BIRMINGHAM, Alabama—Garbage in, garbage out. It’s not exactly Zeno’s dichotomy paradox, but here’s the quandary: If you want artificial intelligence to improve processes—to reduce human mistakes while also speeding things up—but if all you have to train the AI system is your current messy data, how do you even get started? Can you trust AI?

“Transportation data sucks,” said John Sutton, director of corporate strategy for Top 10 3PL Sunset Transportation. “In banking and health care, their data is very structured because it’s very regulated. In other large industries, like retail, their data is very vertical but, at the same time, very narrow.

“Whereas in transportation, our data is very wide, very ugly, and very polluted.”

The catch for a brokerage or 3PL is that trying to coach their shippers and carrier partners to improve that data—to make it more uniform and accurate for the benefit of the entire supply chain—requires a commitment, as Sutton suggested at the recent McLeod Software AI Conference here. And asking a customer for a little more effort is a good way to run off business.

See also: How AI could change trucking in 2024

“We’ll lose our value proposition in those scenarios,” Sutton said, “because they’ll work with someone that isn’t placing that arbitrary restriction on them.”

And that’s historically true, Dwight Bassett, president of The Boyd Companies, noted during the panel discussion, “From Hype to Haul: Carriers and Brokers on How AI will Drive Real Value.”

“I hate that you said that about our data because it is so much better than it used to be—but it’s still not great,” Bassett said, drawing laughter from the full house for the conference. “Change is a big deal. I’ve looked at a lot of small and midsize carriers in the last 20 years, and I’m amazed at the differences in technology, how some people process transactions, and how some people use automation. A lot has changed because [the technology] is available, and it’s horrible that people just don’t want to use it. The fear of managing change is going to be a big obstacle.”

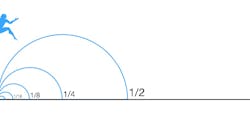

Indeed, just as Zeno’s logic was flawed, technological improvements in freight transportation are real, even if incremental. And the most crucial step is the first one.

“These guys will probably agree: I’ll take a little crappy data over government regulation any day,” quipped Brent Ellis, VP of business systems and processes for Decker Truck Line. “We’ll work with the garbage data.”

Getting started

AI applications in freight transportation run the gamut: driver coaching, route and fuel optimization, and weather forecasting, to name a few.

But to automate pricing and bidding to improve yield is an obvious area for fleets to implement AI—because non-asset players are already setting the market, thanks to some impressive technology.

“Automated quoting is something that we’re very excited about,” explained Sunset’s Sutton. “That enables us to take the unstructured data out of an attachment or an email and put it into a pre-structured format for someone to leverage, to be able to validate that the information the client is requesting is correct before they actually send that to a rating engine and systematically capture that quote.

See also: Uber Freight unveils new freight bid software, generative AI

“Ultimately, the focus remains for that AI ‘copilot’ to make your job as easy as possible. That way, you are always free to pick up the phone for a client. That’s our real bread and butter right now, just making sure that we’re picking up the phone. A lot of our large competitors are hemorrhaging clients because they won’t do that anymore.”

Also impressive is Sunset’s use of technology for contract management. Sutton explained how the system took a proposal from Campbell’s Soup, compared it to Sunset’s “playbook” of dos and don’ts for its broker-shipper agreements, and determined where the terms are “in alignment, partially in alignment, or where we’re completely out of whack.”

“Traditionally, Campbell’s massive trade agreement would’ve taken us the better part a day, maybe a couple of days, and we were able to get red lines back to them within about 45 minutes,” he said.

The carrier representatives knew that they were operating at a competitive disadvantage.

“We have highly compensated salespeople that spend half their time working on bids, and that’s ridiculous,” Boyd’s Bassett said. “We’ve got the information; it’s in their brains and it’s in our system. If we can use machine learning to capture that, we can turn around these bids a lot faster.

“The logistics and brokerage guys are way ahead of us on spot pricing; we need to really get caught up in that arena. I don’t want them controlling my business, so it’s going to be defensive for us to be aggressive in spot pricing.”

Decker’s Ellis, who noted he has experience in both the broker and the carrier businesses, agreed.

“Brokerage is always a little faster to adopt technology than the asset side, for whatever reason,” Ellis said. “But it’s a defensive move at this point. You have to get ahead of the 8-ball because the broker has already taken that market over. They’re going to be able to control rates and dictate what we can do on the asset side. We’ve got to get a little more on the ball.”

Up next: Too much, too soon leads to “thought suffocation”