in truck-as-a-service business models where OEMs or third-party providers handle equipment maintenance and life cycle management, allowing fleets to focus on the rest of their operations.

While EVs still can’t replicate what diesel-powered trucks can do for the U.S. economy—along with political pushback from the Trump White House and Republican Congress—AVs could shake things up even more by 2030.

AVs could surpass EVs

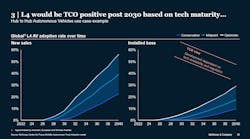

McKinsey analysts expect autonomous hub-to-hub trucking to be “TCO positive after 2030” if the technology continues to mature. Already this year, Kodiak Robotics sold its first Class 8 RoboTrucks to operate (on private roadways) without humans on board. Competitor Torc Robotics plans to go commercial with Freightliner in 2027, and Aurora is rolling out with Volvo Autonomous Solutions and other partners.

While the AV industry continues building its business case, more fleet leaders are interested in its potential, according to McKinsey findings.

“In our survey, we see a lot of customer willingness to look at Level 4 autonomy,” Ganorkar said. “They really want to think about that as an option. Obviously, with all the driver shortages and issues with training drivers, this becomes a real big enabler for fleets in terms of their profitability.”

On one level, trucking involves moving freight from Point A to Point B. However, that simple movement is becoming more complex. With autonomous and zero-emission technology maturing, OEMs looking for more ways to service (and keep) fleet customers, and new truck-as-a-service business models emerging and looking for your business, it’s tough to keep up.

The good news for most fleet managers is a human-driven, diesel-powered tractor-trailer is still the most efficient way to move goods in the U.S. But that doesn’t mean it will be forever.

“As we think about these transitions, we do expect a bit of a reconfiguration in terms of how the industry approaches it,” Ganorkar said. “Today, it's been more about OEMs thinking about selling a truck and then the fleets trying to bring in all the ancillary services together. Increasingly, we expect to see a shift toward a much more holistic, integrated ecosystem of partners coming together.”

The fleets and managers that best adapt to these transportation transitions are laying the groundwork for 2030 and beyond.

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.